Courtesy of David at All About Trends

Well folks we’ve yet again came a long way in a short period of time and made the best of it. Now? We need to do what this guy is doing.

We seriously need to see a Coca-Cola market from here if we are going to continue higher. Which means pullback or go sideways or even both depending upon what you are looking at. Like we said yesterday, we can build a case for higher into year end and a case for that’s it. Sometimes though the markets need to pause a bit and that is where we are right now. I am starting to see a lot of names sitting at resistance levels or even possibly putting in double tops. Take some of the names below for example whom we recently walked away from.

All of which leads us to taking it easy here long or short. If this is just a pause before higher and you short? (aside from a quick scalp type person who can sit in front of a screen) you might end up just getting chewed alive. Lets just give it a few days here. I’m going to spend the rest of the day really doing some serious scans long and short but I seriously don’t think I’ll see to much in the realm of being able to go long anything right here. We just had a nice run here at all about trends feel free to grab a Coca- Cola. We’ll spare you the nose bleed index charts for today. SHORT SIDE WATCH LIST

None currently as its that time of year.

LONG SIDE WATCH LIST

"Only The Best And Forget The Rest "

"We Trade What We SEE, NOT What We Think, Hear Or Fear "

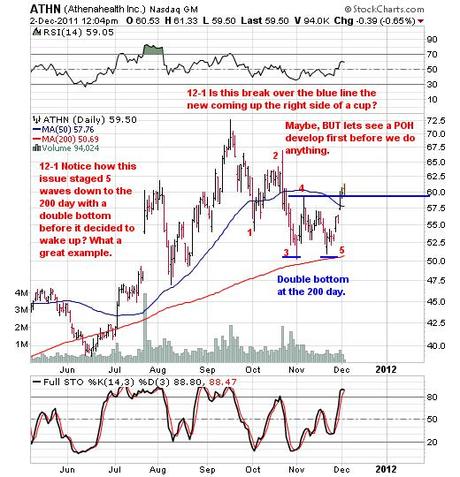

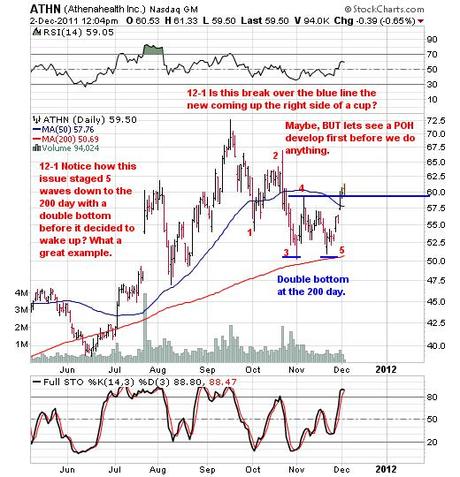

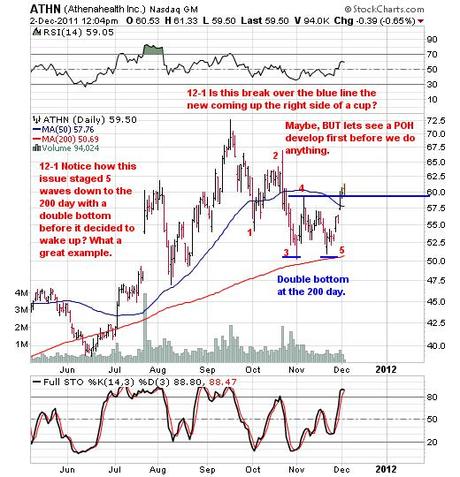

12-1 Given what we’ve seen in the indexes the last few days it stands to reason this list should be very small and rightfully so. Until we see some work off of the overbought conditions (sideways or down) this list will stay small. There is enough names out there on the back burner that given some sort of backing and filling and of course some POH-ing that we’ll have enough to work with in the coming days. As they develop we’ll bring them front and center. Right now though lets exercise some caution as we just ripped.

ATHN

BACK ON WATCH LIST AND WE STRESS WATCH

FEATURED BUT NOT TRADE TRIGGERED BY US LIST GLD

. OIH

CURRENT POSITIONS

"Let Your Stocks Tell You What To Do By The Action They Exhibit." NOT YOUR EMOTIONS! LONG SIDE POSITIONS 12-2 Notice how our holdings are getting smaller and smaller? That’s because this isn’t the 90′s anymore where we buy strength and the high go higher. We’ll just keep doing what we have been doing and that is buy fear off of technical supports and indicators and sell strength off of technical resistance levels and indicators all the while being ever mindful of the total value of our portfolio. We’ll continue to take it a step at a time and lock down gains along the way. NUS is the next one on deck, that is unless we wake up Monday and AAPL and AMZN are each up 10 to 20 points at the open for some stupid reason then we’ll lock them down too but I doubt that, I’d like it but doubt it. We want to try to hang on to the star receivers of paint the tape land (AAPL,AMZN) as best we can but like I said if we see a big spike from here in them? We won’t look that horse in the mouth at that moment in time. Heck all we need is for some analyst to come out and upgrade AAPL and AMZN and pow zoom to the moon. Keep in mind Wall St. Also has a habit of upgrading after a name has made a run as they are emotional animals too. And of course downgrading at the bottom for the same reason. We’ll see. NUS (We are long 250 shares of this at 46.42 as of 11-28-11)

12-2 Heck at 48.62 its a quick 500.00 worth of gains. The one minute charts show this issue POHing in that time frequency btw. A retest of the highs too though would seriously make us get out much like we did with FIO CVLT RAX. 12-1 Looking ok here. A break below the C and we have to walk away. AMZN (We are long 75 shares of this at 204.56 as of 11-18-11)

12-2 And as you can see it can still run to the red channel line sooooo here too much like our notes in the BIDU trade trigger this morning we fight with it on one hand.

