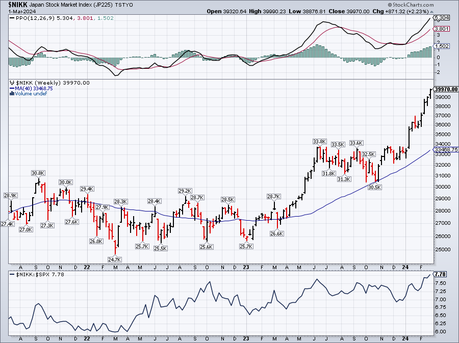

It is indeed a Global Market Party, now with the Nikkei 225 up 14,300 (55%) since last year with 7,000 (27%) coming in the last two months alone. This seems fantastic but keep in mind the Nikkei is priced in Yen and the Yen has fallen from 72 in January to 66.6 this morning and that's down 7.5% - so it's certainly contributing to the boost but you'll never hear other analysts discussing this important concepts - which is kind of like weathermen who don't mention the wind when it's cold outside - NOT the whole story!

Anyway, congratulations to Japan for suddenly fixing everything after underperforming for 40 years!

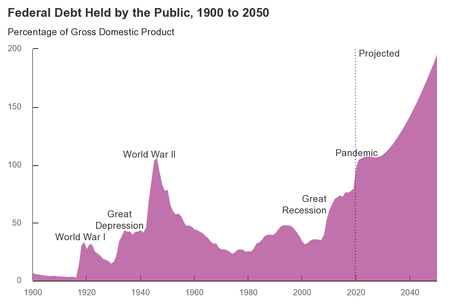

How did they do it, you may ask? Debt, debt, and MORE DEBT - 1,286,450,000,000,000 Yen worth of it ($1.28 QUADRILLION). Fortunately, that's "only" $10.5Tn but Japan's GDP is only $4Tn so we're at 262.5% of GDP, which would be equivalent to the US being $65.6Tn in debt (currently "only" $34Tn).

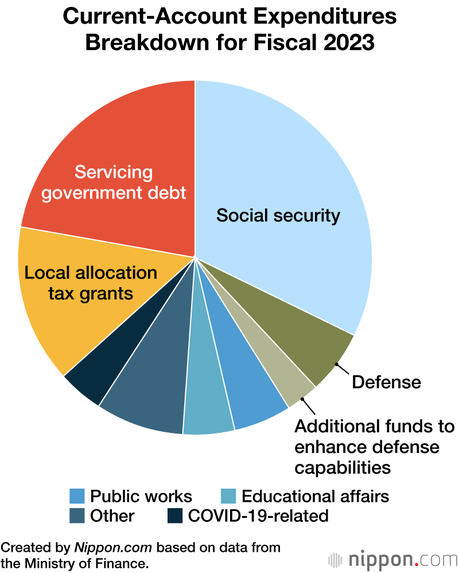

Last year Japan's Government took in $65Tn Yen but they spent $120Tn Yen - almost 100% more than they took in. If you look at the expenditure chart above - you can see that they would have to cut EVERYTHING BUT Social Security and Debt payments to balance their budget - and Japan only has a small military budget, unlike the US, where it's $842Bn per year (not including VA benefits or subsidies to Ukraine, Israel, etc).

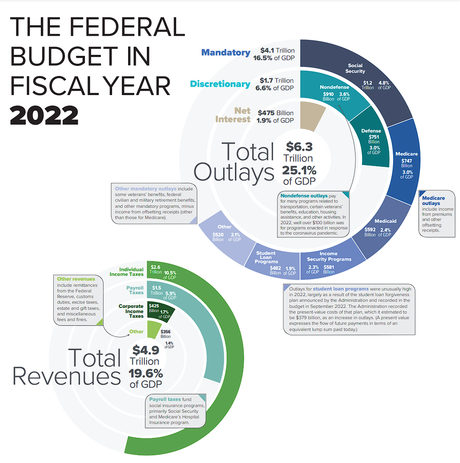

As you can see, the US has no plans of standing in second place to Japan as the World's largest debtor - even in percentages and we're on a path to double our own debt to GDP ratio over the next two decades but the flaw in this plan is that, when Japan wants to go 10% more in debt each year - they only need to borrow $400Bn but when the US want's to add 10% more debt - they need $3.4 TRILLION in new loans (and they need to roll over the old ones too).

