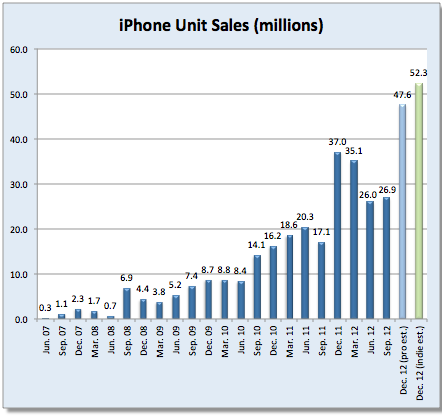

Apple's stock has dropped 4%, all the way down to $497 pre-market as Reuters is reporting that the Nikkei is reporting that AAPL has slashed orders for new IPhone displays by 50% as well as other components. Of course, AAPL never comments on rumors and today is a holiday in Japan so no comments from the suppliers either but the MSM is running with the rumor and the thinly-traded AAPL futures are taking a pounding, and dragging the Nasdaq futures down with them and that's dragging down our other indices and giving us a generally crappy open.

Also a very important point made by Forbes is that Q1 2012 was a rare 14 weeks and Q1 2013 has only 13 so AAPL has a 7% handicap out of the gate. We will, of course, be BUYBUYBUYing more AAPL at $500 as there is no news here and perhaps there is a kernal of truth in the rumor (there is in all the good ones) but likely it's related to AAPL selecting another supplier or shifting their focus to the also-rumored new IPhones that also haven't been confirmed yet.

What we can do right now (8:15) is to go long on the Nasdaq Futures (/NQ) off that 2,725 line – as that's where AAPL is bouncing at $500 and makes an easy signal to get out if it doesn't hold. AAPL's 4% drop is a 0.8% drag on the Nasdaq and there's no other reason for the index to be dropping as the other news this weekend has been fairly benign.

IN PROGRESS

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.