The virus rages on.

The virus rages on.

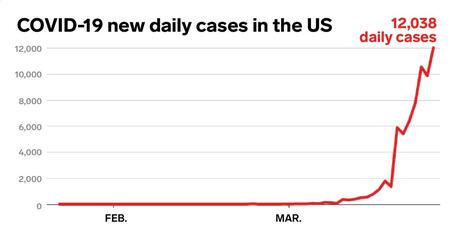

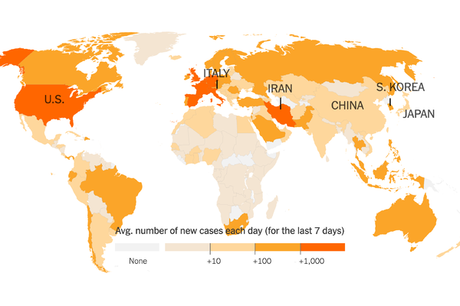

US infections have jumped from 85,996 on Friday, when we had just passed China, to 143,055 as of 6:11 this morning and that's up 66% in two days. Globally, there are 735,650 infections with 34,686 deaths and 154,673 recoveries so, to date, 18.3% of the outcomes are – DEATH!!! No, I don't think it's funny – I want to emphasize that so people, HOPEFULLY, will stop risking their lives to go on a beer run or whatever other silly thing you do that you don't have to do – this is serious people and it remains serious.

On the other hand, as I have pointed out before, 7,708 people die every day in America from all sorts of things but mainly cancer or heart conditions so 2,500 dead (so far) in the US is just another manic Monday morning as far as it's effect on the economy. What matters is how soon we can get things under control as they are currently still clearly OUT of control as our hospitals are being overwhelmed (leading to more deaths) and supplies are running short.

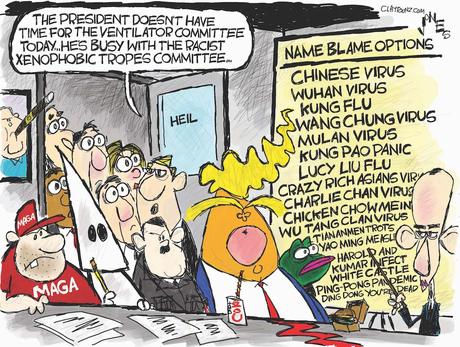

Trump is right, this is like a war but it's a war we are clearly losing despite Trump telling us:

- Jan 22nd - “We have it totally under control. … It’s going to be just fine”

- Jan 30th – "We think we have it very well under control. We have very little problem in this country at this moment — five. And those people are all recuperating successfully. But we’re working very closely with China and other countries, and we think it’s going to have a very good ending for it. So that I can assure you.”

- Feb 24th – "The Coronavirus is very much under control in the USA. … Stock market starting to look very good to me."

- Feb 26th - “And again, when you have 15 people, and the 15 within a couple of days is going to be down to close to zero, that's a pretty good job we've done."

- Feb 28th - “It’s going to disappear. One day, it’s like a miracle, it will disappear.”

- March 2nd - "We had a great meeting today with a lot of the great companies and they're going to have vaccines, I think relatively soon.”

- March 6th - “Anybody that needs a test, gets a test. They’re there. They have the tests. And the tests are beautiful.”

- March 9th - “So last year 37,000 Americans died from the common Flu. It averages between 27,000 and 70,000 per year. Nothing is shut down, life & the economy go on.”

- March 17th - "I've always known this is a real — this is a pandemic. I felt it was a pandemic long before it was called a pandemic."

I'm sorry if it seems I am "picking" on the President or if I somehow don't worship him appropriately enough for my Conservative readers but our job as investors is to be objective and make good investing decisions and to do that we need good information and we need to filter out bad information – like the kind we get from our President and his team of clowns and sycophants.

