They make investors think everything is undervalued in a sector when one company gets bought for high cash premiums and BEAM (Jim Beam) is one of those companies many of us know and love but not, apparently, as much as the Japanese who will be taking over this 110 year-old American Icon. BEAM did not rise 30% last year, making it "cheap" vs other S&P choices and, of couse, the only thing in the World more plentiful than Free Dollars is Free Yen – so why not gobble up some assets while the gobbling's good?

Suntory is a 1 TRILLION Yen Company and a steady, 4% dividend payer in Japan. A move like this is another bullish signal for the markets as this is the proverbial money coming off the sidelines, when foreign companies begin buying up US companies and Japan is a prime candidate as the Nikkei was up 45% last year – making the S&P look pretty cheap to them.

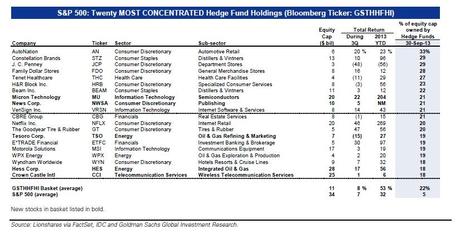

If you want to find other companies that look cheap, I would suggest the S&P's 20 Most Concentrated Hedge Fund Holdings, where BEAM was number 7. These are the companies most favored by hedge funds and it's not the usual suspects:

The Free Money is still out there, as long as you can service a 10-year loan at 3%, any of these companies can be yours and refinancing a decade from now is the next CEOs job – especially if you are a CEO already over 55 and looking to put your stamp on your company with a big move. STZ, for example, is a $15Bn company at $80 a share (expect it to move higher on this news) and a…