Well, in the US at least. In South Korea, the court has found that both companies infringed on each other's patents and banned the sale of Apple’s iPhone 3GS, iPhone 4, iPad 1 and 2 in the country effective immediately. However, iPhone 4S and the new iPad were cleared. Samsung also has to stop selling its Galaxy S, Galaxy S II and Galaxy Tab range of tabs although it can continue selling the Galaxy S III smartphones.

Obviously we haven't heard the last of this but MSFT should be a winner as it sends more phone manufactures to their Windows Phones and NOK should do very well as their old-fashioned, low-cost designs are a far cry from infringing on AAPL's patents. Slow and steady may indeed with the race here.

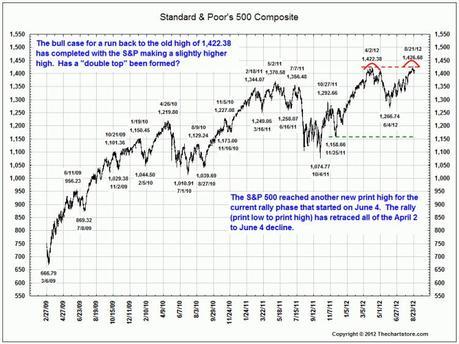

Meanwhile, the S&P has slowly and steadily moved back to it's April highs (1,422) but hit a major wall at this level and this week we'll probably see if we've been consolidating for a break to higher levels or if this is indeed the dreaded double-top after making an 11% run since June 4th:

AAPL gapping up 2.5% this morning will be a big help. AAPL is 4.42% of the S&P 500, although it's $40Bn in net income contributes disproportionately to the S&Ps total earnings and is, in fact, 120% of the indexes earnings gains from last year. On the Nasdaq, AAPL represents over 20% of the index, again, after being adjusted back to 12% in the last rebalancing. The 50% creep up in AAPL's portion in the Nasdaq has also been 120% of the Nasdaq's total gains for the year but, what the heck – a win is a win, right?

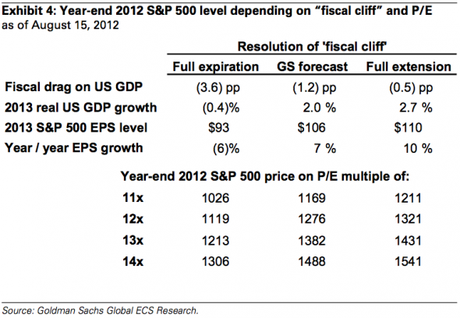

As you can see from this chart by GS, there's a fairly wide range of predicted outcomes that vary by the actual p/e the S&P 500 prints next year as well as whether or not we go off that fiscal cliff. I would point out that even if we hit our worst case and not only do earnings drop 10% but confidence drops the p/e ratio another 20% – we're still at S&P 1,026, which is 54% above the 2009 lows and 27% off the current mark, so a 1/3 retrace of our gains.

As you can see from this chart by GS, there's a fairly wide range of predicted outcomes that vary by the actual p/e the S&P 500 prints next year as well as whether or not we go off that fiscal cliff. I would point out that even if we hit our worst case and not only do earnings drop 10% but confidence drops the p/e ratio another 20% – we're still at S&P 1,026, which is 54% above the 2009 lows and 27% off the current mark, so a 1/3 retrace of our gains.

If that's the WORST case and up another 10% is the best case – don't you think it's hard for the Fed to declare an emergency in Jackson Hole this weekend that mandates the extra-extraordinary measure of pumping liquidity into a market where stocks and commodities are at or near all-time highs?

Heck, we were at 1,074 last October, when the Fed began Operation Twist and that was good for a 32% pop in the S&P and the Fed just extended that program at their June meeting, leading to our current 11% run at the cost of another $400Bn to the Fed and the US markets, if not the US Economy, have certainly responded, with the US markets now over their Oct. 2007 peaks and up more since March 2009 than every country on Earth other than Singapore and Mexico. We're almost 15% over the global average despite the fact that the Global Economy is falling off its own cliff – isn't that INCREDIBLE (as in NOT credible)?

