Fed meeting Wednesday.

Fed meeting Wednesday.

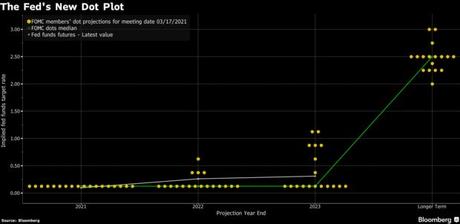

Until then, nothing is likely to happen and, after that, anything can happen. There are currently rumors that the Fed may begin to gear their language to being to anticipate a rate hike sooner than later – due to recent data that has pointed to rampant inflation. Sooner, of course, would be next year anyway, as the March "Dot Plots" didn't indicate any movement by the Fed through 2023 but the March Fed Data pedicted consumer prices rising 2.4% for the year and, after a 5% Q2, they'd have to flall by more than 1% in Q3 and Q4 for that to be right and, if that happened – we'd be in a recession.

Fed officials’ individual March projections, charted in their dot-plot, showed all 18 policy makers expected to leave interest rates unchanged through this year. Four expected to start lifting rates next year, and seven projected that rates would be higher by the end of 2023. The new dot-plot coming Wednesday should show more individuals expect to raise rates in 2022 or 2023. A June survey of 127 market participants by MacroPolicy Perspectives LLC showed 68% of respondents expecting at least one rate increase in 2023.

So, EITHER the Fed has to admit that inflation is running away and they need to tighten to control it OR the Fed needs to predict a Recession in the 2nd half of the year – what's it going to be? Not only has Inflation soared since then, as the economy has rebounded much faster than expected, but businesses have struggled to hire workers and shortages of key materials have wreaked havoc on supply chains.

We have some useful data…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!