I'm travelin' down the road,

I'm flirtin' with disaster.

I've got the pedal to the floor,

My life is running faster.

I'm out of money, I'm out of hope,

It looks like self destruction.

Well how much more can we take,

With all of this corruption. – Molly Hatchet

What?

Did you think just because Greece voted to accept more money from the EU that everything was "fixed" again? Not by a long-shot. That's like your cousin getting out of jail and hitting you up for a loan that you know you'll never see again "fixing" the family's finances.

While little Greece may be able to slide by for a few more months now, this does nothing for Spain and Italy and we've already had a rally that anticipates some massive G20 action and today the clown college meets in Mexico and it's put up or shut up time for our Global leaders.

SocGen analysts predict the Fed will unveil a $600Bn QE3 program at its meeting on Wednesday AND extend the existing Operation Twist but it's not enough without firm commitments from the EU and $600Bn from those guys is NOT going to cut it. We had a nice pop in the Futures last night but now the clock is ticking and every hour that goes by without a firm announcement of more stimulus will take more wind out of the markets' sails – you can't just jawbone the Global Economy anymore – hopefully our "leaders" finally realize that.

SocGen analysts predict the Fed will unveil a $600Bn QE3 program at its meeting on Wednesday AND extend the existing Operation Twist but it's not enough without firm commitments from the EU and $600Bn from those guys is NOT going to cut it. We had a nice pop in the Futures last night but now the clock is ticking and every hour that goes by without a firm announcement of more stimulus will take more wind out of the markets' sails – you can't just jawbone the Global Economy anymore – hopefully our "leaders" finally realize that.

Spain's 10-year bond yield went UP this morning, to 7.08% – a completely unsustainable amount and Italy hit 6.12% – a very unsustainable amount. On the bright side, Greece's 10-year bond yields pulled back 62 basis points – all the way down to 26.51% on the "good news" following the election. So if Spain and Italy are fixed the way they "fixed" Greece – we're all DOOMED!

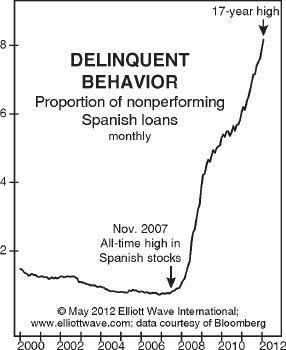

Bad loans held by Spanish banks hit an 18-year high in April, data from the Bank of Spain shows, with 8.72% of loans over three months in arrears. The total number of nonperforming loans is 10 times the level of 2007, the peak of the property boom. The data explains why 10-year yields are surging. "Yields are at levels at which Spain can’t really afford to finance itself for more than a few months,” said Craig Veysey, head of fixed income at Principal Investment Management in London, part of Sanlam Group, which manages $72 billion.

Bad loans held by Spanish banks hit an 18-year high in April, data from the Bank of Spain shows, with 8.72% of loans over three months in arrears. The total number of nonperforming loans is 10 times the level of 2007, the peak of the property boom. The data explains why 10-year yields are surging. "Yields are at levels at which Spain can’t really afford to finance itself for more than a few months,” said Craig Veysey, head of fixed income at Principal Investment Management in London, part of Sanlam Group, which manages $72 billion.

Both German Chancellor Angela Merkel and French President Francois Hollande have denounced “speculators” who are “unjustly attacking” Italy and Spain. “Increases in interest rates are not justified in countries like Italy that have made serious efforts and have a budget surplus,” Hollande said. “You can’t ask people to make efforts when there are no rewards for the effort.”

In short, because the markets are not reacting to the agreed-upon austerity measures as the leaders of Europe agreed they should, SOMETHING else needs to be done. The European Financial Stability fund was created precisely to provide funds in these situations—where markets balk at lending at the rates politicians think are appropriate. But Rome and Madrid are loathe to accept the sort of sovereignty surrender that Ireland and Greece have had to endure, to avail themselves of EU and IMF funding.

