What's the point?

What's the point?

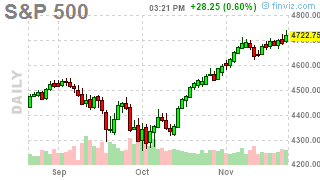

I already can't get people to pay attention to projects this week. We ended last wek on a high note but it was the same high note (S&P 4,708) that we hit on November 5th and Friday was the 22nd so 11 trading days with no net progress and, suddenly, we're closing out Novemer already. The last day that SPY had 100M contracts traded was Ocober 6th and there has only been 2 days above 69M since Ocober 15th. So volume is dying and we're making no progress.

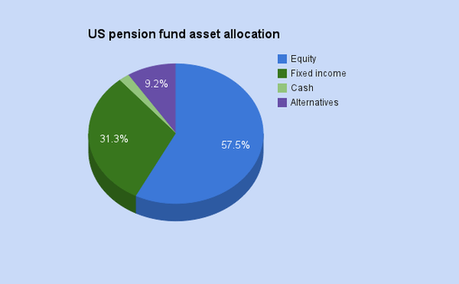

As I've mentioned before, low-volume rallies are caused by the default buy-ins of "Dumb Money", which is a combination of IRA, 401K, Fed and other Central Banks and individual investors who put thier money into index funds, which buy the bad stocks along with the good – at full market prices. That's what causes the usual end-of-day surges but the Fed is withdrawing some of their Monetary Easing and now Pension Funds are seeing their cash allocations dropping to 7-year lows.

Public pension funds have historically been able to access cash when equity markets faltered by selling bonds. But over the past two decades, fixed income portfolios shrank to 24% of assets from 33%, according to the Boston College data, as falling rates turned bonds into a drag on returns. Now inflation threatens to further erode the value of fixed-income investments.

Meanwhile, with Thanksgiving just days away, Federal medical teams have been dispatched to Minnesota to help with Covid-19 cases at overwhelmed hospitals. Michigan is enduring its worst case surge yet, with daily caseloads doubling since the start of November. Even New England,…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!