What a fun weekend we've been having in Vegas!

What a fun weekend we've been having in Vegas!

We had a great dinner at Nobu on Saturday night (co-sponsored by TradeStation), followed by some poker and yesterday we had our first seminar day where we looked at the Global Macros, discussed trading techniques and made a few new picks for 2015. That was followed by another great dinner at Rao's last night and this morning we are getting started at 6am Vegas time and will be doing live trading all day long. We will be simulcasting in our Live Chat Room via WebEx – Greg will post a link when it's ready.

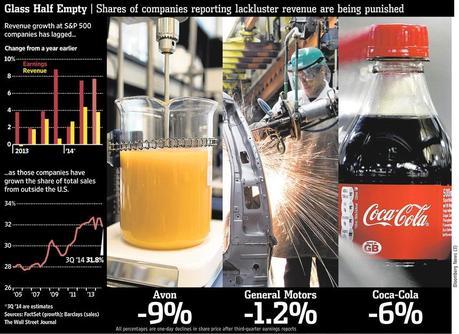

Meanwhile, all quiet on the Global front over the weekend or, at least, just the normal nonsense so the markets continue to drift along at the highs but it's a very busy week and we'll have to wait PATIENTLY to see how things play out. We have 4 Fed Speakers this week but not too much data, which will keep the focus on the tail end of earnings. So far, so blah on that front:

As noted by the WSJ: "While profit gains have generally been solid, many blue-chip companies are posting weak sales growth or outright year-over-year revenue declines, causing worries about their long-term growth prospects. Others are reporting earnings increases driven by factors that don’t reflect sustainable improvements in their business, such as share buybacks and cost-cutting efforts."

Amplifying those concerns is a softening global economic outlook. U.S. multinational firms are now contending with slowing economic growth in key markets like Europe and China, and a strengthening dollar that threatens to further damp revenue by reducing the value of payments collected in foreign currencies when converted into dollars.

Few investors expect a sustained stock decline. But many traders and analysts say they fear future growth at U.S. companies won’t be robust enough to meet the high expectations currently implied by the above-average valuations on blue-chip shares. Friday’s employment report for October, which showed another month of modest job gains tempered by only slight increases in wages, underscored those concerns.

While earnings, so far, are up about 7.7% over last year…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!