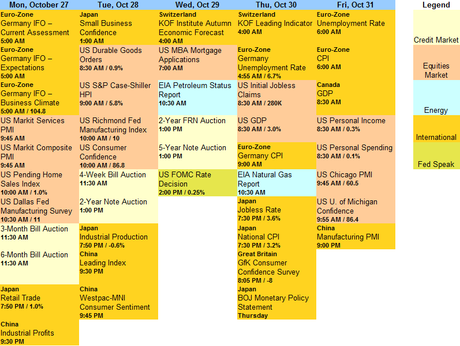

Strap yourselves in – it's going to be a wild one!

Strap yourselves in – it's going to be a wild one!

After closing out the best week in the market since 2012 (right after the worst week since 2011) it looks like we're in for more craziness as Draghi's happy talk fades into a distant memory (it was Friday afternoon) to be replaced by fear of the Fed on Wednesday (2pm) as well as an almost certain drop in our GDP from Q2s shocking 4.6% to probably 2.5% in Q3's first guesstimate.

Speaking of guesstimates – did you catch that downward revision to New Home Sales on Friday? On September 24th, the WSJ ran a headline proclaiming: "U.S. New-Home Sales Surge 18% in August - Highest Level Since 2008; Signals Higher Consumer Demand That Could Boost Housing Market" and the S&P popped 18 points (1%) and IYR began a 6% rally that day everyone was happy.

Only it was a lie. As it turns out, new home sales were actually only 466,000 and this month (Sept data) they are 467,000 yet, at the time, no one (except us) thought to question the validity of a sudden 18% jump in home sales when mortgages were still in decline.

Only it was a lie. As it turns out, new home sales were actually only 466,000 and this month (Sept data) they are 467,000 yet, at the time, no one (except us) thought to question the validity of a sudden 18% jump in home sales when mortgages were still in decline.

Even after the fact, people don't seem to think it's a big deal when major market-moving data has a fudge-factor of +/- 10%. It's bad enough that "THEY" control the markets – do they HAVE to fake the data as well? As Dave Fry notes regarding Friday's low-volume action:

So why did stocks rally?

In the midst of all this crummy data, CNBC rolled-out some commentary from one of the chief QE talking head proponents, the ECB’s Mario Draghi. His comments lit a fire under bulls and algos where terms like “more stimulus” are in the code.

DRAGHI CALLS FOR STIMULUS: CNBC

DRAGHI SAYS JOINT EFFORT NEEDED TO AVOID RECESSION: CNBC

DRAGHI SAYS INFLATION TO REMAIN LOW IN THE NEAR TERM: CNBC

This is really all you need to know beyond the fact that as of now, October is still in the red. And, no matter all the talk, QE in the U.S. is scheduled to end this month. And, unless they have a change of heart, that’s what’s going to happen. We’ll see how the markets deal with this unless bulls rely on the less than reliable Draghi to grab the Fed’s baton and launch a real effort.

For those who must invest, following the tape and putting the BS out of your mind is the only way to fly.

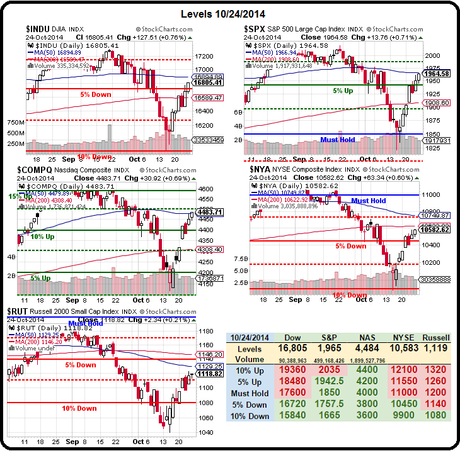

So, what is the tape telling us?

Not much, judging by the movement above. We have made our short-term strong bounce lines (see last Tuesday's post) except on the Russell but it only takes one straw to break this camel's back and, at this point, if ANY of our indexes now fail their line before the Russell goes over (1,128) – that's going to be a very bearish signal.

We went into the weekend a bit more bearish, just in case, because we have a lot of gains to protect (see our Virtual Portfolio Review – Members Only). We also have a lot of CASH!!! to protect and that, I must remind our Members, is why we have gold and silver hedges – despite their poor performance.

We went into the weekend a bit more bearish, just in case, because we have a lot of gains to protect (see our Virtual Portfolio Review – Members Only). We also have a lot of CASH!!! to protect and that, I must remind our Members, is why we have gold and silver hedges – despite their poor performance.

For example, in our Long-Term Portfolio, we have 10 short ABX 2016 $17 puts that are down $1,750 since 6/17 but we also have $637,800 in cash that has gone up from 80.50 ($USD) to 86 – a 6.8% gain there ($43,500). It's important to remember that cash is an asset that also needs hedging and protecting!

CASH!!! is a very valid investing strategy. We don't NEED to be invested all of the time. When the markets are uncertain, cash can be your best friend and, in this last drop and pop in the market, we have moved our portfolios to 80%+ cash positions – allowing us to enjoy the last two months of the year without caring much whether the market goes up or down from here.

CASH!!! is a very valid investing strategy. We don't NEED to be invested all of the time. When the markets are uncertain, cash can be your best friend and, in this last drop and pop in the market, we have moved our portfolios to 80%+ cash positions – allowing us to enjoy the last two months of the year without caring much whether the market goes up or down from here.

If there are nice opportunities to invest – we are certainly ready to take them. There are still 23 stocks on our Buy List (out of 40) that haven't gotten away yet, thanks to the recent pullback. Just last week, in our new Top Trades section, we found long-term trade ideas for CAT (up 10% for the week), SDRL (up 7%), EBAY (up 5%) and GSK (up 7%) as well as a quickie trade on GTAT that made 33% in a day (and another 33% the next day for those who held it).

That's in addition to the dozens of trade ideas we provide for our Members in the Live Member Chat Room so – why would we fear cash? Cash is just another word for opportunity in our portfolios, especially during earnings season, where something is always going on sale.

Meanwhile, we get to sit back and enjoy the ride!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!