"This is a policy move you expect from a dictatorial regime … not in an EU member state. If the EU governments can clandestinely expropriate 7-10% of their (citizens' savings) after the close of business on Friday night, what else are they capable of doing … Why keep your money at a Spanish or Italian bank when you can jump to Germany or France … Why even keep money in the EU banking system at all."

Those are the well-worded thoughts of Jefferies' David Zervos (who may be Greek) regarding the Cyprus seizure of up to 10% of their nation's bank deposits over the weekend to pay off some of that pesky debt they've gotten themselves into. I, on the other hand, sent out an early morning (4am) Alert to our Members calling the pre-market drop an over-reaction saying: "What Idiocy:"

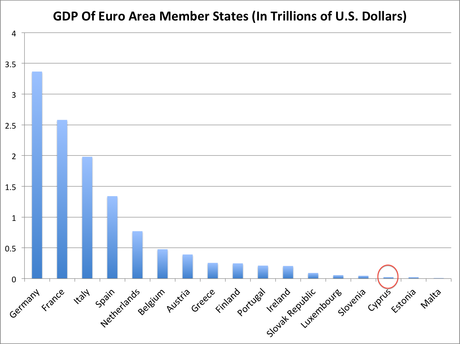

You guys do realize that 20% of your own bank deposits were "confiscated" since 2008 (through Dollar devaluation), right? What difference does it make if they take the cash or if they just devalue the currency the cash is based on? The whole problem with the EU is they CAN'T devalue Cyprus's currency so they MUST confiscate the currency to pay debts. There's only 3 possible ways to pay back debt – A) Pay it back B) Pay it back with Devalued Currency C) Default. If you want to avoid C, you must choose either A or B and the Euro makes B impossible for Member States and that leaves A and then you have austerity, higher taxes or confiscation of wealth (and France has a wealth tax now).

For God's sake people (of the World) grow up and stop whining!

It was important enough that I tweeted out the comment as we had great opportunities to go long on the Nasdaq and Nikkei Futures – both of which gave us lovely early-morning gains and we're now just watching and waiting into the close to…

It was important enough that I tweeted out the comment as we had great opportunities to go long on the Nasdaq and Nikkei Futures – both of which gave us lovely early-morning gains and we're now just watching and waiting into the close to…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.