There's a whole lot of nothing going on this week.

There's a whole lot of nothing going on this week.

We''re in between earnings seasons and in between market-moving events and, though we do have a GDP Report on Friday, it's the third revision to Q1, not a new report and should be steady at 3.1% so – yawn. It's the 2nd Quarter's GDP that's in trouble as estimates have that down around 2% and possibly below. Durable Goods come out on Wednesday and, unless they are a strong positive upside (doubtful), we're closing Q2 with a whimper, not a bang.

Other data that matters this week is Consumer Confidence tomorrow along wiht Home Sales and Personal Income and Spending on Friday along with Michigan Sentiment. Earnings season restarts in the middle of July with bank earnings but, until then, it's pretty much all speculation as to whether things are getting better or worse on the eearnings front.

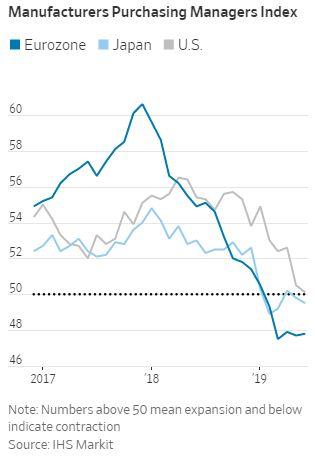

One major data-pont that has us worried is Factory Activity, whichhas gone into contraction in the US, Europe and Japan and is sitting at decade lows as of the June surveys. And it's not just the PMI that's in the dumps, the latest IHS Survey found strong correlation to the downside in all aspects of Manufacturing AND Services:

One major data-pont that has us worried is Factory Activity, whichhas gone into contraction in the US, Europe and Japan and is sitting at decade lows as of the June surveys. And it's not just the PMI that's in the dumps, the latest IHS Survey found strong correlation to the downside in all aspects of Manufacturing AND Services:

- Flash U.S. Composite Output Index at 50.6 (50.9 in May). 40-month low.

- Flash U.S. Services Business Activity Index at 50.7 (50.9 in May). 40-month low.

- Flash U.S. Manufacturing PMI at 50.1 (50.5 in May). 117-month low.

- Flash U.S. Manufacturing Output Index at 50.2 (50.7 in May). 37-month low.

Don't worry though – it's not like the market is suddenly going to care about the actual data. We've been declining since early last year yet the market continues to surge – despite the fact that we've fallen in 18 months as much as we rose in the previous 102 months.

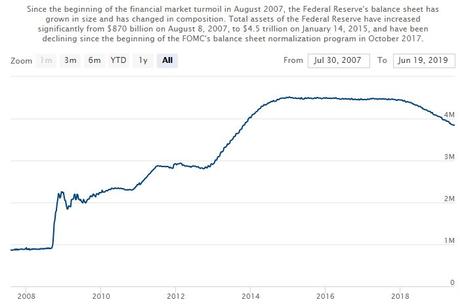

Yes, people think the Fed is going to help but the Fed is the one that bailed us out to the tune of $4.5Tn over the past 10 years and they STILL have a $4Tn balance sheet – are they going to now spend another $5Bn to bring manufacturing back or are we just going to stop looking at data altogether? Not since 1999 have Fundamentals been so thrown out the Window but 1999 was a reallly good year in the markets – we didn't collapse until March of 2000.

What's scary going forward is that the Fed simply doesn't have the firepower to fix things again if they go bad. That's why they tried to sell off assets since 2015 but, obviously, have not had much success since they've only knocked it down 10% in 4 years so far and now they are talking about going back to easing? That seems just a bit insane, doesn't it? If there is no harm in the Fed running up Trillions in debts, why don't they just always do that?