Things are getting so bad with the PIIGS that now Mommy and Daddy are fighting too. Deepening splits between Angela Merkel and François Hollande erupted into the open on Friday as the German chancellor attacked Paris for allowing the French economy to stall. Merkel warned the policies of the new Socialist president could destroy the eurozone by bringing the sovereign debt crisis to France itself. “Europe must discuss the growing differences in economic strength between France and Germany,” she said.

Mr Hollande, elected last month, has announced plans to increase the cost for companies of laying off workers after a jump in French unemployment. Senior German and EU officials have expressed concern that the Socialist policies will bring market turbulence to France and increase French borrowing costs, threatening the country’s long-term credit rating. “France needs its AAA or else the euro cannot bear the debt burden. Germany cannot do it alone,” said a eurozone official.

Well, so much for that relief rally, right? We went into the weekend very bullish with our virtual portfolios but still mainly in cash because of exactly this sort of uncertainty. Our last trade of the day on Friday was, in fact, an aggressive TZA downside hedge at $20.45, using the July $22/28 bull call spread at .95, offset with USO Aug $29 puts at .90 to keep the cash commitment down to .05 on the possible $6 spread – we already had downside hedges in place (hedge first, then buy) earlier – this was just in case of a real disaster…

Well, so much for that relief rally, right? We went into the weekend very bullish with our virtual portfolios but still mainly in cash because of exactly this sort of uncertainty. Our last trade of the day on Friday was, in fact, an aggressive TZA downside hedge at $20.45, using the July $22/28 bull call spread at .95, offset with USO Aug $29 puts at .90 to keep the cash commitment down to .05 on the possible $6 spread – we already had downside hedges in place (hedge first, then buy) earlier – this was just in case of a real disaster…

So far, what we have this morning is disappointment but don’t blame the markets for your runaway expectations. There was no way we’d get any major announcement before the G20 meeting (can’t steal their thunder) UNLESS the Greek elections went bad AND the markets opened down massively. As it is, all we have is a flattening in Europe and a 0.5% drop in US Futures coming up on 9am.

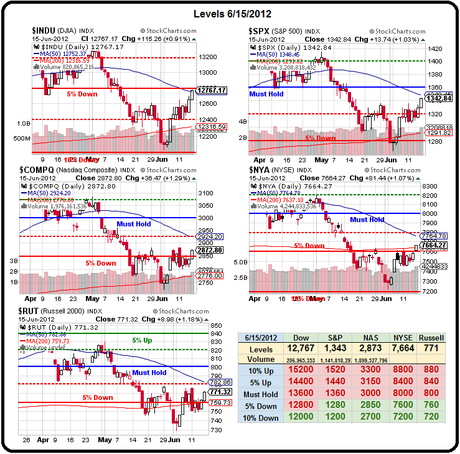

Our predicted close for Friday was Dow 12,757, S&P 1,350, Nas 2,887, NYSE 7,665 and RUT 777 according to our 5% Rule and the actual close was 12,767 (+10), 1,342 (-8), 2,872 (-15), 7,664 (-1) and 771 (-6) for a total miss of 40 out of 25,416 market points – off by 0.15%. Our 5% rule also dictates we should have up to a 1% pullback, which is a 20% retrace of the run we measured and that would still be bullish. Since we only missed our close for the week by 0.15% using the 5% Rule – I think we should give the 1% pullback a chance to hold before freaking out today – just a thought…

On the whole, we’re still right in the trading range on our Big Chart and all we need to do this week is hold the 5% lines on the Nasdaq (2,850), NYSE (7,600) and Russell (760), the -2.5% line on the S&P (1,320) and capture the -5% line on the Dow (12,800) and we will remain, as I kept saying we were last week – “constructively bullish.”

Our premise is still that there WILL be MASSIVE coordinated stimulus from the G20. A failure on their part to come through will put us aback to cashy and bearish very quickly so we’ll be watching the rumor mill with great interest but we also will not be the last ones out the door if 3 of our 5 levels fail (and the Dow is already failing).

So let’s be careful out there, it’s going to be another crazy week!