2,000 finally held!

2,000 finally held!

It was a really ugly hold but we did hold 2,000 on the S&P all day long on Friday and that, as I've said for a long time, is finally a signal we need to do a little bottom-fishing. We have already been picking up some material stocks in our Live Member Chat Room, including adding BTU ($13.29) on Friday morning to our Income Portfolio, despite a Goldman Sachs downgrade that cost them 5% pre-market.

Coal has been getting a bad rap this year as China has slowed down and, of course, its environmentally unpopular (and 300,000 people marched in NYC this weekend for action on Climate Change) but the reality is, coal use isn't going away anytime soon.

In fact, 65% of China's energy comes from coal and, for the first time ever, China passed the EU in pollution levels per capita with each person in China producing 7.2 tons of carbon dioxide on average compared with 6.8 tons per European and just 1.9 tons per Indian.

In fact, 65% of China's energy comes from coal and, for the first time ever, China passed the EU in pollution levels per capita with each person in China producing 7.2 tons of carbon dioxide on average compared with 6.8 tons per European and just 1.9 tons per Indian.

Of course, none of them hold a candle to the US, where we proudly produce 16.4 tons of CO2 per person!

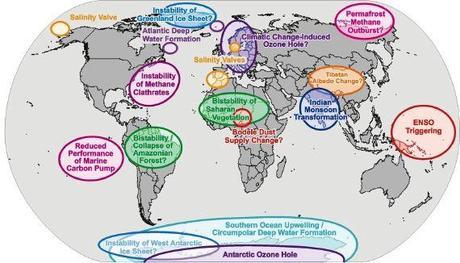

Still, with 1.3Bn people, China has now passed the US in overall carbon emissions, contributing to a new Global Record of 40Bn tons of CO2 added to the atmosphere in 2014. According to a recent UN study, at this rate, the theoretical limit for carbon in our atmosphere (before irreversible damage sets in) will be hit in just 30 years. But don't worry folks, that's just science and we can always vote Republican and ignore it.

Still, with 1.3Bn people, China has now passed the US in overall carbon emissions, contributing to a new Global Record of 40Bn tons of CO2 added to the atmosphere in 2014. According to a recent UN study, at this rate, the theoretical limit for carbon in our atmosphere (before irreversible damage sets in) will be hit in just 30 years. But don't worry folks, that's just science and we can always vote Republican and ignore it.

Remember – we ARE Koch!

Emissions grew 4.2 percent in China, 2.9 percent in the U.S. and 5.1 percent in India last year. The EU’s pollution level declined 1.8 percent because of weaker economic growth. So coal is not going away as soon as people think and we have been literally burning off the surplus this year. In Europe, utilities are switching back to Coal which makes about 5 Euros per megawatt-hour to produce energy while Natural Gas is losing 17 Euros per megawatt-hour as subsidies run out.

So, if you want to offset the cost of oxygen in 2030, BTU is a nice hedge on the G20 continuing to do nothing about Climate Change for another year.

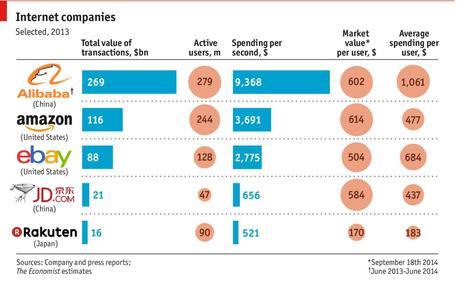

YHOO continues to be a bargain (see Friday's post) as it went down instead of up on Friday (as did SFTBY) despite BABA winding up at $231Bn in market cap. Morningstar calls YHOO a $42 stock and that's fine with our spread but they are citing "liquidity concerns" as the reason for not fully realizing YHOO's 16.3% remaining ownership ($37.6Bn) after cashing in $8.3Bn on Friday.

YHOO continues to be a bargain (see Friday's post) as it went down instead of up on Friday (as did SFTBY) despite BABA winding up at $231Bn in market cap. Morningstar calls YHOO a $42 stock and that's fine with our spread but they are citing "liquidity concerns" as the reason for not fully realizing YHOO's 16.3% remaining ownership ($37.6Bn) after cashing in $8.3Bn on Friday.

$37.6Bn + $8.3Bn is $45.9Bn so, if BABA does hold $93/share, at $40.7Bn in market cap (at $40.93), the rest of Yahoo's business, which is making $1.4Bn a year in profits, is being valued by Morningstar (and many other analysts) at NEGATIVE $5.2Bn. Even Morningstar is forced to admit that, without knocking 20% off BABA's current price, YHOO is worth $47 a share, not $42 and certainly not $40. So we'll certainly be buying more of that this week!

$37.6Bn + $8.3Bn is $45.9Bn so, if BABA does hold $93/share, at $40.7Bn in market cap (at $40.93), the rest of Yahoo's business, which is making $1.4Bn a year in profits, is being valued by Morningstar (and many other analysts) at NEGATIVE $5.2Bn. Even Morningstar is forced to admit that, without knocking 20% off BABA's current price, YHOO is worth $47 a share, not $42 and certainly not $40. So we'll certainly be buying more of that this week!

If the markets can avoid collapsing for another day (and, if not, see our TZA hedge from 9/10), then we'll take advantage of our Live Webinar on Tuesday (1pm) to go over our Buy List (Members Only) and do a bit more bottom-fishing.

ABX is back where we like to buy them at $15.50, CHK is $24.67, DBA at $25.16 is looking good, GSK still cheap at $47.38, HOV is out of favor again at $3.94, IRBT you know we love at $31.67, MAT still low at $33.88 into Christmas, NYT still getting no respect at $11.90, etc. Those are, of course, just some of the stocks. The next step is setting up trade ideas the let you buy the stocks for an additional 15-20% discount:

By the way, that AT&T example in the video is already up 90% – 3 months early! The AAPL example had us selling the 2016 $350 puts for $30, post-split, those are the $50 puts and they are now 0.35 for a 98.8% gain since we made the video in June.

Perhaps you want to tune in for Tuesday's Webinar so we can show you more trade ideas like those?

Tags: AAPL, ABX, BTU, CHK, climate change, DBA, GSK, HOV, IRBT, Koch Brothers, MAT, NYT, SFTBY, SPY, T, TZA, YHOO

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!