LTC has investments in 30 states leased or mortgaged to 40 different operators. Recent acquisitons include a school property located in Minnesota, two senior housing properties located in South Carolina, and two properties, including skilled nursing properties in Florida and Texas.

The best thing about LTC is that they pay a MONTHLY DIVIDEND of $0.14 per share, which is a current dividend yield of 6.64% (as of October 5th, 2011). I love monthly dividend payers because when I'm old and gray they will inject my portfolio with free cash on a monthly basis instead of every three months like most stocks. Keep in mind that babyboomers are aging and LTC is in a sweet spot for capitalizing on the seniors.

Click here to visit LTC's website, and here to learn more about this solid REIT. If you have some free time please review LTC's annual report, click here.

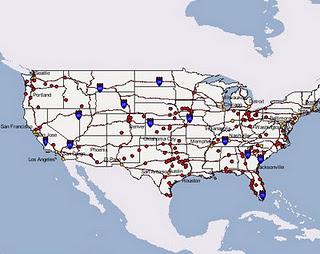

As you can see in the picture below, LTC has real estate all throughout the continental United States. I suggest investing in LTC as soon as you can so you can being to reinvest your monthly dividends. Wealth is possible with smart decisions like investing in health care REITS! Have a great day!