While I am angry that this level of incompetence and deciept is a danger to America and its people, I am also concerned about the danger to our portfolios when the Government lies to us and gives us bad information and, of course, our forward-looking projections have to take into account how well we feel the Government is equipped to handled this situation, whether or not they have a solid plan, etc. – the same as we do when we are evaluating Corporations we are investing in.

While I am angry that this level of incompetence and deciept is a danger to America and its people, I am also concerned about the danger to our portfolios when the Government lies to us and gives us bad information and, of course, our forward-looking projections have to take into account how well we feel the Government is equipped to handled this situation, whether or not they have a solid plan, etc. – the same as we do when we are evaluating Corporations we are investing in.

The time to contain the virus while there were only 15 patients in the US has long passed and here we are closing our March and still no masks, gloves and test kits to contain the virus or ventilators to take care of people who are infected and need hospitalization (about 20% of those infected and half of those die – even with the best of care). Clearly, we are not delivering either the best of care or the best of containment. Based on the current known spread of the virus, as I predicted on Friday:

It is 24 hours later and the US has gone from 69,000 to 85,000 cases in the past 24 hours. There will be well over 100,000 cases on Monday and 200,000 by the end of next week and, if we are still not getting things together and responding to desperate needs for protective gear in the hospitals and SERIOUS protocols to halt the spread of the virus, the only thing we'll have by Easter (4/12) is 500,000 cases of the virus – almost 10 times what we have on this curent(ish) map.

So far, I seem to have underestimated as we're up to 143,055 cases this morning but hopefully that's partly due to the fact that we are rolling out testing and simply confirming cases (China had a huge uptick in confirmed cases close to the end of the cycle as they implemented more testing). We'll know more as the week progresses but the longer it takes our Government to get it's act together, the more likely we end April way over 1M cases and that would lead to 3M in May but I don't think we get that far as the Governors are using their powers to fix things locally - even when Trump fails them Federally.

Let's say then that we top our at about 2M cases, that would put at least 400,000 people in the hospital and the US only has 300,000 total hospital beds that are generally 68% occupied at any given time, leaving just 100,000 available beds and not even half as many respirators.

That means, very simply, that a lot of people are going to die – probably 200,000 and, though it's still not going to have much effect on the economy – keeping that number at 200,000 and not 2M requires us to shut down the economy probably well into May.

That means, very simply, that a lot of people are going to die – probably 200,000 and, though it's still not going to have much effect on the economy – keeping that number at 200,000 and not 2M requires us to shut down the economy probably well into May.

Still, while this will obviously cause a Recession (two consecutive quarters of economic contraction), IF we mange to keep people and businesses from going into bankruptcy then, unlike normal recessions, we can sound the "all clear" siren on May 15th and everyone can go back to work and back to the malls and the economy would instantly go back to normal. The only thing preventing that happy outcome would be Government incompetence and, unfortunately, THAT is the main problem we are dealing with at the moment.

The US GDP is $19Tn so close to $5Tn per quarter and let's say we knock of 1/3 of that for 2 quarters. That's $1.5Tn x 2 = $3Tn. While expensive, that is fixable but it all comes down to how our Government distributes the money. Will it really go to the people and businesses that are impacted by the virus or will it go to maintain the outrageous incomes of the Top 1% – so they can add to their money pile – even while the rest of the World suffers?

Fortunately, it's an election year so hopefully our Government will chose to do the right thing – if only to save their own asses on November 3rd (assuming we haven an election, of course). Based on those assumptions and based on the $2Tn already authorized by Congress – I think we do get past this and on the way to normal by July so, taking that into account – I think the sell-off we have so far is overdone as these factors are not likely to have a lasting impact on most companies' ability to make profits going forward.

Unfortunately, the market was previously trading at inflated prices that assumed things were great and were only going to get greater and that is simply no longer the case so we have to first look at every one of our holdings as earnings comes out and decide if each stock can make it through 2 dead quarters (taking into account the aid they recieve as well) and then thinking about how well they can get back to normal – including what damage their supply chains and customer base has sustained. It's a lot of work, but hopefully it will be covered in Q1 Earnings Reports – which start to come out very soon.

