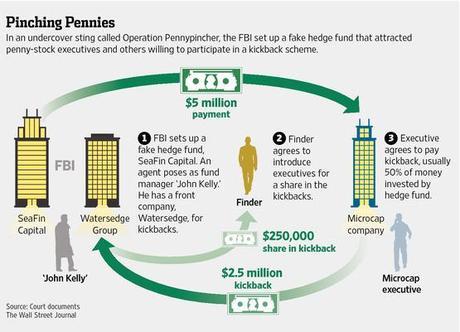

Operation "Penny Pincher" nabbed 22 penny stock pumpers.

Operation "Penny Pincher" nabbed 22 penny stock pumpers.

As I often point out to our Members, a stock doesn't have to be a penny to be a penny stock – any stock with a market cap under $100M is generally what we're talking about – regardless of the share price.

That's because the stock can be easily influenced by exactly the kind of action the FBI proved is RAMPANT in this industry – a single trader can, for a fee, move money into the stock and send the prices skyrocketing – then press releases are put out to whip retail investors into a frenzy and they follow with their money and, usually, get burned.

Of course, the same thing happens with mid-cap stocks as well and even large-caps – it's just that the people manipulating those stocks are generally better at covering their tracks! 22 is the number of people the FBI caught in the short period of time an operation like this can run before word gets out that their cover people are conducting a sting. Imagine how many other must be out there!

Obviously the markets are manipulated. We know CEOs and their Boards worry about the stock price – the minute they begin to worry about the stock price, manipulation is sure to follow. That's the way the system is designed. We have a Fed who worries about the price of the market and they manipulate it too! It's our job simply to be aware of the manipulation and take it into account in our trading and investing decisions.

Obviously the markets are manipulated. We know CEOs and their Boards worry about the stock price – the minute they begin to worry about the stock price, manipulation is sure to follow. That's the way the system is designed. We have a Fed who worries about the price of the market and they manipulate it too! It's our job simply to be aware of the manipulation and take it into account in our trading and investing decisions.

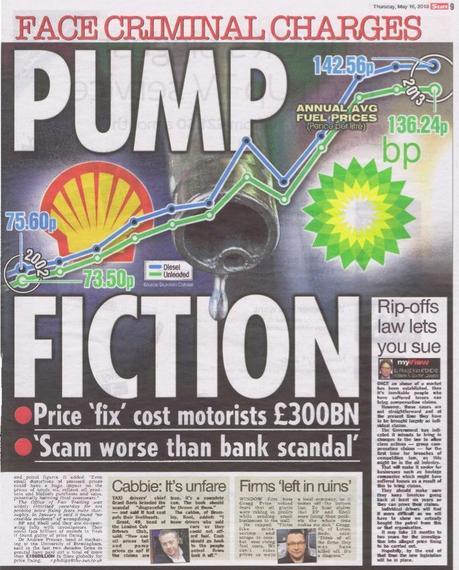

Back on June 12th, I began a series of articles pointing out that oil and gasoline prices were being manipulated into the holiday weekend. Oil shot up to $107.68 that day and stayed between $105 and $107.50 through June but the EXTREME lack of actual demand we warned you about. This morning, oil is below $104 and up $3,500 per contract from a short at $107.50 – a trade idea we highlighted for our readers Friday morning, June 13th.

You can subscribe to Philstockworld and get interesting trade ideas like that one, in your mailbox, at 8:30am most days (unless I'm late with my post). Stuff that's featured in the morning post only requires a Report Membership to unlock.

Our higher-level Members get access to other trades during our Live Daily Chat, like 20 SCO Oct $22/26 bull call spreads at $1.30 ($2,600) paired with 10 short Oct $24 puts at $1.25 ($1,250) for net $1,350 on the $8,000 spread. The upside potential is $6,650 (492%) should SCO (an ultra-short on oil) be over $26 at the October close. Already, as of Friday's close, SCO hit $25.37 and the spread is already at $2,750 – up 104% in just the first month which means it's "on track" to make the full 492% by October.

Our higher-level Members get access to other trades during our Live Daily Chat, like 20 SCO Oct $22/26 bull call spreads at $1.30 ($2,600) paired with 10 short Oct $24 puts at $1.25 ($1,250) for net $1,350 on the $8,000 spread. The upside potential is $6,650 (492%) should SCO (an ultra-short on oil) be over $26 at the October close. Already, as of Friday's close, SCO hit $25.37 and the spread is already at $2,750 – up 104% in just the first month which means it's "on track" to make the full 492% by October.

