Now you swear and kick and beg us

That you’re not a gamblin’ man

Then you find you’re back in Vegas

With a handle in your hand

Your black cards can make you money

So you hide them when you’re able

In the land of milk and honey

You must put them on the tableYou go back Jack do it again

Wheel turnin’ ’round and ’round

You go back Jack do it again - Steely Dan

Once again, if you snooze (or sleep at all) you lose in these markets as we’re once again gapping up over 1% in pre-market trading – the kind that can only be taken advantage of by Banksters and those fortunate enough to already be rich enough to have high-margin futures accounts – retail investors can simply suck wind and chase the rally this morning as God (according to Lloyd Blankfein) intended.

We had a little fun in Member Chat this morning shorting the oil (/CL) futures off the $102 line and we got a nice ride down to $101.25 but now we’re back at $101.75 as the Dollar fell back to 78.50 – a line it seems to be holding, setting us up to do it all again ahead of the open.

On the whole, we’re ALMOST getting back to Friday’s pre-market highs where we took the money and ran on our naked short-term positions (see Friday’s post as well as our Morning Alert to Members and Stock World Weekly for an Executive’s Summary of the week’s events). Now we’re back to "Cashy and Cautious" with our White Christmas Portfolio entering it’s second month with less than 10% of it’s cash committed to positions, which are well-balanced but still a bit bullish (mostly FAS).

On the whole, we’re ALMOST getting back to Friday’s pre-market highs where we took the money and ran on our naked short-term positions (see Friday’s post as well as our Morning Alert to Members and Stock World Weekly for an Executive’s Summary of the week’s events). Now we’re back to "Cashy and Cautious" with our White Christmas Portfolio entering it’s second month with less than 10% of it’s cash committed to positions, which are well-balanced but still a bit bullish (mostly FAS).

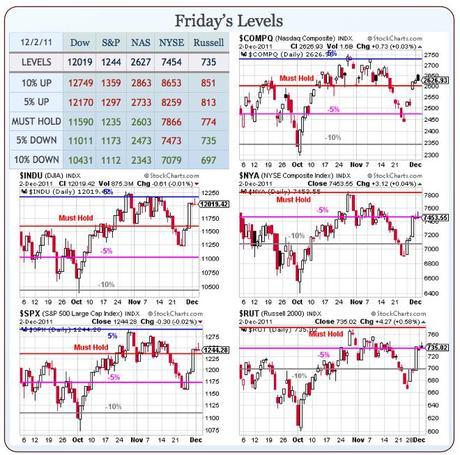

If we hold our "Must Hold" line on the S&P (1,235), which seems likely so far – then we’ll be looking for the NYSE (7,473) and the Russell (774) to take back and hold their Must Hold lines and we’ll be looking for the Dow (12,170) and the Nasdaq (2,733) to make good progress towards breaking their +5% lines.

It’s certainly too tall of an order for one day but we have our goals and we look for incremental progress this week. We didn’t cash out last week because we intended to fight the Fed – we did so because the uncertainty of the weekend simply made it a poor risk of an almost 10% market gain on the week and we’d still RATHER see a 2% pullback here than a continued low-volume rally – as that sets the stage for a violent pullback later, like we had in mid-November as well as late October.

This morning, the Global markets are celebrating harsh austerity measures in Italy, in which the newly installed Italian Prime Minister, Mario Monti, outlined a three-year plan of €30 billion ($40.2 billion) in tax increases, spending cuts, pension overhauls and growth-boosting measures, or 1.9% of the country’s entire gross domestic product. Investors expect separate Franco-German proposals to create a regime for budget policies in the euro zone later on Monday, an effort seen as setting the stage for European leaders’ key summit on Thursday and Friday.

Gosh, if we knew how well investors would react to tax increases and growth boosting, maybe we might have tried it here and – oh who am I kidding – the Republicans would be against gravity if they thought it was what the Democrats wanted…

According to the WSJ: "Leaders hope a deal could pave the way for a massive European Central Bank intervention in government bond markets that is aimed at stopping the exodus of private capital and reversing the rise of countries’ borrowing costs to ruinous levels. The unraveling of Italy’s bond market, one of the world’s biggest, amid a vicious circle of rising borrowing costs and investor flight has become the biggest single threat to the survival of the euro. If Italy is unable to refinance its huge debts in the coming year, the rest of Europe would struggle to prop up the country for long, even with help from the International Monetary Fund."

![Monday Market Movement – Do It Again [Fornero1205jpg]](https://m5.paperblog.com/i/10/103745/monday-market-movement-do-it-again-L-pwHyhy.jpeg)

Under Mr. Monti’s plan, the retirement age for women with private-sector jobs would be raised by 2018 to 66 years old, from 60 today, a change that would align the retirement ages of men and women. Labor Minister Elsa Fornero broke into tears during the news conference, saying the pension changes were necessary to avoid "collective impoverishment."