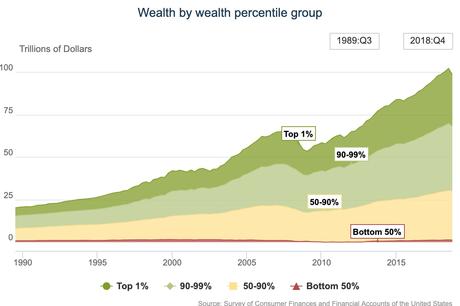

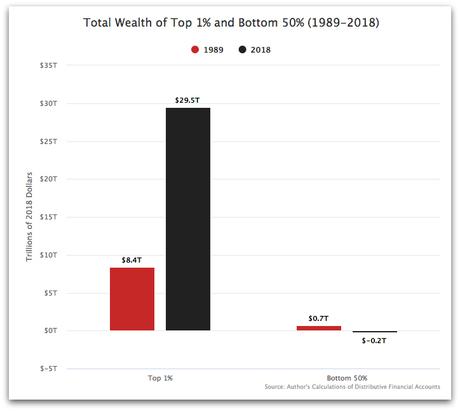

That is, in effect, what all the World's Central Banks are now doing – printing endless amounts of money in order to pretend everything is awesome when it most clearly is not. It's the same with Trump, who keeps telling people how great things are when they clearly are not. Saying it doesn't make it so. And Trump didn't start the fire that's destroying America – he just threw gasoline in it. Since 1989, Trump and the Top 1% gained $21Tn in wealth while the bottom 99% 50% lost $900M.

In fact, according to the People's Policy Project think tank, the Bottom 50% of Americans now have no wealth at all, with their debts exceeding their assets by a wide margin. “We have the worst inequality in this country since the 1920s…Three wealthiest people in America have as much wealth as the bottom 50 percent,” said Pramila Jayapal (D-Wash) of the Congressional Progressive Caucus.

How can this country move forward – even those of us in the Top 1%, if we are destroying the lives of half the people? Trump and the GOP have been taking away their Health Care, their Job Security (though they don't notice it so far with "full employment") – the entire Social Safety net in this country is being dismantaled and the next crisis will have a devastating impact on those who are, even in all this "prosperity" are struggling to survive.

And, of course, if you are reading this newsletter that caters to the Top 1% (and it's very unusual for any of you reading this to not be in the Top 10%), you think things are "GREAT" in America because our wealth has more than tripled in the last 20 years and the Top 10% has doubled so most of the people who work directly for us are doing well too so it's easy to lie to yourself and pretend EVERTHING IS AWESOME – but it's not, not for the real America.

That means you are also fooling yourself if you think that the data trends we're seeing are some kind of aberration, rather than serious warning signs and I would urge you to consider that when investing and keep a good supply of CASH!!! on the sidelines (30-50%) as it would not take much to send this market down 10-20% in very short order.

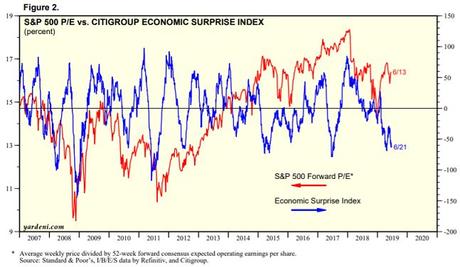

As you can see from Citigroup's Economic Surprise Index, the surprises are getting worse and worse wile the valuations are getting higher and higher and noww, in fact, the surprises are as bad as they've been in the past 10 years while the valuations are just about as highand quite a bit higher than they were in 2007 – before the last big crash.

Needless to say, we'll be watching earnings very, very closely for signs of danger but my spider-sense is already tingling and, if it were not for the likelihood of either a China Trade Deal or a rate cut (if there is no trade deal) then I'd be packing it in already. I know I say this a lot but that's because we've been at this market top a lot this year but the underlying Fundamentals are getting worse, not better.

We're still shorting the Dow (/YM) Futures at 26,800 with tight stops above that line and we'll keep doing it until it doesn't work anymore. That's lined up with 2,960 on the S&P (/ES), 7,775 on the Nasdaq (/NQ) and 1,555 on the Russell (/RTY)

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!