Courtesy of David of All About Trends

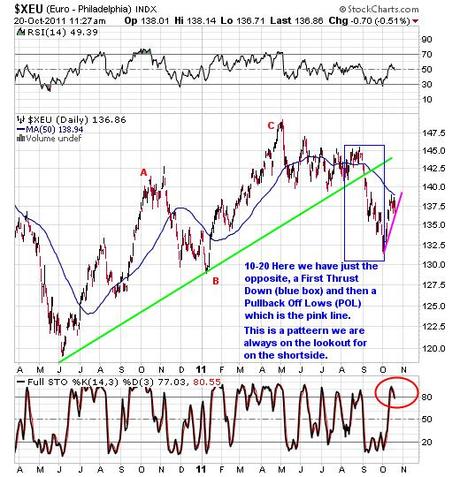

This is where it gets tricky. Tricky in the sense that we’ve got a pending news driven event out of the EU this weekend or maybe just more extend and pretend. So expect a lot of rumbles into it and of course misinformation and rumors too. What is going to happen is going to happen. We have no clue as to what though with the circus parade over there. I will say this though, at All About Trends we are chartists first and foremost. That said take a look at the two charts below. One is the US dollar and the other the Euro. Actually these two charts are classic All About Trends FIRST THRUST PATTERNS, one bullish one bearish. What’s tricky is that in the past when the USD tended to take off stocks took it on the chin to the downside. Whether that is going to be the case this time or not I have no clue, I’m just stating a past trend for the most part.

What’s tricky is that in the past when the USD tended to take off stocks took it on the chin to the downside. Whether that is going to be the case this time or not I have no clue, I’m just stating a past trend for the most part.  By the same token one look at the Euro shows that of a bearish pattern so you see there are some opposite correlations actually out there vs the all for one and one for all moves we’ve been seeing. This all stems from the constant fiasco of the EU’s issues. you know, the ones where they refuse to accept reality? Keep in mind eventually the markets will have had enough of the dancing around and will make the decision for them or force them to make a decision. Remember we are all looking for resolution to the issues. I assure you the markets will react to that, what way I don’t know. BUT keep in mind just because the market reacts doesn’t mean that you have to. If they slam us? Good because its our chance to buy stocks in the face of fear which has been THE trade of the year around here. Look, if the markets get slammed? Starbucks is still going to serve coffee, General Mills is still going to make cereal, Google is still going to make money from they’re adds , Apple is still going to sell iphones, ipads and itunes. See

By the same token one look at the Euro shows that of a bearish pattern so you see there are some opposite correlations actually out there vs the all for one and one for all moves we’ve been seeing. This all stems from the constant fiasco of the EU’s issues. you know, the ones where they refuse to accept reality? Keep in mind eventually the markets will have had enough of the dancing around and will make the decision for them or force them to make a decision. Remember we are all looking for resolution to the issues. I assure you the markets will react to that, what way I don’t know. BUT keep in mind just because the market reacts doesn’t mean that you have to. If they slam us? Good because its our chance to buy stocks in the face of fear which has been THE trade of the year around here. Look, if the markets get slammed? Starbucks is still going to serve coffee, General Mills is still going to make cereal, Google is still going to make money from they’re adds , Apple is still going to sell iphones, ipads and itunes. See

…