That's all I can say about the action this morning. There's a Global currency-manipulation scandal, China had an alraming drop in exports, a decline in manufacturing and expanding inflation at home, Japan's GDP has been revised down, Global debt has now passed $100,000,000,000,000, and an airplane is "missing" (possibly terrorism), yet the US Futures have already rallied back from a half-point deficit to flatten out an hour before the open.

The Russian thing is still going on, France's economy is showing no sign of improvement but none of this seems to matter to equity buyers and, in fact, Goldman Sachs looked at the recent action and put out a note to BUY Chinese stocks:

“Given how share prices have corrected and given where the valuations are, from a risk-reward standpoint we still think we can make a positive case on Chinese equities,” Kinger Lau, a strategist at Goldman Sachs, said in an interview in Hong Kong on March 4. He predicts the Hang Seng China Enterprises Index (HSCEI) will climb to 12,000 in the next 12 months, a 24 percent advance from last week’s close, versus the brokerage’s December forecast for the measure to reach 13,600 by the end of 2014.

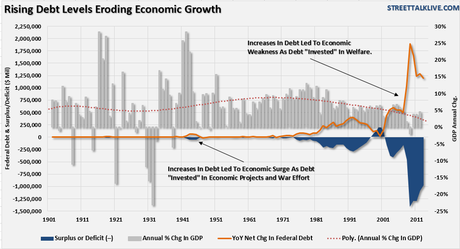

As you can see from the chart above (good article here, thanks Sibe) China's money-creating stimulus puts the rest of the World to shame but that $100Tn total Global Debt should bother someone, shouldn't it?

As you can see from the chart above (good article here, thanks Sibe) China's money-creating stimulus puts the rest of the World to shame but that $100Tn total Global Debt should bother someone, shouldn't it?

Seth Klarman calls it a "Truman Show Economy" and that's an excellent description of what's going on. This weekend he updated his outlook, noting:

From "born bulls" to "worry genes" and from Bitcoin to flash-mob-speculation, "there is a growing gap between the financial markets and the real economy…and the overall picture is one of growing risk and inadequate potential return almost everywhere one looks… as every 'Truman' under Bernanke’s dome knows the environment is phony."

A skeptic would have to be blind not to see bubbles inflating in junk bond issuance, credit quality, and yields, not to mention the nosebleed stock market valuations of fashionable companies like Netflix and Tesla. The overall picture is one of growing risk and inadequate potential return almost everywhere one looks.

Kind of depressing, isn't it. Fortunately, all of the skeptics have been taken out and shot – so as not to bother you – or at least that's how it would appear in the MSM and especially on TV, where being a bear means you only think TSLA will go to $300 this year, not $500. It is, in fact, scary to short. Rather than shorting at what we think is top, last week we went back to cash and we're waiting for a dip – because betting on one has been a fool's game for most of the last 5 years!

Doug Short did an excellent analysis this weekend and compares the market now to where we were in early 2000 but back in 2000 we didn't have a coordinated effort by all of the World's Central Banks to push the markets ever higher. Forget Truman, this market is more like Icarus on steriods. I don't know how close to the Sun we can ultimately fly but I'm worried enough to like cash better than very expensive equities at the moment, as Klarman says:

Six years ago, many investors were way out over their skis. Giant financial institutions were brought to their knees…

The survivors pledged to themselves that they would forever be more careful, less greedy, less short-term oriented.

But here we are again, mired in a euphoric environment in which some securities have risen in price beyond all reason, where leverage is returning to rainy markets and asset classes, and where caution seems radical and risk-taking the prudent course. Not surprisingly, lessons learned in 2008 were only learned temporarily. These are the inevitable cycles of greed and fear, of peaks and troughs.

Can we say when it will end? No. Can we say that it will end? Yes. And when it ends and the trend reverses, here is what we can say for sure. Few will be ready. Few will be prepared.

Let's be careful out there!