Wheeee!

As I noted on Friday, it doesn't take much to mkes a lot of money on the Futures shorts and Friday's plays are all paying off in spades this morning and we only just crossed back under the 13,000 line on the Nasdaq (/NQ), which pays us $20 per point, per contract – on the way down from here. By keeping a tight stop (13,005) over the line, we limit the loss to $100 per contract but we have no such limit on a potential win and the Nasdaq is more than 1,000 points over-valued at 13,000 – so it doesn't take much of a push to get us lower.

Of course, we don't want to be greedy and we lock in gains of $500 or $1,000 per contract by putting tight stops on 1/2 and, if those trigger, then tight stops on the other half so we don't lose more than 25% of our total gains. Then we follow the 5% Rule™ to see if we have a weak or strong bounce and that tells us whether we should get out or double back down for the additional ride. That's how we played the Nasdaq, which dropped to 12,940 on Friday before giving us a ride back to 13,120 and sticking with that has put us in a fantastic position on that index as well.

According to our fabulous 5% Rule™, the Nasdaq topped out at 13,060 and 12,900 is the 7.5% line up from 12,000 and 13,200, of course would be the 10% line and a rejection of that 1,200-point run would be 240-points but we'll call it 250 and that make 12,950 the weak retrace line. If that holds, we should be worried but, if it fails, the next support is way down at 12,700 so that's the next shorting zone we can play.

Since we expect a bounce at 12,950 however, it's a good place to take 1/2 our profits off the table and, if we head higher, we set a stop on the rest at no less than 75% of our maximum gain, which will be $1,000 per contract. Then we calculate a bounce off the 12,950 line, which would be a 110-pont drop so 22-point bounces and we'll call that 12,975 (weak) and good old 13,000 (strong) again.

So, if 12,950 holds, we cash out 2 of our 4 shorts and we have a stop on the other two over 12,975 but then, if that fails, we can get right back in and use that for a stop line or we can play again at 13,000 if we get back these. Very simple and, as I mentioned above – there's no limit to our downside gains – we just keep lowering the stops to the next bounce zone using simple math.

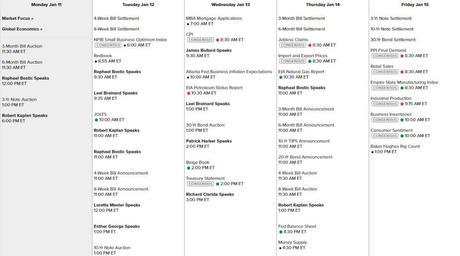

Political Turmoil is going to be the theme of the week but also Earnings Season kicks off in earnest on Friday and a record-tying 14 Fed Speeches lined up to boost the market in these tumultuous times. With this much effort being put in to prop up the market – don't expect a huge sell-off – even if Trump does get impeached, again.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!