Uh-oh!

Uh-oh!

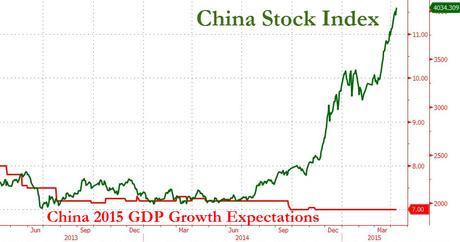

It's Monday and there are no major M&A deals and no QE announcements to goose the markets. China is still going like gangbusters as lots of bad economic data of there is getting traders expecting more stimulus announcements by the PBOC, so 100% is no longer a reason to pause after 6 months of gains, is it?

We picked up 40 of the FXI May $48 puts on Thursday and those should be down around 0.70 this morning. So far, so wrong on our entry though as FXI is up 5% since we went short just 2 sessions ago. At this rate, Chineese markets will be double again by the end of the month – no wonder traders are rushing to get in desptie the World Bank downgrading their growth projections this morning. After all, who needs economic growth when you have market growth, right?

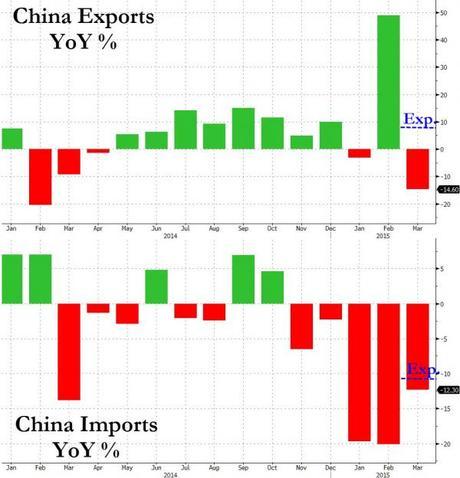

Imports have now been in freefall for 5 consecutive months and that's a drag on the whole Asian economy and Exports were sucking too except for the Feb shipment of IPhones and IWatches to the US that bumped the numbers 50% from last year but back to our usual crap numbers already in March.

Isn't this the kind of data that makes you want to pay an average of 100% more for the companies that are participating in this economy? If you are a Chinese trader, the answer is – OF COURSE! Things are slowing down so fast in China that Feb Power Consumption was off 6.3% from last year, due exclusively to a 2.5% drop in consumption by Primary Industries, who are the primary users of power in China (remember when we used to manufacture stuff?).

BNPs Chief Economist, Richard Iley calls China a "self feeding frenzy of speculation" that is using margin debt to finance "speculative gains built on unsustainable increases in leverage." There's no hidden meaning here, folks – the man is telling you to GET THE F OUT of the Chinese market! Q1 GDP comes out for China on Wednesday and 7% is expected for Q1 but anything lower will cause a rapid pullback, though it's not likely we get an honest assessment of the economy from preliminary China numbers.

Will we be regretting our recent cash out at 2,100? So far, we're not and our Long-Term Portfolio finished the week up just under 45%, at $723,770, so it caught a bit of the rally despite being 90% in cash now. Our Short-Term Portfolio held on to a 90% gain at $189,995 so the combined $913,765 is still a new high, up 52.3% in 16 months and almost entirely in cash – it's hard to be upset with that position…

April Options expire on Friday, so we'll be doing a full review for our Members later this week but we already made our STP adjustments on Thursday in our Live Member Chat Room (Alert sent to all Members at 10:17) where we added those FXI shorts as well as EWJ shorts (we're short /NKD at 2,000) and we took the opportunity to get a bit more aggressively long on oil when it dipped.

To protect our longer-term longs, we're hedging with shorts on the Oil Futures (/CL) at $52.55 on the April contacts (/CLK5) and $54 on the May contracts (/CLM5) and hopefully we'll pick up $2,500 per contract on a nice dip back to $50. Last Friday, as we're still showing off during our Quarterly Free Trade Idea Giveaway, we told you we were long on Gasoline (/RB) Futures at $1.75 and, at $420 per penny, per contract, we went over $1.80 for a $2,100 per contract gain on the day (you're welcome).

Keep in mind that it's Monday and Monday's don't count. Earnings season kicks off in earnest with JPM, WFC and JNJ tomorrow morning and that should give us a nice preview of how the Financials will shape up this week and next, when about half of the majors report.

Be careful out there,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!