What an incredible finish!

What an incredible finish!

We have retaken most of our September highs after dropping about 10% in the first two weeks of October. Technically, it LOOKS like a strong market but Fundamentally, we know that the boost is the result of Trillions of additional stimulus from Japan and Europe and, as I mentioned on Thursday, it's not that the US has STOPPED stimuluating the economy – we've simply stopped INCREASING the amount of stimulus – hardly a "taper."

So we're watching and waiting this week, especially ahead of the elecion. We did a Portfolio Review over the weekend and all 5 of our Member Portfolios are looking very good into the end of the year so we don't want to rock the boat and we angled more bearish into the weekend, just in case but, on the whole BALANCE is our goal.

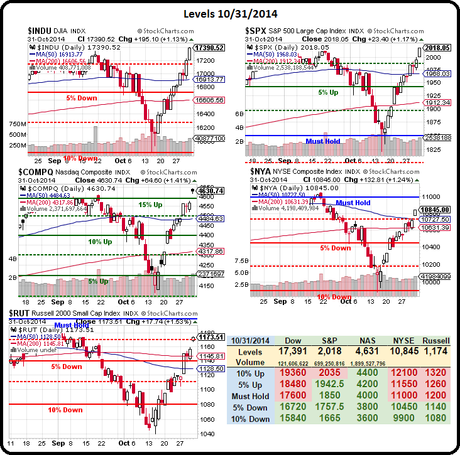

As we expected, weak Chinese data (see morning notes to Members) is putting a damper of Friday's rally already and, as you can see from our Big Chart, we're back at levels that have proven to be harsh overhead resistance for our indices.

As we expected, weak Chinese data (see morning notes to Members) is putting a damper of Friday's rally already and, as you can see from our Big Chart, we're back at levels that have proven to be harsh overhead resistance for our indices.

We're still waiting for the Russell and the NYSE to confirm by making their own new highs and Russell's pop to 1,174 on Friday was so fake that we did decide to short /TF (Russell Futures) below the 1,170 line this morning – we'll see how that goes as a fun bearish play.

On the whole, last week's action had the Fundamentalists throwing up their hands and simply screaming. Soc Gen's Albert Edwars summed it up nicely, saying:

“The amazing thing is how little interest there is with western investors about Japan and how it effects US or European portfolios

Notwithstanding the fact that it is the 3rd biggest economy in the world by a long way (the same size as Germany and France added together if you look at it the right way ie current exchange rates rather than PPP)

Little understanding out there what yen devaluation means for Chinese renmimbi and how they will be forced to devalue too.

ECB money printing will never be able to compete with Japan. The euro might be going down vs the dollar but it will be going up against the yen

Little understanding how, not only will the eurozone be going into recession and deflation but that Germany will be the weakest economy in zone. Once Germany’s budget deficit starts to rise sharply as a result of their recession the new mad balanced budget act will kick in and they will be cutting spending aggressively. Expect the eurozone to disappear down a black hole!”

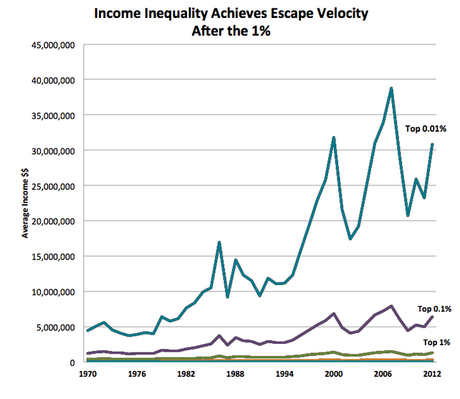

A complicated and dangerous game is being played out on the World stage as Global Currencies are being devalued, which destroys the wealth of people who get paid and save in those currenices (the bottom 99%) while Global Assets are being inflated, which benefits the people who hold large amounts of assets and little cash (the top 1%). Never before in human history has so much been taken from so many to benefit so few…

A complicated and dangerous game is being played out on the World stage as Global Currencies are being devalued, which destroys the wealth of people who get paid and save in those currenices (the bottom 99%) while Global Assets are being inflated, which benefits the people who hold large amounts of assets and little cash (the top 1%). Never before in human history has so much been taken from so many to benefit so few…

JP Morgan estimates that QE has added $9Tn in equity wealth, or about 32% of the S&P's current 2,010 level. Zero Hedge argues it's closer to 50% in the linked article but, either way – it's a lot! Low interest rates have added about $2.5Tn (10%) to property values as well, more windfalls for the top 1% and, best of all, the Fed has successfully combated wage inflation (yes, it's one of the things they actively do) so there's no nasty middle or upper-middle class anymore competing to buy the good vacation homes.

Overall, $11.5Tn has been added to household net worth through QE and 90% of that increase has gone to our 30,000 greatest Americans (the top 0.01%). Tomorrow the sheeple will go to the polls and vote for two more years of the same and they will likely keep voting that way until they can no longer affrod the bus fare to go to the polls.

Overall, $11.5Tn has been added to household net worth through QE and 90% of that increase has gone to our 30,000 greatest Americans (the top 0.01%). Tomorrow the sheeple will go to the polls and vote for two more years of the same and they will likely keep voting that way until they can no longer affrod the bus fare to go to the polls.

It's sad, really, like watching cows follow each other into the slaughterhouse – you kind of hope that just one of them would realize what's going to happen and bust out of the line but no, they simply don't see tragic fate that lies just ahead of them and the rancher certainly doesn't seek to enlighten them, their horrible, early death after an unfulfilling life of drudgery is how he makes his living – just like our top 0.01% makes their living off the once-free American People!

Ask the rancher if he feels he should provide education, health care and retirement benefits to his cattle and he will give you the same answer the average Republican gives you about the bottom 99% – it's a free country, they need to take care of themselves. Acutally the farmers do provide some health coverage as well as minimal shelter because, unlike a Republican, a rancher does place some value on the creatures that work for him.

Ask the rancher if he feels he should provide education, health care and retirement benefits to his cattle and he will give you the same answer the average Republican gives you about the bottom 99% – it's a free country, they need to take care of themselves. Acutally the farmers do provide some health coverage as well as minimal shelter because, unlike a Republican, a rancher does place some value on the creatures that work for him.

Tomorrow we celebrate the illusion of Democracy because, somehow, Americans have become convinced that Democracy means choosing from the two things that are offered to you by the people who are already in power. This is no real choice – this is the choice offered a prisoner to have the cell on the left or the cell on the right yet we have somehow convinced the American people that there is no third option (freedom, perhaps?).

What's even sadder is that you will read hundreds of articles and watch dozens of TV shows covering the subject and not one of these Corporate Media outlets will call into question the very concept of our ridiculous two-party system where 90% of Congress is re-elected every time and, in general, the candidates who spend the most get the most votes – what on Earth does this have to do with Democracy?

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!