The Shanghai dropped 5.3% fro the day and the Hang Seng finished down 2.22% and that 5.3% is very impressive when you consider that 10% is "limit down," the point at which trading is halted so, if half the stocks were even, then half the stocks were halted!

The concept behind "The China Syndrome" is that a severe meltdown of containment in a nuclear reactor would create a reaction so hot that it would melt through the housing of the building and through the Earth, in theory all the way to China (ignoring the fact that gravity doesn't actually work that way).

This weekend, Forbes realized that "Pessimism Grows in China" with 36.4% of 5,000 businesses surveyed saying they believed the macroeconomic landscape has weakened, compared to 31.9% who said so in the first quarter. Nomura Securities economist Zhiwei Zhang in Hong Kong said he would not be surprised if China’s second half GDP fell below 7%, bordering on the old “hard landing” territory. Similarly, the Washington Post sees "China's Economic Slowdown Emerges as Risk to US Economy."

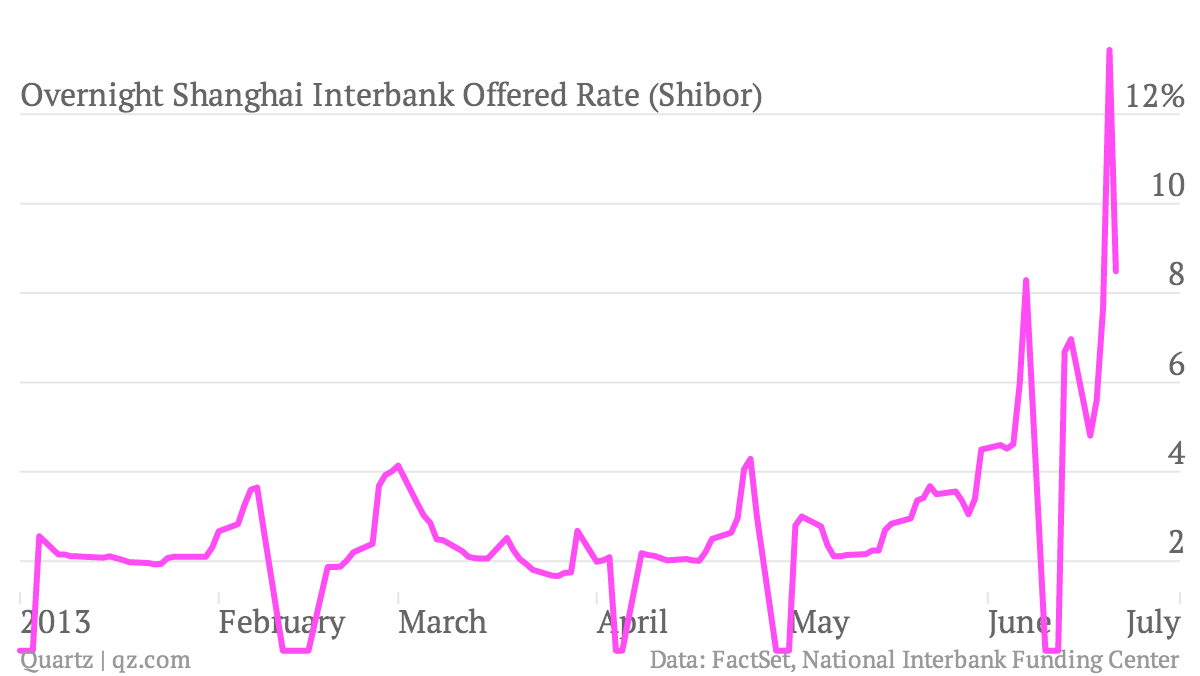

This punishes lenders who have taken on too much debt and relied on short-term repo agreements to…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.