Didn’t we do this last week?

Didn’t we do this last week?

Hmmm, let’s see – Massive Chinese inflation and a popping bubble of an economy cause a sell-off in Asia and renew concerns of EU stability causing a relative rise in the Dollar that tanks commodities and melts down the global indexes. Yep, check, Check and CHECK! I’m not only going to say "I told you so" and I’m not going to even bother telling you again as you can just read last week’s post where our plan was to short oil Futures (/CL) at $97.50 (now $95, up $2,500 per contract) and our trade ideas from the Morning Alert to Members were:

If you want to play a pullback in China, I like 10 FXI Jan $40 puts at $1.90, selling 5 Aug $40 puts for .40 as a bearish spread. That knocks 10% off the purchase price with 5 more months to sell so it’s a nice way to stake a starter hedge on China.

Also, of course, I loves my EDZs. The Aug $17/19 bull call spread is .55 and can be offset with the usual suspects (any bullish short put you REALLY want to own) or the short EDZ Aug $15 puts .50 on the assumption EDZ doesn’t drop another 10% or, if it does, that’s not a bad place to commit long anyway as it would be below the 52-week low (and good options to sell).

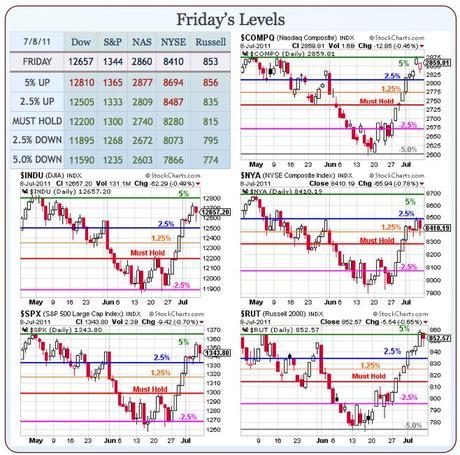

We were bearish all week (see Stock World Weekly for a nice summary of the week’s events and trade ideas for the week ahead) and, although the market didn’t seem to agree with us, we simply scaled in and rolled our short positions higher – taking a couple of protective longs on Friday’s dip – just to get a little balance but, as you can see from our weekend reviews of the $25K Portfolio and our Income Portfolio – we are still leaning pretty bearish until the market does a little more than fake some technical moves to impress the retail suckers.

Certainly our Weekend Reading post did little to cheer us up. In fact, it was so depressing I had to resort to cute pictures of kittens and babies to keep it from getting too sad. As noted in David Fry’s SPY chart for Friday, the gap down on the jobs numbers was genuine but the rest of the day’s action was fake, Fake, FAKE:

Certainly our Weekend Reading post did little to cheer us up. In fact, it was so depressing I had to resort to cute pictures of kittens and babies to keep it from getting too sad. As noted in David Fry’s SPY chart for Friday, the gap down on the jobs numbers was genuine but the rest of the day’s action was fake, Fake, FAKE:

So after a large rally in stocks over the past week of trading days we hit what should have been an epic sell-off given the employment report. But this didn’t happen as stocks only sold-off modestly and rallied smartly off their lows. Why? I’m not sure. A lot of hedge funds and trading desks have put some serious bullish markers down recently and need to defend them.

They also must believe corporate earnings will be great as jobs are outsourced and the weak dollar makes sales overseas look better. There’s also more than just a whiff of QE3 in the air. Further with interest rates this low M&A can take place not to mention financing of more stock buy backs.

Bulls must believe we’re stuck with high unemployment and a poor housing economy so they’re just hardened to it. Consumers are shopping building up their credit card debt and cars are always easy to finance so they focus on that. Further, bulls just believe, for now anyway, government debt issues whether here or overseas (Italy on Friday) will be resolved one way or another.

Despite our belief that Friday’s recovery was total BS – we had to respect the manipulators’ ability to hold our 2.5% lines – especially after starting the day with such terrible employment numbers. Of course, as usual, bad news is good news because it’s been all QE2 as $600Bn spent by the Fed since the September 2010 announcement lifted the Dow 2,500 points but really it’s only 1,500 points from where QE1 took us (11,000) and then we dropped 10% before QE2 was rolled out.

Despite our belief that Friday’s recovery was total BS – we had to respect the manipulators’ ability to hold our 2.5% lines – especially after starting the day with such terrible employment numbers. Of course, as usual, bad news is good news because it’s been all QE2 as $600Bn spent by the Fed since the September 2010 announcement lifted the Dow 2,500 points but really it’s only 1,500 points from where QE1 took us (11,000) and then we dropped 10% before QE2 was rolled out.

Now, as with the summer of 2010 – we are beginning to drift back to the lower end of our channel (our -2.5% lines) with the occasional run-ups on pretty much any rumor that QE3 is coming just around the corner. I think that, unless we break BELOW our -5% marks, we’re not going to get a QE3 intervention any earlier than we did last year, which was at the September Fed meeting in Jackson Hole.