As traders, we don't "care" if the market is manipulated – as long as we are able to understand HOW it's being manipulated so we can play along. We teach our Members to "Be the House" and play along with these games – rather than be one of the suckers these scams are aimed at.

Those who know me, know I do care – A LOT – about this stuff and we do what we can to make people aware of what's really going on in the market and we do what we can to make our legistlators aware of it too but, unfortunately, most of them are already aware – because they, like the people in the FBI sting, are willing participants in the problem.

When people vote along party lines as their main criteria, then there's no penalty for being a crook in politics. That's why politics is so crooked – it's not an issue that is likely to cost a Senator or Representative their seat – unless it's so blatant that it can't be ignored, and I'm sure you can think of some really blantant stuff that DIDN'T cost someone a seat.

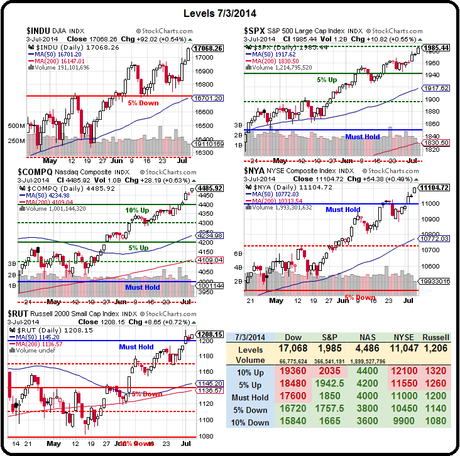

So we play the rigged markets because it's the only game in town. Two weeks ago (June 23rd) we updated our Big Chart and the Nasdaq has already plowed through it's goal at 4,400 and LOOKS (which can be deceiving) like it may be on the way to 4,800 – re-testing those dot com highs!

So we play the rigged markets because it's the only game in town. Two weeks ago (June 23rd) we updated our Big Chart and the Nasdaq has already plowed through it's goal at 4,400 and LOOKS (which can be deceiving) like it may be on the way to 4,800 – re-testing those dot com highs!

These are indeed exciting times to be in the market – there is mindless money to be made on the way up (and our Buy List has 29 names on it, 8 of which we've pulled the trigger on already for our Member Portfolios) and highly leveraged money to take advantage of on the way down as well.

While we can't predict where exactly the music will stop – that's no reason not to enjoy the game – while it lasts…

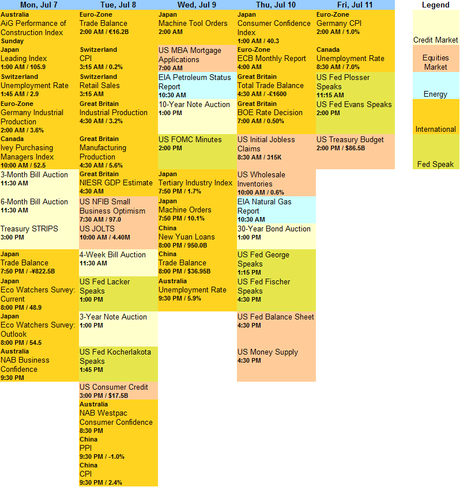

Meanwhile, we have a low-data week but we do have over $100Bn in bonds to sell, so a lot of Fed speak along with their minutes on Wednesday (2pm). Earnings season officially kicks off tomorrow with AA reporting after the bell along with HTZ (of the ones I care about). HELE and WDFC on Wednesday, FDO, PGR and PSMT on Thursday and Friday morning we get FAST, INFY and WFC and THEN (next week) earnings season really begins with C, BAC, INTC, CSX, BLK, MTG, PJC, TXT, GTXI, MTB, WHR, COF, GOOG & BK.

I hope you had a good rest, now it's time to get back to work!

Email This Post

Email This Post

Twitter

Twitter

LinkedIn

LinkedIn

del.icio.us

Google+

del.icio.us

Google+

Tags: earnings, Fed, Market manipulation, Oil, penny stocks, SCO, USO

This entry was posted on Monday, July 7th, 2014 at 8:23 am and is filed under Immediately available to public. You can leave a response, or trackback from your own site.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!