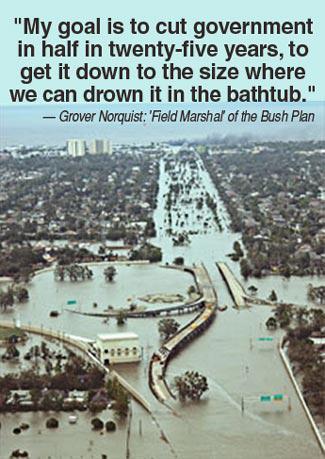

These delicious tears of sorrow are, of course, like blood in the water for Conservative cost-cutters, whipping them into a feeding frenzy as the "bond vigilantes" move from Nation to Nation, tearing down social safety-nets and pushing the working class closer and closer to death as soon as they retire (when big business is done with them). As Norquist said back in 1994, the best way to destroy Government is to first raise the debt to unsustainable levels – forcing a "crisis" to which the solution is, of course, the unraveling of decades of social progress.

These delicious tears of sorrow are, of course, like blood in the water for Conservative cost-cutters, whipping them into a feeding frenzy as the "bond vigilantes" move from Nation to Nation, tearing down social safety-nets and pushing the working class closer and closer to death as soon as they retire (when big business is done with them). As Norquist said back in 1994, the best way to destroy Government is to first raise the debt to unsustainable levels – forcing a "crisis" to which the solution is, of course, the unraveling of decades of social progress.

Workers with jobs don’t give up their rights but keep them unemployed or scared of losing their jobs and they will willingly give up everything just to get a paycheck – especially when you destroy the alternate means of support meant to sustain the workforce through economic downturns.

The Bush/Norquist Plan is right on schedule for a total destruction of the Government of the United States of America by 2019 and that’s GREAT news for Big Business, who already have control of the Government but would rather not have to pay the bribes anymore – so getting rid of it completely is the next logical step (and, as Corporations, they have a responsibility to the shareholders to maximize profits, right?).

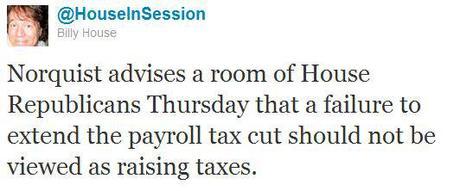

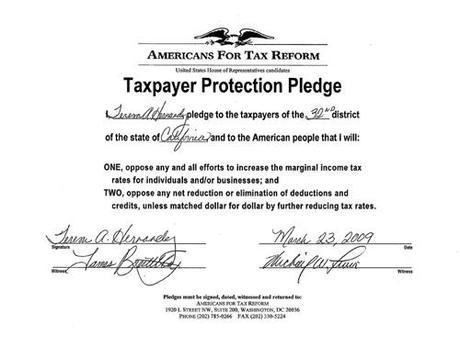

279 of our Senators and Congressmen (out of 535) have signed Mr. Norquist’s Orwellian-named "Taxpayer Protection Pledge" – although that protection doesn’t actually include allowing the Middle Class-targeted Payroll Tax Cuts expire. Norquist met with Republican members last Thursday to let them know that opposing the extension of the payroll tax cut — which would provide many families an extra $1,000 a year — would not amount to supporting a tax increase, leading to the Republican rejection of the extension last week in order to insure that the top 345,000 taxpayers (the top 0.15%) would not pay an additional 2.1% in taxes of their over $5M incomes. .

279 of our Senators and Congressmen (out of 535) have signed Mr. Norquist’s Orwellian-named "Taxpayer Protection Pledge" – although that protection doesn’t actually include allowing the Middle Class-targeted Payroll Tax Cuts expire. Norquist met with Republican members last Thursday to let them know that opposing the extension of the payroll tax cut — which would provide many families an extra $1,000 a year — would not amount to supporting a tax increase, leading to the Republican rejection of the extension last week in order to insure that the top 345,000 taxpayers (the top 0.15%) would not pay an additional 2.1% in taxes of their over $5M incomes. .

Allowing the payroll tax cut to expire at the end of the year would hit middle-class families with a $1,000 tax increase, providing a substantial drag on the economy. In fact, according to Macroeconomic Advisers, allowing the payroll tax cut to lapse “would reduce GDP growth by 0.5 percent and cost the economy 400,000 jobs.” Other estimates are even worse, with Barclays’s estimating that a payroll tax increase could say 1.5 percent off of GDP growth.

Allowing the payroll tax cut to expire at the end of the year would hit middle-class families with a $1,000 tax increase, providing a substantial drag on the economy. In fact, according to Macroeconomic Advisers, allowing the payroll tax cut to lapse “would reduce GDP growth by 0.5 percent and cost the economy 400,000 jobs.” Other estimates are even worse, with Barclays’s estimating that a payroll tax increase could say 1.5 percent off of GDP growth.

The GOP has, time and again, blocked any legislation that would increase taxes by the slightest amount on the ultra-wealthy, even with tax revenue at a 60 year low, taxes on the rich the lowest they’ve been in a generation, and income inequality out of control. Instead, Republicans would prefer to raise taxes on the middle-class, knocking the economy where it can least afford it. Now we see their real agenda – clearly violating their own pledge to protect their wealthy donors over their middle-class constituents.

Now I promised not to call for public beheadings on BNN this afternoon so I suggest you look over this list of morons and make sure you remove them all from office and then elect responsible people to represent us and then we can pass laws to prosecute the people who really caused this crisis and conduct good old-fashioned State-sanctioned beheadings – the kind of capital punishment the GOP likes to get behind anyway!