They say that breaking up is hard to do

Now I know, I know that it's true

Don't say that this is the end

Come on baby, let's start a new

'Cause breaking up is hard to do

As you can see from the Big Chart – we're at a pretty crucial inflection point.

We still have all the nonsense in Europe casting a pall over the Global markets with an EU meeting in Athens meeting heavy protests amid doubts that Greece will miss the next round of targets required to get another tranche of financing – so we're right back to where we started on that one.

Spain's a total mess, with the Government there bailing out Catalonia even as Catalonians march for independence from Spain and the Canary Islands need a bailout as well and now Venice wants to break away from Italy (or sink away) and the UK doesn't want to participate in the EU budget as the IMF cuts UK growth forecasts back to a recession as part of a general downgrade of the Global Economy while the World Bank does the same to Europe and throws in a gloomy forecast for Asia just to hammer the point home and JPM declares a 0.8% contraction for Japan in Q4 as a result of the ongoing dispute with China.

Good golly what a global mess!

Good golly what a global mess!

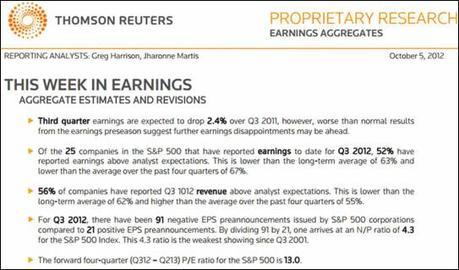

Of course, as you can see from the Thomson/Reuters note on the left, our own Q3 picture is looking more mixed than disastrous and expectations are already pretty rotten with 4.3 negative earnings pre-announcements for every one positive guidance – that's the worst since Q3 2001, when 9/11 gave us all a nasty downside surprise.

No one terrorized us in Q3 2012 but people sure are terrified and that's why I've been getting a little more bullish on the markets – at this point, expectations for Q3 earnings are pretty darned low – it's going to be tough for US companies to disappoint further.

AAPL had a particularly nasty couple of weeks, dropping over $50 from the September highs but, as you can see from Dave Fry's chart, still well within the long-term bullish consolidation zone but you'd think the company was somehow failing the way people are freaking out over a relatively minor pullback. We're still operating under the assumptions that earnings on October 25th will be the last time you are able to buy AAPL for under $700.

AAPL had a particularly nasty couple of weeks, dropping over $50 from the September highs but, as you can see from Dave Fry's chart, still well within the long-term bullish consolidation zone but you'd think the company was somehow failing the way people are freaking out over a relatively minor pullback. We're still operating under the assumptions that earnings on October 25th will be the last time you are able to buy AAPL for under $700.

With AAPL down 7% in two weeks at 20% of the Nasdaq, it's been causing a 1.4% drag on the main index (and about 0.5% on the S&P) but the QQQs are holding up pretty well and we'll be going back to the well today on the Oct $70 calls, which closed Friday back at .30 but should open later as it's a fun way to play AAPL to bounce back from $650 without making a major commitment.

WE have the Beige Book on Wednesday and PPI on Friday but not much of a data week as the spotlight turns to earnings with AA and YUM kickiing it off tomorrow followed by COST, HST, PGR & RT on Wednesday, SWY, WAFD and WGO on Thursday and INFY, JPM and KMG on Friday as a great warm-up week for earnings season.

The Euro is much stronger now than it was in Q2, about 6.5% higher than it was in July/August so, for many companies, depending on how they calculate exchange rates, international earnings may come in as a very nice upside surprise. Of course the Euro itself is poised just below that critical $1.30 line and, if we get some good news out of this next round of EU meetings – we could see a nice pop in the Euro that drops the Dollar back to 78 and gives a general lift to the price of US equities and commodities.

The Euro is much stronger now than it was in Q2, about 6.5% higher than it was in July/August so, for many companies, depending on how they calculate exchange rates, international earnings may come in as a very nice upside surprise. Of course the Euro itself is poised just below that critical $1.30 line and, if we get some good news out of this next round of EU meetings – we could see a nice pop in the Euro that drops the Dollar back to 78 and gives a general lift to the price of US equities and commodities.

Speaking of commodities – oil continues to rattle along at our target $88.50 level but we're still not bullish (see Friday's note) but neither are we particularly bearish here – $88.50 is just right for the moment but I'm more concerned about copper, which was rejected at $3.80 and touched $3.70 this morning – they can talk all they want about Global Demand picking up but copper at these prices is a very strong indicator of overall weakness.

Today will be a bit of a watch and wait day – as will the whole week, for the most part. Our Big Chart levels will give us a very quick heads up if we begin to fail to hold supports and we've got a healthy 2.5% drop we can play for (we already grabbed some DIA puts on Friday to cover the weekend) if those 5% lines all fail but the S&P is looking strong so far and we're not really going to lose faith until it does.

Be careful out there.