This is why there are plenty of speculators for Bitcoin (now $65,000 dollars to get one) and this is why we just sent out a Top Trade Alert to buy Barrick Gold (GOLD). who are sitting on 77 Million ounces of proven gold reserves, currently priced at $2,091. We have to take in the extraction costs of the gold, known as AISC, which includes direct mining costs, labor, materials, energy, taxes, and royalties and that is $1,370 so, at $2,091, GOLD makes a profit of $721 per ounce they extract and last year they sold about 4M ounces of gold and they made $2.9Bn in operating profits so that's about right.

At $14.94, GOLD has a market cap of $26.25Bn but, if they extracted 77M ounces of gold for a $721 profit, that would be $55.5Bn. Of course that would take 20 years at the current rate but that's still $2.7Bn a year which means $26.25 is a very fair price for gold and, the way we structure our options trades - we don't need GOLD to go up - just not going down is fine for us!

Now, should gold rise to $2,300 per ounce - let's say just to keep up with 10% inflation over 2 years - we could assume the AISC goes up to $1,507 but the net spread would then be $793, which is a 10% increase in profits as well so the stock is likely to rise 10% to about $16.50.

That does not take into account additional Dollar devaluation as the country goes another 10% ($3.5Tn) into debt in the next two years, which is why our base case for investing on GOLD is:

That's net $200 on the $8,000 spread so there's $7,800 (3,900%) upside potential at $17 and the break-even on the trade is $15.20, which is right about where it is now. So our worst case would be owning 1,000 shares of GOLD at $15.20 ($15,200) but if we then sold 2028 puts and calls for $12,000, that would drop our net to $3,200 ($3.20/share) and our break-even would be $10.10 - still pretty good, right?

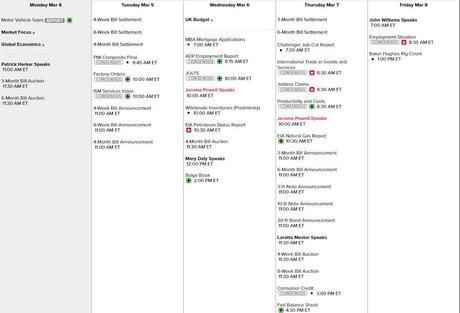

Remember folks - I can only tell you what is likely to happen and how to make money trading the situation - the rest is up to you!For whatever reason, there is not a lot of upcoming data this week. Factory Orders, PMI, ISM, Beige Book, Productivity is important as that's how we've been keeping inflation down against rising labor costs and Consumer Credit come ahead of the Big Kahuna - Non-Farm Payrolls on Friday and, once again, they expect 210,000 jobs - even though they've been way short almost every single month (was 353,000 in Jan).

Powell speaks to Congress on Wednesday and Thursday so Wednesday will be a big deal. Harker, Daly, Mester and Williams are covering the other days. We do still have a good amount of earnings reports to sort through but, on the whole, we've made it through Q1 earnings with no real damage to the markets.

TGT will be interesting tomorrow and JD was a recent Top Trade Alert for our Members - so we'll be watching them closely. COST is always exciting and it's coming right after their rival BJ's.

It should be an interesting week!

Become a Member and join us inside! You will gain access to our 6 Member Portfolios as well as Trade Ideas, Our Legendary Live Chat Room, Live Trading Webinars, Trading Education and other exclusive perks.

Find out why Forbes called Phil " The Most Influential Stock Market Professional on Twitter" (in 2016, before Elon ruined it!).Email Maddie - [email protected] - for a 7-day FREE trial at sign up.