VHC (We are long 300 shares of this at 21.64 as of 11-11-11)

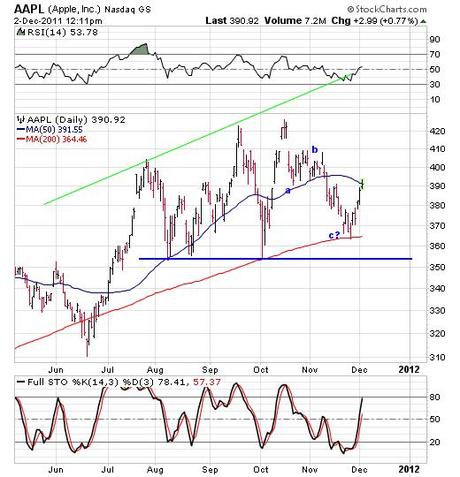

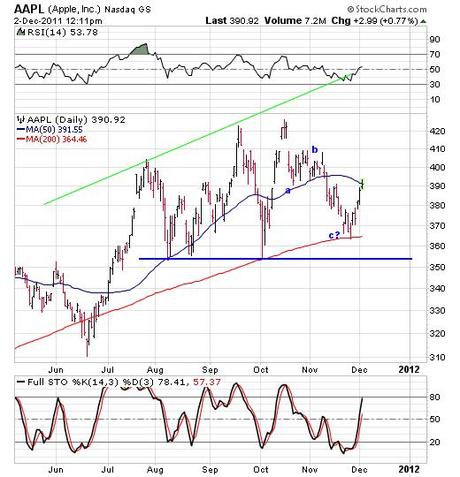

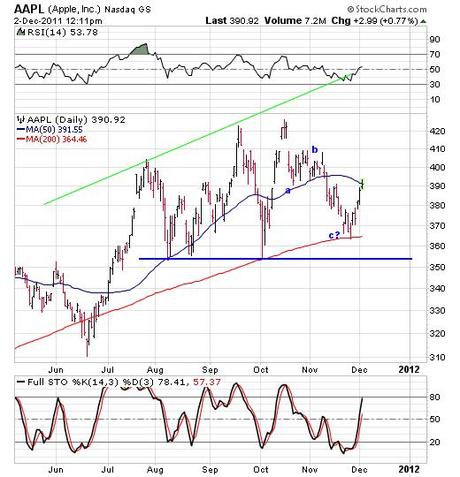

AAPL (We are long 25 shares of this at 398.56 as of 11-1-11)

Our average cost on this issue is 395.17

12-2 Folks I fight with this one here. Much like our notes in the BIDU trade trigger this morning on one hand. On the other hand? Well? Its AAPL. Keep in mind in a smash in the market this issue could roll right back over. But then again after something like that if it were to occur it could bounce right back too as we’ve seen.

12-1 While this issue doesn’t look all that great its got structure. The structure is that it went into a correction and sold off to the 200 day average and is now working its way up from there. Lets see what happens at the 50 day average at 391.70. Keep in mind if the market wants to pump the indexes this is they’re star player to do so as it makes up a large percentage of the indexes. Not to mention every mutual fund on the planet owns it.

11-21 Our notes from 11-10 still apply to this name.

11-13 Recently we saw a few blurbs about how this issue is totally damaged because its below the 50 day. We get that on the surface HOWEVER look at the overall trend of this stock. It doesn’t trade off the 50 day, it trades off of a big green trend channel.

11-10 So lets play "What If" . What if this issue goes to the green trendline? Well first off its a support level. So would we want to stop out there? Knowing its a support level? And if it were to blow thru there and head to the 200 day average at 262 would we want to stop out there? Knowing its even more major support?

What impact would that have to the total value of our portfolio IF (not saying its going to not saying its not as I don’t know neither does anyone else) it went to the 200 day?. Let’s see we own 50 shares at 395.17 and this issue makes up 11% of our total portfolio. So IF it were to go to 362.00? we’d be down on the position 8.3% on its own. But what about the total impact to our overall portfolio? 9/10ths of one stinking percent!

On top of that? IF we would go there and stop out (which we wouldn’t do because its only a moment in time subject to the next moment in time) it would be a 1658.00 dollar loss. know what? We are up 3300.00+ for the month. So now how much damage would that be to us.

By using trade size risk management it really allows us to never really get flustered or in trouble. This allows us to always stay centered and objective because it really doesn’t mess with our most important asset which is our state of mind. Folks use this conversation as an example for yourself to think things forward and thru. It really helps calm the mind.

SHORT SIDE