You can't argue with a good chart.

You can't argue with a good chart.

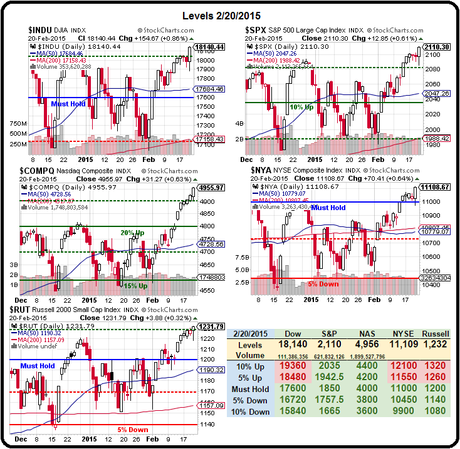

All of our indices are ripping up to new highs and don't let the lack of volume bother you – as it doesn't seem to bother anyone else in the media these days. Volume in the first half of Q1, so far, has been about half the rate we had in Q1 of last year and Q4 was no better so maybe this is just the new normal – a rally with nobody actually trading.

Just because no one is buying – it doesn't mean you can't mark up the prices, does it? The only time there is price pressure to the downside is when there is a lot of selling and, so far, no one is selling either – they're just not buying or selling – it's a dead market.

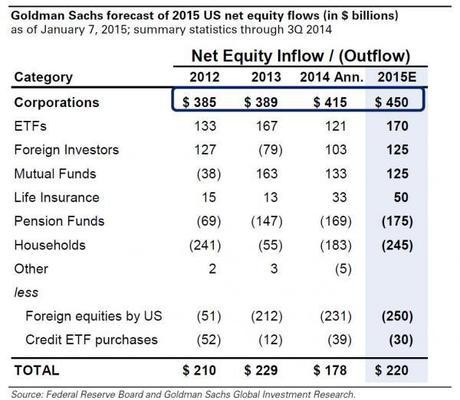

Corporations are, in fact, the largest purchasers of stock – accounting for 200% (not a misprint) of the net inflows into equities. Without companies buying back their own stock at record paces, this market would be dropping like a rock attached to an even bigger rock:

Despit buying back incredible amounts of their own stocks, actual Corporate Earnings have dropped 10% since Q3 from a high of $29.84 on the S&P down to less than $27 per share so far for Q4s reports. 4 x $27 divided by 2,100 = 20.20 – that would be an insanely high p/e for the S&P, where 15 is more common ground. Having a major index that is possibly 33% overvalued is, as they say in Stockholm - not good.

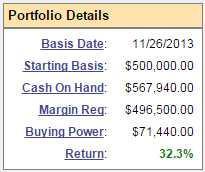

We've already take steps to prevent a disaster in our Short-Term Portfolio, which we steered much more bearish last week by adjusting our hedges. That, unfortunately, led us to our first loss in many weeks as we dropped back to $192,205 – losing almost $10,000 on the week (up 92% overall) which cancelled out the gains on our Long-Term Portfolio, which jumped to $661,417 (up 32.3%).

One of the great mistakes traders make is not knowing when to quit. If we made 42% every year, even for just 10 consecutive years, we'd turn $600,000 into $20M. Obviously, that's NOT normal, so the logical thing to do is treat our 42% gain as an outlier and PROTECT IT – especially when we're less than fully confident in the market/economy.

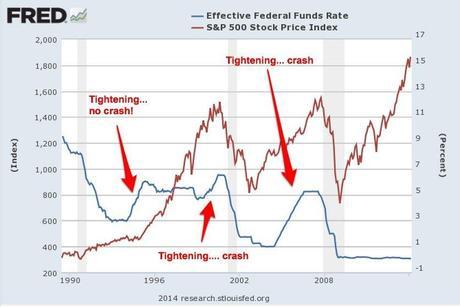

When you can see an obstacle up ahead in the road do you step on the gas and only swerve at the last possible second or do you perhaps apply the brakes, as we are doing with our portfolios, and get ready to take evasive action. Maybe the obstacle is nothing, maybe it will turn out to be a mirage but, when you have your wife, your kis, your retirement riding in that car – perhaps it pays to play it just a bit safer…

Be careful out there!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!