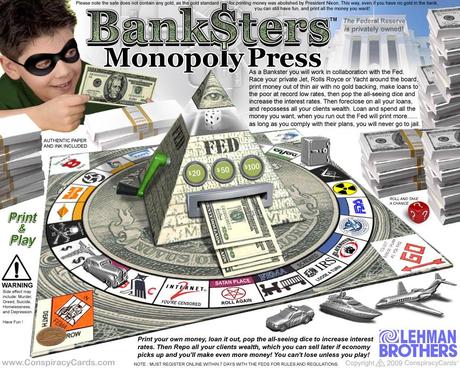

Isn't that just great? $125Bn thrown at the banks is bigger (proportionate to GDP) than the US's $760Bn TARP program but, then again, Spain doesn't have the luxury that the US Banksters have of getting an additional multi-Trillion Dollar stealth bailout from the Federal Reserve as they devalue the currency (effectively robbing every man, woman and child in America) in order to give 0% loans to their friends.

Borrow a few Trillion Dollars at 0% and lend it out at 4% for a few years and you too can declare record profits and pay yourself record bonuses for being smart enough to have formed the Federal Reserve to fool the American people into thinking this private banker club was somehow concerned with their interests (see "The Creature from Jekyll Island").

As Monty Python sort of said "scam, scam, scam, scam…" but that's our financial system so no point in complaining about it unless you get paid to like I do. So $125Bn buys us 12.5 points on the S&P but, unfortunately, that was sort of baked in in Friday as we already popped 10 points so the rally last night seemed overdone, and we were forced to go short on the Futures in Member Chat at 10:18 pm, when I said to Members:

…Anyway, back to the Futures: The RUT should have a rough time at 780 (/TF) and a short there (now 777.20) is realistic as is shorting the S&P (/ES) below 1,340 (now 1,336.75) and the Dow (/YM) does not seem to like 12,650, now 12,644 so – if you want to be bearish off this pop (which does seem a bit overdone), that's the way to go as well as, of course, oil (/CL) if it breaks back below $86 (now $86.03).

Although we went into the weekend bullish (see Stock World Weekly for nice summary of the action), the nice thing about the Futures is you can lock in silly overnight gains with a contrary bet. Oil is already below $85 at 7 am for a nice $1,000 per contract gain and the indexes have given back about 1/3 of their gains too. At the same time as we flipped short on the Futures, our Nikkie (/NKD) long play from Friday morning was up 200 points – good for another $1,000 per contract going…