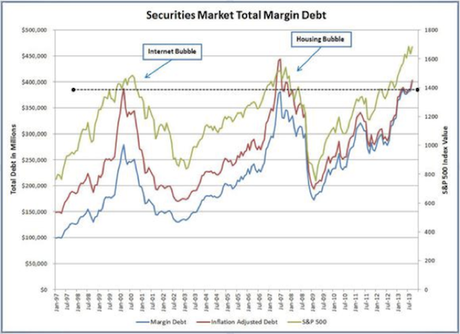

That, according to John Mauldin, should be the Fed's theme song this year. Not too many people disagree that we're in a bubbly economy and no one disagrees that the Fed and other Central Banksters' easy money policies are the cause. What does seem to be subject to debate is whether or not this is a bad thing.

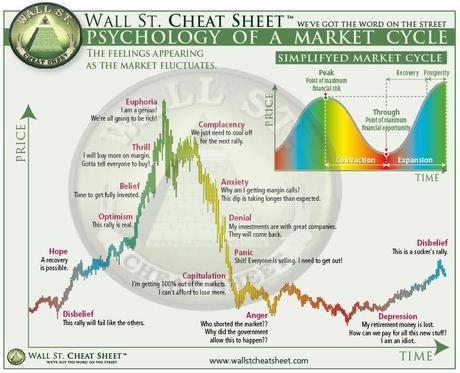

That's why that first link is very important – it reminds us how the "best and brightest" minds of a generation can be so completely wrong about something so "obvious" in hind-sight. The reason us macro guys don't like bubbles is PHYSICS – they burst. And, when economic bubbles burst, they cause a lot of damage – the hangover simply isn't worth the party.

People simply aren't wired that way. You KNOW there is no such thing as a free lunch yet when do you ever turn down a free lunch? We tell our children not to take candy from strangers but then make up an entire holiday where the whole point is to take as much candy from strangers as you possibly can. My daughter came back home with a pillowcase full of candy – more candy than she's allowed to have all year, not counting last November, when she consumed her last pillowcase full of candy.

IN PROGRESS