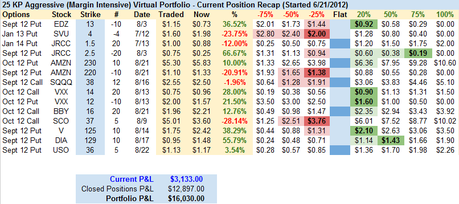

While it was very tempting to take our 2-month, 64% profits and run back to cash in our virtual $25,000 Portfolio (and I did emphasize to our Members that that was the intelligent thing to do on Friday morning), in my 10:55 Review of the Portfolio, as we went through our list position by position – it turned out there were simply not too many we wanted to let go of (as an aggressive carve-out of our larger, long-term bullish Income Portfolio). My overriding comment to Members was:

While it was very tempting to take our 2-month, 64% profits and run back to cash in our virtual $25,000 Portfolio (and I did emphasize to our Members that that was the intelligent thing to do on Friday morning), in my 10:55 Review of the Portfolio, as we went through our list position by position – it turned out there were simply not too many we wanted to let go of (as an aggressive carve-out of our larger, long-term bullish Income Portfolio). My overriding comment to Members was:

We're up 40 and 60% so the correct thing to do is cash out because we're not sure which way the markets are going. Keep that in mind because, if this were money I cared about – I'd rather have $40,000 cash after starting with $25K two months ago than leave it on the table over the weekend

I'm still happy with the positions but, I'd rather take my $15,000 profit and go somewhere nice next week than leave them open. Since it's my job to be here – I'm not going to do that but, if $15,000 is a lot to you – don't be greedy!

We did close out some positions and added others (Members only but oil futures gave us another short entry at our $97.50 target this morning) but, on the whole – even knowing about the AAPL patent decision and expecting it to give us a rough ride – as well as the giddy anticipation into Jackson Hole, we remain bearish because we believe that this QExuberance that has gripped the Global markets since June is indeed irrational and, as I noted in Friday's post – expectations are no so high, that it's not very likely they can be met, even if there is coordinated action – an outcome I believe remains unlikely.

We did close out some positions and added others (Members only but oil futures gave us another short entry at our $97.50 target this morning) but, on the whole – even knowing about the AAPL patent decision and expecting it to give us a rough ride – as well as the giddy anticipation into Jackson Hole, we remain bearish because we believe that this QExuberance that has gripped the Global markets since June is indeed irrational and, as I noted in Friday's post – expectations are no so high, that it's not very likely they can be met, even if there is coordinated action – an outcome I believe remains unlikely.

There is simply too much bad Global Economic news that is being ignored that WILL NOT be fixed by the Central Banksters handing out more money to their top 1% friends for us to want to pay top Dollar for International Corporations at this time. As Dr. Bernanke has repeatedly told our do-nothing, obstructionist Congress – at this point it's up to them to do something to help the middle class before this whole ball of yarn begins to unravel and I think it's more likely that THAT is what you'll hear at Jackson Hole this weekend, rather than another pointless money dump from the Fed.

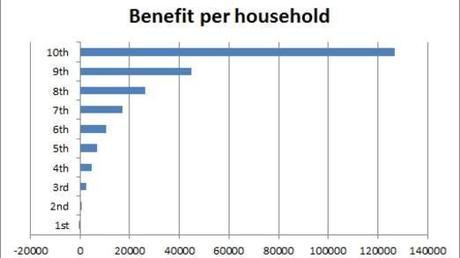

In fact, the news that won't be reported in the US Corporate-Controlled Media but is being heeded overseas is the BOE's report to Parliament that 40% of the market gains from the UK's $600Bn QE program went directly to the top 5% with the average family in the top 10% adding roughly $300,000, leaving less than $5,000 for the bottom 90%. They didn't break it down any further than that for fear of beheadings…

In fact, the news that won't be reported in the US Corporate-Controlled Media but is being heeded overseas is the BOE's report to Parliament that 40% of the market gains from the UK's $600Bn QE program went directly to the top 5% with the average family in the top 10% adding roughly $300,000, leaving less than $5,000 for the bottom 90%. They didn't break it down any further than that for fear of beheadings…

Note how similar the chart on the left is to the Romney/Ryan tax plan except, with their plan, the negative returns begin in 8th place (bottom 80%). It should be noted that, because the benefits include bloated market returns that are unsupported by anything real, that the top 10% gained $1.2Tn on $600Bn worth of stimulus – no wonder we're short! As noted by the BOE:

For a defined benefit pension scheme in substantial deficit, asset purchases are likely to have increased the size of the deficit. That is because although QE raised the value of the assets and liabilities by a similar proportion, that nonetheless implies a widening in the gap between the two. The burden of these deficits is likely to fall on employers and future employees, rather than those coming up for retirement now.

Really – get out of those longs while you can!