What a busy weekend!

What a busy weekend!

We finished part 3 of our Merry May Trade Review and it was merry indeed with 31 of 37 trade ideas coming up winners in week 3, giving us a total of 125 wins and 17 losses (88%) for the first 3 weeks of the month. Needless to say, we were generally bullish but some of our bull misses, like ABX, CLF, FCX are exactly the kind of trades we should be looking at as new entries – if this rally is going to continue.

We also updated Big Chart's Must Hold Levels this morning to a more aggressive zone in our latest installment of "Charts from the Future." While we are still rally-skeptical, we're not going to fight the Fed from a TA perspective – we're simply moving up the lines which will tell us to get more bearish – just in case the market ever does head lower again (doesn't seem like it will happen with the VIX at 10.85, does it?).

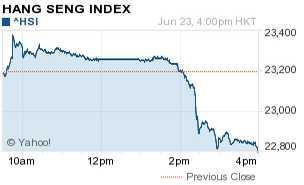

Meanwhile, the chart of the day is the Hang Seng, which fell off a cliff at 2pm (2am, EST) as China's Beige Book showed the economic slowdown deepening in Q2. Capital spending showed weakness and fewer companies applied for credit with the slowdown hurt hiring and wages, and interest rates offered by shadow lenders fell below levels offered by banks.

Meanwhile, the chart of the day is the Hang Seng, which fell off a cliff at 2pm (2am, EST) as China's Beige Book showed the economic slowdown deepening in Q2. Capital spending showed weakness and fewer companies applied for credit with the slowdown hurt hiring and wages, and interest rates offered by shadow lenders fell below levels offered by banks.

“Since investment has been the engine of the economy for the past seven years, this weakness has sweeping effects on sectors, regions and gauges of firm performance. Overinvestment has been an addiction and withdrawal symptoms will not be pretty.”

For the first time since the China Beige Book survey began in 2012, no sector showed an improvement compared with the previous quarter, according to today’s report. Transportation, mining and retail slowed andservices weakened more sharply. The survey showed “dramatic differences” between parts of the real estate industry, with commercial and residential realty “pummeled while construction held up fairly well,” China Beige Book said.

Services took the “biggest hit” in the quarter’s slowdown, the survey showed. The proportion of respondents reporting revenue growth dropped to 44 percent, down 11 percentage points from the previous quarter and 10 points from a year ago.

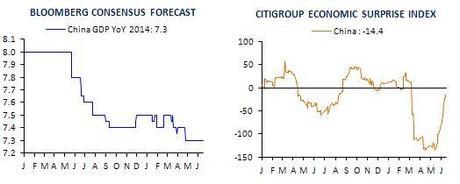

While this stuff may sound bad – let's keep in mind that the PBOC PURPOSELY slammed the brakes on the economy as it was overheating last year and, when we say slowdown for China – we're still talking 7% annual growth – not too shabby. The danger is that the economic slowdown will lead to a series of loan defauts from too-optimistic real estate and market investors but, so far – it simply hasn't happened yet (but it's a big concern of ours moving forward).

Still, as noted in our Big Chart Review, we reamain very market-skeptical at these levles and it comes down to the simple fact that, looking at the 30 stocks on the Dow, we just can't get our heads around a 20% gain from where we are now (Dow 20,000+) and, if the Dow can't make those gains, then isn't it still possible that the other indexes, that are 20% ahead of it – may be wrong?

Still, as noted in our Big Chart Review, we reamain very market-skeptical at these levles and it comes down to the simple fact that, looking at the 30 stocks on the Dow, we just can't get our heads around a 20% gain from where we are now (Dow 20,000+) and, if the Dow can't make those gains, then isn't it still possible that the other indexes, that are 20% ahead of it – may be wrong?

As you can see from the chart above, the Dow is up 33% in the past two years but the Nasdaq and Russell are up over 50%, with the S&P and NYSE up around 45%. Can 30 of the World's largest companies be wrong or is the fact that they are heavily traded on large volumes, even in a low-volume market mean that we should be worried that the other indices are full of hot air?

As you can see from the chart above, the Dow is up 33% in the past two years but the Nasdaq and Russell are up over 50%, with the S&P and NYSE up around 45%. Can 30 of the World's largest companies be wrong or is the fact that they are heavily traded on large volumes, even in a low-volume market mean that we should be worried that the other indices are full of hot air?

If not, then we can expect the Dow to begin to catch up. CAT, MRK, INTC and JNJ are all up about 20% for the year already while V, PFE, NKE, GS, IBM, BA, GE and WMT are dragging in the rear with negative performances between -2.5% and -5%. If we assume our top performers can hold up, we still need more than 20% moves out of our laggards – if not, then Dow 20,000 is just a pipe dream.

Of course pipe dreams are legal now in Colorado and clearly the Fed has been smokin' something strong the way they throw their money around (as well as the gibberish they use to justify it) so let's think about how to profit from the Dow making a move over 17,000 – on the way to 20,000:

- DIA is the ETF that tracks the Dow and is currently at $169.08 with the Dow at 16,847 so roughly 1/100th of the Dow. For one thing, the Jan $180 calls are only $1.10, so a move to Dow 20,000 would return about $20 for a 1,700% gain on a good run – so there's one way you can use leverage to profit from a rally!

-

- We can also construct a bull call spread, buying the DIA Dec $170 calls for $4.75 and selling the $175 calls for $2.55 for net $2.20 on the $5 spread. By itself, that spread makes $2.80 (127%) if the Dow gets over 17,500 and holds it through January expiration.

- However, we can get a little fancier and SELL puts on some of the Dow components that we REALLY want to own if they get 20% cheaper like WMT, which is now $75.68 and 20% off that is $60 and we can sell the 2016 $60 puts for $1.45. That makes the DIA calls FREE (plus a .35 credit) and it makes the bull call spread net 0.75 and then the upside, at $5 is a 566% return on cash.

-

- NKE is also at $75 ($75.10) and similarly, we can sell 2016 $60 puts on them but those puts pay a whopping $2.75 – more than we need. So we can sell the 2016 $55 puts for $1.80 and that means, even if NKE is put to us, it will be at $20 (26%) below the current price. That's our "worst" case.

-

- PFE would be my other pick off the Dow laggards. At $29.78, it's at the bottom of a 2-year range and, more imporntly, it's 25% behind MRK for the year – time to play catch-up, I think. PFE 2016 $23 puts are 23% below the current price at 0.75 and you can sell 2x of those for $1.50 or 3x for $2.25 to raise some cash for an aggressive Dow play.

-

If you are a subscriber to Philstockworld (and, if not, you can subscribe here), we will be going over these trade ideas in more detail in our Live Trading Webinar tomorrow at 1pm (EST) or, if not, you'll be able to read about the outcomes in our June Trade Review sometime in July, when you'll wonder why you never get to see these great trade ideas before they double.

We are STILL very skeptical and will remain so until earnings but we're also not fighting the Fed and, if we have ways to make 566-1,700% gains on some of our cash while we keep the bulk of it on the sidelines – then why not have a little fun?

Email This Post

Email This Post

Twitter

Twitter

LinkedIn

LinkedIn

del.icio.us

Google+

del.icio.us

Google+

This entry was posted on Monday, June 23rd, 2014 at 7:55 am and is filed under Immediately available to public, Uncategorized. You can leave a response, or trackback from your own site.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!