The problem is that, this time, we have already run-up in anticipation of QE3 – over and over again! Also, as I mentioned in our weekend reading, we are at the point of diminishing returns on QE programs so the Fed is going to have to come up with something bigger and better than just a plan to buy another Trillion in TBills to accommodate our brand-new $17Tn debt ceiling.

Just as we HAVE to respect the technicals when everyone is over the 2.5% line (never happened as NYSE hit it like a brick wall – which was our danger indicator all week), we HAVE to respect those same technicals when we have a 5-index breakdown, like we are likely to have this morning. After that, we can flip more bullish if we see 3 of our 5 levels get back over the line but I’d be more concerned about holding our "Must Hold" levels unless we get some miraculous pop today (and miracles do come daily in this phony baloney market – Harrumph!).

Just as we HAVE to respect the technicals when everyone is over the 2.5% line (never happened as NYSE hit it like a brick wall – which was our danger indicator all week), we HAVE to respect those same technicals when we have a 5-index breakdown, like we are likely to have this morning. After that, we can flip more bullish if we see 3 of our 5 levels get back over the line but I’d be more concerned about holding our "Must Hold" levels unless we get some miraculous pop today (and miracles do come daily in this phony baloney market – Harrumph!).

In an attempt to protect their phony baloney jobs, the EU has called emergency meetings to respond to yet another banking/credit crisis, which may be beyond the EU’s ability to throw money at. The European rescue fund now in place does not have enough assets to cover Italy’s problems. The cost of insuring against default on Portuguese, Irish and Greek government debt rose to records. In a classic act of misdirection, Italy is ordering short sellers to disclose their positions, because after all, the entire European credit crisis was caused by analysts who identified over valued stocks. A whiff of desperation hangs over this diversionary action, reminscent of similarly foolish attempts done in 2008 in the US.

As Barry Ritholtz noted this morning: "The bottom line remains: The Low hanging fruit in this rally appear to have been picked, and a modest correction appears to be underway. Markets have been modestly overbought, and in need of some corrective action. Whether this turns into anything more than a pullback off of recent highs will be determined in the coming days . . ." We’re also watching that budget debate in Congress but the process is a total joke. Per the NY Times:

On “Fox News Sunday,” the Senate Minority Leader Mitch McConnell of Kentucky said that he was “for the biggest deal possible, too, it’s just that we’re not going to raise taxes in the middle of this horrible economic situation.”

Yes, we are in a “horrible economic situation.” Of that there can be no doubt. But the horribleness of that situation is not being felt by a segment of the population — High Net Worth Individuals (HNWI) — whose numbers and net worth have swelled even over the past two years. Per the annual Capgemini/Merrill Lynch World Wealth Report:

Yes, we are in a “horrible economic situation.” Of that there can be no doubt. But the horribleness of that situation is not being felt by a segment of the population — High Net Worth Individuals (HNWI) — whose numbers and net worth have swelled even over the past two years. Per the annual Capgemini/Merrill Lynch World Wealth Report:The population of HNWIs in North America rose 8.6% in 2010 to 3.4 million, after rising 16.6% in 2009. Their wealth rose 9.1% to $11.6 trillion. [Ed note: Per Capgemini's 2010, the HNWI gain in 2009 was 17.8%.].

Barry points out: "While the single biggest asset most of us own is our home (still deflating, unfortunately), the single biggest asset most HNWI own is their investment portfolio (S&P500 up almost 100 percent over the past two years); real wages for working stiffs barely budging while those in the C-suite party like it’s 1999 (or 2007). These folks — presumably the “job creators” about whom we hear so much on a regular basis — have seen their wealth rise by about 28% over the past two years." That’s about $2.5Tn that’s been transferred from the bottom 99% to the top 1% in just 2 years and the Republicans are willing to let the whole country go down in flames to protect those gains – isn’t that special?

Just to be clear – in order for 3.4M American taxpayers to make $2.5Tn more in a flat economy, the other 106.6M taxpayers must make $22,452.16 less EACH. Now, if you happen to be bright enough to be in the top 20% (people earning over $60,000 a year) then you can probably figure out that most of that $22,452.16 PER TAXPAYER wasn’t taken from the bottom 80%, who barely have enough disposable income to buy a $8 burrito at Chipolte. That’s right, that money is being ripped out of the hands of the middle class and out of the profits of small businesses and being shoved into the vaults of the VERY privileged, VERY few.

Of course you only notice part of the theft – that’s the genius of the thing! Sure you pay more for food and fuel and clothing and health care and education but that doesn’t seem like the kind of thing you can just pin on the 3.4M people who own those businesses, can you? They are just innocent Capitalists making their profits at your expense but that’s the game, right? What you don’t see is that they are also being handed hundreds of billions of Dollars in loans and bail-outs and the debt for that infinite money creation is a bill that the bottom 93.6% haven’t gotten – YET.

WAKE UP AMERICA – It’s almost too late!