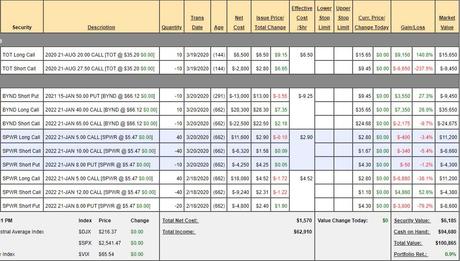

So, to get the ball rolling, let's analyze a few stocks to see if they are worth saving. We can start with our Future is Now Portfolio as it's only got 3 stocks in it so let's review them all. Overall, the portfolio is flat for the year after we doubled down on Beyond Meats (BYND) and Sunpower (SPWR) back in our March 20th Portfolio Review:

- Total (TOT) – We just added them two weeks ago as we like the fact that TOT is rapidly diversifying into alt energy. Stll, they are a massive oil company with $176Bn in sales and $11.5Bn in profits last year but, even when oil was around $20 between 1996 and 2003, TOT's stock was still in the $30s so we jumped on them at $25, which is a $70Bn valuation and took a very conservative $20/27.50 spread that will pay $7,500 if they stay over $27.50.

- The spread is now net $6,200 so only $1,300 left to make and we'll probably try to take it off the table at $7,000 – so no good as a new trade but a nice $3,300 (89%) profit off our $3,700 entry already!

- Beyond (BYND) – This was always a forward-looking call as the company only did their IPO last year at $25 in May and they rocketed up to $239 in July and back to $71 in November and as low as $48 in March, which caused us to pull the trigger on them (we had 5 original short puts which we rolled down to 10 of the new ones).

- BYND sold $297M worth of product last year, up from $88M the year before and Q4 was $98M so they are still growing fast and $66 is a $4Bn valuation and the company is running about break-even with $275M worth of cash in the bank and the cost of revenue + SG&A last quarter was $90M so, even if they can't cut it back – they still have the cash to cover it (without a bailout).

- I'd say they are on very solid ground so we're going to stick with them as our target is only $65 – where it is now. If this trade works out, it's a $15,000 spread currently priced at net $1,525 so $13,475 (883%) upside potential if it holds $65 into Jan, 2022.

- Sunpower (SPWR) – A stock so nice, we bought it twice! Installing solar power is something companies do to save money so I don't think those kinds of projects are likely to be cancelled due to a virus. Also, a lot of stimulus money is flying around, which may lead to more orders down the road. We couldn't pass up the chance to buy another position when SPWR was close to $5, which is an $850M valuation for a company running about break-even on $1.8Bn in sales.

- They are certainly going to take a hit but they do have $422M in cash and $358M in inventory and "only" $900M in debt so they are not in trouble and not likely to be if we are back to work by summer so we can stick with them.

- The $5/10 spread pays $20,000 at $10 and is currently netting $240, so there is $19,760 (8,233%) upside potential and just 10 short puts means your worst case is owning 1,000 shares of SPWR at $8 ($8,000) plus the $240 if you lose that too – still not terrible!

- The $5/12 spread is our original spread with a more aggressive upside but let's say it pays the same $20,000 at $10 as we no longer have confidence in $12. That's OK and the current net is a $1,780 credit as we are more aggressive on the puts (2,000 at $8 LESS the $1,780 credit is the worst case) so $21,780 upside potential at $10.

So, as a new portfolio, I would not play TOT but the other 3 trades give you a net $15 credit to have the potential to make $55,015 over the next two years. We have a total obligation to own up to 1,000 shares of BYND for $50 ($50,000) + 3,000 shares of SPWR at $8 ($24,000) so we're using up $74,000 of our $200,000 in buying power (ordinary margin).

When we see the market improving and we get more comfortably, we can add another coupld of trades from our Watch List and that is how we evaluate our portfolios. Tomorrow we'll tak a close look at how we repair our positions after a big drop and,, sadly, there are plenty of examples in this market!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!