And how was your morning?

And how was your morning?

Probably better than it was for people in France, where an Air Products (APD) factory was attacked with a car bomb. Our markets have become so jaded to terrorism that they spiked HIGHER minutes after the attack (6:40). Meanwhile, in China, the Shanghai Composite continued to tumble, down a whopping 7.4% on the day, which is amazing since they halt stocks at 10% so only a few of them DIDN'T go limit down for the day.

We've been warning you about this (and shorting China with (FXI), (FXP) and (CHAU)) for over a month now but this time may be different as Morgan Stanley (MS) warned it's investors NOT to buy the F'ing dip in what is now China's $8.8Tn market (was over $10Tn when we started shorting).

“This is probably not a dip to buy,” wrote Jonathan Garner, the head of Asia and emerging-market strategy at Morgan Stanley in Hong Kong. “In fact, we think the balance of probabilities is that the top for the cycle on Shanghai, Shenzhen and the ChiNext has now taken place.”

Chinese markets peaked out on Friday, June 12th and I called the top on Monday, June 15th, with "Monday Meltdown – Greece and China Race to Default" in which I said:

Chinese markets peaked out on Friday, June 12th and I called the top on Monday, June 15th, with "Monday Meltdown – Greece and China Race to Default" in which I said:

China is only better off than Greece in that they get to print their own money and make up their own economic statistics without the fear of being audited (it was an audit of Goldman Sach's cooked books that began the Greek crisis). That means China has less chance of having their backs placed against the wall than Greece but that doesn't mean that, like fellow BRIC nations Brazil and Russia, investors won't simply lose confidence in what is more and more obviously an unsustainable system.

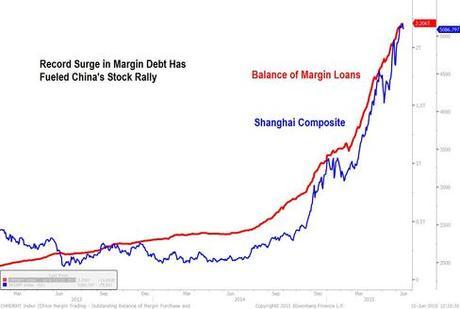

Since last June, the Chinese markets have gained $6Tn (150%) in PRICE (not value!) as margin debt climbed from $100Bn to $358Bn (250%). Meanwhile, net inflows of cash into the Chinese markets were just $200Bn. $200Bn + $358Bn is not $6,000Bn is it?

Back on May 22nd, I had written: "Failing Friday – China Defaults Keep Adding Up" where I pointed out how Municipal and Corporate defaults in China were about to become an issue. A month before (4/24), it was: "Friday Failure – Kaisa Bond Default Underlines China Housing Crash." I don't know what it is about Fridays – I guess I start looking ahead and they are my biggest global fear for a market collapse… In fact, in that April article, I explained exactly why I was being such a Chicken Little and was NOT going to stop sounding the alarms on China – it's a good lesson for those of you who would like to avoid being caught in a major market correction.

Back on May 22nd, I had written: "Failing Friday – China Defaults Keep Adding Up" where I pointed out how Municipal and Corporate defaults in China were about to become an issue. A month before (4/24), it was: "Friday Failure – Kaisa Bond Default Underlines China Housing Crash." I don't know what it is about Fridays – I guess I start looking ahead and they are my biggest global fear for a market collapse… In fact, in that April article, I explained exactly why I was being such a Chicken Little and was NOT going to stop sounding the alarms on China – it's a good lesson for those of you who would like to avoid being caught in a major market correction.

At the time, we were using the China ETF (FXI) to play short with the June $50 puts at $1.20. That was a FREE Trade Idea, right in the morning post and FXI finished at $46.79 on expiration day (June 19th), so those puts were $3.21 – up 167% in less than a month but we had already flipped to the July puts and those we already cashed in and got MORE aggressively short with Ulra Short (FXP) in our Short-Term Portfolio and we shorted the Ultra Long (CHAU) in our Long-Term Portfolio indicating we really couldn't be more confident with that call.

At the time, we were using the China ETF (FXI) to play short with the June $50 puts at $1.20. That was a FREE Trade Idea, right in the morning post and FXI finished at $46.79 on expiration day (June 19th), so those puts were $3.21 – up 167% in less than a month but we had already flipped to the July puts and those we already cashed in and got MORE aggressively short with Ulra Short (FXP) in our Short-Term Portfolio and we shorted the Ultra Long (CHAU) in our Long-Term Portfolio indicating we really couldn't be more confident with that call.

At $47.75, FXI should open lower this morning and we do expect China to step in with more stimulus but the Aug $45.50 puts at $1 are still a fun way to play if you don't like complex spreads and, if China does stimulate and FXI pops higher, THEN we can adjust it and roll it to higher Sept puts because NOTHING they do can really stop this market from making a serious correction, at least to that $44 line ($1.50+ on the options, up 50%) and possibly the $40 line ($5.50, up 450%) – it's just a matter of when (or should I say Wen?!? Get it, Wen.. that's the Premier's name – Wen! