Get ready for a wild ride!

Get ready for a wild ride!

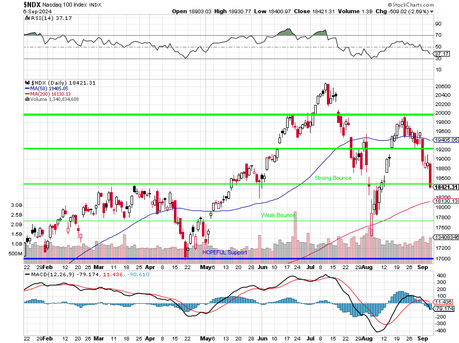

After last week's worst week in years, now we need to see how bouncy we can be as we wait (im) patiently for the Fed Decision on the 18th. It's only the 9th, so 9 days to go (Math!)(AAPL) has their event at 1pm, EST, today and we'll be watching that closely and we used to call it the APPLdaq but now it's the NVDAq although AAPL is still the most-weighted company at 9.13%, MSFT 8.2% and NVDA "only" 7.05% but, as you know, NVDA has grown 1,000% in the past two years so it's effect on the Nasdaq has been effectively adding 70% to the index - take that Apple!

Surprisingly,

NVDA is only 8.82% of the SOXX - behind AVGO at 9.93% and ahead of rival AMD at 7.21%. Semis will be the sector to watch and AAPL will let us know (eventually) which semis will be blessed with orders in the new (A)iPhone line-up - so there's quite a lot riding on today's event - including whether or not the Nasdaq will be able to retake the Strong Bounce Line at 18,480 - or will they slip slide away down to test the 200 dma at 18,130 - tied to the tracks and hoping the Fed will come save them before the train comes.

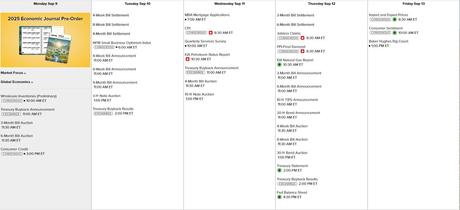

The calendar is pretty quiet this week but let's keep an eye on those note auctions. Bad auctions can tie the Fed's hands as it could indicate that the bond market isn't going to accept a rate cut. There's no Fed Speak ahead of the meeting so the only data excitement this week is Consumer Credit at 3pm, Small Business Optimism and the 3-Year Auction tomorrow, CPI (big for the Fed) and the 10-Year Auction come on Wednesday. Thursday we have PPI (more grist for the mill) and the 30-Year Auction and Friday we get Consumer Sentiment - but that's about it.

On the earnings side, thought it's late in the season for Q2, we still have some interesting reports rolling in. This week we look forward to:

-

Monday: Oracle (ORCL)-Expect strong results as cloud services remain a core growth driver. Also, Rubrik (RBRK) enters the spotlight.

-

Tuesday: GameStop (GME)-Will meme stock magic strike again? Options activity is soaring, with traders bracing for volatility.

-

Wednesday: Manchester United (MANU)-Investors are watching for updates on potential ownership changes.

-

Thursday: Adobe (ADBE), Big Lots (BIG), Signet (SIG), RH (RH), LoveSac (LOVE) and Kroger (KR) are in the hot seat, with Adobe facing scrutiny on its AI push.

And then tomorrow, we have the Trump/Harris debate - where Democracy will be on the ballot for the first time in American history. Will we choose to be a Republic ("

If you can keep it", as Franklin said) or do we trash the whole thing in favor of

the candidate backed by Russian propaganda campaigns (I was going to say "

and Fox News " but Grammarly said that was redundant...)? We report, you decide...

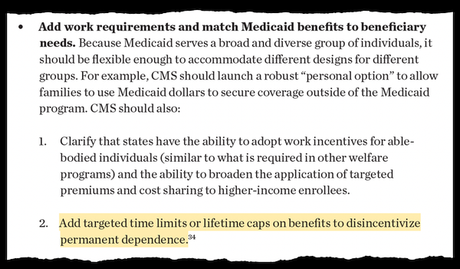

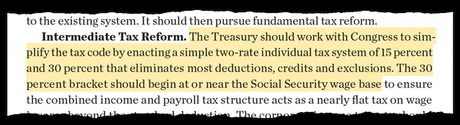

That SOUNDS good but people making under $40,000 currently pay 12% and get deductions and this would RAISE taxes to 15% with no deductions - a 50-100% INCREASE in taxes on the bottom 25% of earners in the US. Benefits don't kick in until your salary is over $300,000 - at which point the tax savings become massive and The Rich (Trump and his buddies) get much, much richer - paid for by all of us with $7Tn of additional debt from uncollected taxes. Don't get scammed, America - please!

Get ready for a wild ride!

Get ready for a wild ride!