And down we go again!

And down we go again!

That's OK because last Monday we gapped down 200 points and spent the rest of the week gaining almost 1,000 points and April 27th opened down from the Futures but then we recovered and gained 1,000 points.

With all these 1,000-point gains you would think we'd have made huge progress but not really – we're still hanging around the same 2,850 line on the S&P 500 that we were at last April and the April before that. There was no virus in April of 2018 or April of 2019 but there also wasn't $6.7Tn in stimulus floating around so, if we are to consider 2,850 the fair value for the S&P 500 – the question is will the stimulus be more or less or exactly enough to counter-act the economic damage of the virus?

Of course, it's not just the United State's $6,700,000,000,000 contribution that matters as the S&P 500 derives more than half its revenues from the rest of the World so their pain is our pain in these circumstances. Europe has pledged to do whatever it takes and China will be having their delayed, annual People's Congress next week and the PBOC has already promised to provide more economic support (China at about $1Tn so far).

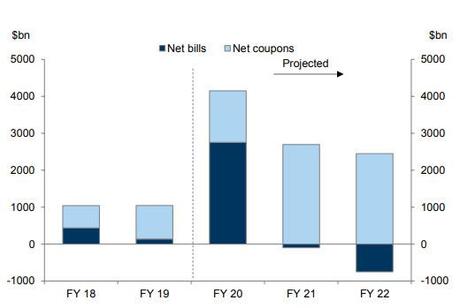

Does it matter that our Deficit has increased by $7Tn in 4 years (now over $25Tn!) and is projected to run another $3Tn in each 2021 and 2022, or does it really no longer matter how much money we print? If it doesn't matter, then why aren't we fixing Social Security and Medicare, among others? The CBO projects the Highway, Pension Benefit Guaranty Corporation Multi-Employer, Medicare Hospital Insurance, Social Security Disability Insurance, and Social Security Old-Age and Survivors Insurance trust funds will all be exhausted in the next 13 years (2033) without action to stabilize their finances.

At $30Tn in 2022 and at 2% interest, the interest on the Debt will be $600Bn a year or 20% of Government Revenues. If interest were to run up to 6%, 1/2 of the Government's Revenues would be needed just to not default on the debt we already have. Do you know what that makes us? I'll give you a hint: "Wop bop a loo bop a lop bam boom!"

30M Americans are unemployed and the reason the markets are down this morning is that the reality of re-opening is not matching the fantasy already with investors getting guidlines for their hometowns like restaurants will open at 1/4 capacity and retail stores will severely limit the number of people allowed to shop, etc. These are all sensible guidlines to control the spread of the virus but how is this helping them make profits – or even just break even?

We have DIS, HBI and XOM in our portfolios and we THINK we bought them at the bottom but clearly it's going to be a rough year and, with losses in Q1 and more losses in Q2 – how can anyone possibly believe that 2020 earnings will come close to 2019 and, if that's the case – how can so many of these stocks be popping back to their pre-virus highs?

I love DIS and I'm thrilled we got in below $100 but I'm under no delusion they should be going back to $150 and even $120 is a stretch given what we know about the virus so far. Yet DIS has popped back from $80 to $110, which is 37.5% off the bottom, simply because they are going to TRY to reopen their parks. Parks are 1/3 of Disney's revenues and, surprisingly, film is only 14% so 1/2 their business is closed and ESPN has no sports but the Disney Channel is getting a big workout during quarantine – along with ABC. 27% of their business is selling Disney Products and Liscensing – those are not terribly affected.

So we like DIS but let's not be delusional about it – It's just a chance to get in on a good brand cheaply. DIS was not, in fact, one of the 20 stocks we grabbed during the downturn (see this weekend's review) because we were concerned about their park, movie and sports exposure. In our Butterfly Portfolio, we just have a long-term (June, 2022) bull call spread that we bought pretty much at the dead bottom:

Security

Description

Quantity

Trans

Date

Age

Net

Cost

Issue Price/

Total Change

Effective

Cost

/Shr

Lower

Stop

Limit

Upper

Stop

Limit

Curr. Price/

Change Today

Gain/Loss

Market

Value

1 Bull Call Debit Spread

DIS Long Call 2022 17-JUN 85.00 CALL [DIS @ $109.16 $0.00] 50 3/23/2020 (767) $105,000 $21.00 $13.45 $26.85 $34.45 $0.00 $67,250 64.0% $172,250

DIS Short Call 2022 17-JUN 120.00 CALL [DIS @ $109.16 $0.00] -50 3/23/2020 (767) $-50,000 $10.00 $6.25 $16.25 $0.00 $-31,250 -62.5% $-81,250

As you can see, it's doing well as we entered the spread for net $55,000 and it's already at net $91,000 so up $36,000 (65%) in less than a month and bull call spreads require no margin – it's a very simple way to take advantage of a stock that's at a discount like DIS was near $80. The spread has a potential, at $120 to be $175,000 so there's still $84,000 (92%) to be gained on this one – even if you missed our $55,000 entry.

Anyway, my main point was that we had originally sold some short puts on DIS but now, back at $110, we cashed them out as they are too risky given the current environment and given their recent earnings notes and Q2 forecast.

At least Disney has been honest enough to tell us they won't be making any money this quarter – be careful if the stocks you hold haven't made disclosures to you!

- Shanghai Disneyland Reopens With Social Distancing

- Dow falls nearly 250 points to start Monday trade as investors face effects of lockdown reopenings and U.S.-China tension

- Factories Close for Good as Demand Drops

- Why the Economic Recovery Will Be More of a ‘Swoosh’ Than V-Shaped

- Economy Week Ahead: Inflation, GDP, Retail Sales

- Gilead’s Remdesivir Supply Won’t Meet U.S. Need, Analyst Says

- Johnson Starts to Ease U.K. Lockdown With Back to Work Plan.

- More Slog Than Snapback Is Outlook for Europe’s Virus Recovery

- Eurozone Breakup Risk Reaches New High.

- Tesla's Head Of Europe Leaves After "Disputes" With Elon Musk.

- ‘Hidden’ Defaults Set to Soar as Recession Squeezes Companies

- Trump’s Economic Team Braces for Worsening Job Market in May

- Mnuchin says jobless numbers will ‘get worse before they get better’ — unemployment may hit 25%.

- Here Is The Real April Jobs Report: 42 Million Unemployed, 25.5% Unemployment Rate.

- Fauci and other top health officials enter quarantine after exposure to White House aide with virus.

- Kudlow says White House holding informal talks with lawmakers on next steps in coronavirus relief.

- 6 Reasons Why Goldman Sees The S&P Sliding Back To 2,400 By August.

- Billionaire Cooperman's 11 Reasons To Be Skeptical Of Soaring Stocks Amid COVID Chaos.

- One Bank Explains Why QE No Longer Stimulates The Economy And Only Leads To Higher Stock Prices.

- Coronavirus: China faces historic test as pandemic stokes fears of looming unemployment crisis

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!