That will be followed by $21Bn worth of 10-year notes tomorrow and $13Bn worth of 30-year notes on Wednesday. The 3-years are expected to fetch about 1.5%, 2% for the 10-year and 3.12% for the 30-years despite the fact that that represent negative returns to inflation. So, either it's just a scam where the Fed, through its member banks, purchase whatever Treasury wants to sell to keep up the illusion that the US is able to borrow cheap OR the rest of the World is so horrifically scary that Global investors are willing to take a loss on $69Bn long-term, rather than risk leaving it in a bank or putting it into a stock or commodities or in the notes that are handed out by other countries.

Like Greece, for example, who were just "fixed" yet today the NEW BONDS are trading as 18.1% for 11-year notes. Hmm, 18.1% for Greece, which has just been declared "safe" by the EU or 2% for US notes? Something is clearly wrong with this picture… You KNOW something is wrong but, if you are buying equities, then you are choosing to pretend that, although there is a very obvious scam going on in the bond markets, that it somehow doesn't affect the equity markets. Come on – admit that you are lying to yourself – you'll feel better!

Buying equities in a Federally funded, Bot-propped rally is no different than participating in an obvious Ponzi scheme. You KNOW it's fishy but EVERYONE is doing it so you just want a little taste and you tell yourself you're just going to help yourself to some of that free money and then you will get out (dumping your shares on some other sucker who will be closer to the eventual burning than you were). That's called the greater fool theory and it works great as the World is bursting at the seams with fools but, eventually, the fools and their money are parted and SOMEONE is left holding the bag.

Will it be you? Of course not, you are no fool! Someone else will buy your GMCR shares for $63, right? Well, that was right on Thursday, but on Friday they dropped to $52.50 and that was after drifting gently down from $69 earlier in the month. It was "just" a 10% loss and then, suddenly, it was a 30% loss. Sometimes there just aren't enough fools around when you need them. John Hussman was interviewed in Barron's this weekend and declared the current market "A Who's Who of Awful Times to Invest" describing the current market as "the basic 'overvalued, overbought, overbullish, rising-yields' syndrome." My comment to Members in our Weekend Reading section was:

Hussman – Sure I agree with him. That's why I pulled back in the Income Portfolio as we're in a very dangerous spot here. If we hold up this week and next (real end of quarter), I'll feel better but the Fed neglecting to ease on Tuesday could knock us back pretty hard and I'm simply not seeing the data to support the markets. As noted above (and by me for a while), take out BAC, AIG and AAPL and the ENTIRE S&P has negative earnings. That's including AAPL suppliers and including auto makers and their suppliers.

This is a rally based on ignorance and we have a lot of ignorant people but, eventually, even they run out of money. If the media starts pointing out some negatives, tone can change very, very quickly and why on Earth would we believe that there will suddenly be any kind of volume of buyers to come in to relive the people who want to cash in their 20% gains at the top? That goes back to my car lot model – we've marked up the entire market based on not even 10% of it being bought and sold and we KNOW 80% of the buying and selling is Robots gaming the system who don't even hold their shares for more than a few milliseconds so now we're down to basing a $10Tn move in now $40Tn market on 2% of the shares being actually transacted. That's some pretty dangerous leverage to base valuations on.

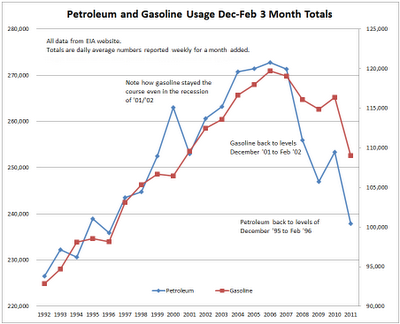

Ignorance is what the MSM feed off of. They program to ignorance while their Corporate Masters then use that ignorance to extract wealth from the masses. I do my best to pull back the curtain on these scams but THERE ARE SO DAMNED MANY OF THEM! The biggest one, of course, is oil and, as you can see from the chart on the right (thanks Mish) from the EIA, the US is now using LESS Petroleum than we did in 2001, when oil was $20 per barrel.

Ignorance is what the MSM feed off of. They program to ignorance while their Corporate Masters then use that ignorance to extract wealth from the masses. I do my best to pull back the curtain on these scams but THERE ARE SO DAMNED MANY OF THEM! The biggest one, of course, is oil and, as you can see from the chart on the right (thanks Mish) from the EIA, the US is now using LESS Petroleum than we did in 2001, when oil was $20 per barrel.

Petroleum by itself has sunk to mid-90s levels of usage when we had oil priced in the teens – back when Al Gore wanted to put a 0.04 tax per gallon on gasoline so we could research alternative energy solutions to prevent our nation from being at the mercy of foreign oil prices. Gore was defeated by the Republicans, who said a 0.04 increase in the price of gasoline (then 0.97 per gallon) would wreck the US economy.

We all know who won that debate – it was Al Gore, who won the popular vote but was defeated by the Supreme Court in the post-election so, instead, we now pay $4 per gallon for gas but at least we don't have that pesky 0.04 tax, which would have raised $132Bn to fund energy research since 2000 and instead we spend, in the US alone, $827Bn a year more than $1 per gallon for fuel and WE STILL DO NOT HAVE A BUDGET FOR PURSUING ENERGY INDEPENDENCE! Would you even know if there were a 0.04 per gallon tax. Hell, we wouldn't even notice .40 and then we'd have $100Bn PER YEAR to put towards the problem. If only Al Gore had been allowed to serve:

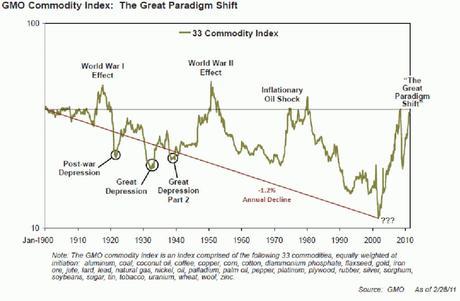

Gold is another major scam, also based on fear and misinformation. Gold spiked to $850 an ounce in 1980 and that was up 466% from $150 in 1976 and then, between 1983 and 2003, gold drifted around between $250 and $400, bottoming out as the market was flying in 1999 as stocks were clearly a better investment than gold, as was housing at the time. Stocks and housing have gone nowhere since 2000 but gold is now $1,700 per ounce, up 580% from $250 or let's call it up 466% from $300. If gold is a hedge against inflation – what exactly is it besides gold that's up 466% since 2000? Oh yes, oil!

Gold is another major scam, also based on fear and misinformation. Gold spiked to $850 an ounce in 1980 and that was up 466% from $150 in 1976 and then, between 1983 and 2003, gold drifted around between $250 and $400, bottoming out as the market was flying in 1999 as stocks were clearly a better investment than gold, as was housing at the time. Stocks and housing have gone nowhere since 2000 but gold is now $1,700 per ounce, up 580% from $250 or let's call it up 466% from $300. If gold is a hedge against inflation – what exactly is it besides gold that's up 466% since 2000? Oh yes, oil!

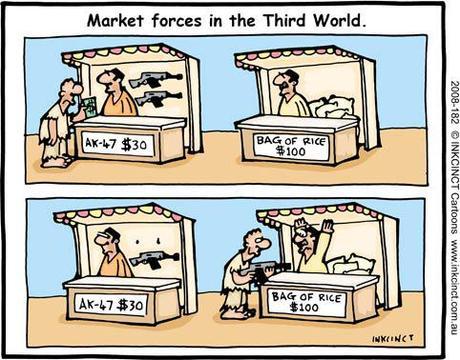

Like oil, we are not using more gold than we did in 2000, we are just paying more for it as the Mainstream Media is now controlled by the very people who want you to buy oil and gold. They pull black goo and shiny bits of metal out of the ground and you break your back all day working for currency that you exchange for less and less of what they produce and you never question it because every single channel on television gives you the same message: Shortage, FEAR, new paradigms, incompetent Governments, nuclear war – whatever works to get you to live in the kind of fear that drives you to overpay for commodities and it's never going to stop until we get to the root of the problem. That was the great accomplishment of the Bill Clinton Presidency, he made the fear go away and people who are not terrified don't pay $4 a gallon for gasoline or $1,700 an ounce for gold.

Without a war, without a shortage, without significant increases of demand, we are paying "emergency" prices for commodities. We pay this because, in 2001 the gutting of the Commodity Futures Trading Commission (CTFC) paved the way for commodity speculators to run wild and repeals of key sections of Glass-Steagall made commodity trading a primary source of income for investment banks. Glass-Steagall limited banks' securities and derivatives trading to less than 2% of their assets, in case such trading might be necessary to help service customers' accounts. Then-Fed Chairman Alan Greenspan raised these limits first to 5%, then 10%, then 25%. When Glass-Steagall was repealed in 1999, all the limits went out the window, a process also furthered by Phil Gramm's so-called Commodities Futures Modernization Act of 2000, known as the "Enron Bill," which totally deregulated derivatives.

We are still suffering the after-shocks of that madness and, just like in 2008, Global consumers are once again being pushed to the limit with inflation in India and Egypt back at near 10% levels that sparked riots that presaged the global collapse that year. As John Hussman points out – this is a particularly dangerous time to invest and we have moved to cover our gains in our Income Portfolio (see weekend update) as we've had a really good run – it's time to give the bag to some other fools and give them a chance to get rich quick while we take a little break.

We are still suffering the after-shocks of that madness and, just like in 2008, Global consumers are once again being pushed to the limit with inflation in India and Egypt back at near 10% levels that sparked riots that presaged the global collapse that year. As John Hussman points out – this is a particularly dangerous time to invest and we have moved to cover our gains in our Income Portfolio (see weekend update) as we've had a really good run – it's time to give the bag to some other fools and give them a chance to get rich quick while we take a little break.

We have goals in our Big Chart and, IF we can take those technicals, we'll be happy to play a technical rally bullish – but we're not there yet. We're at the point where things could go either way and, if they are going up another 20%, we won't miss very much by sitting out the next 5%. If they are going down 20%, then we will have lovely, lovely cash on the sidelines and, who knows, maybe we'll even want to buy some gold for $850.

Be careful out there – it's going to be a crazy week.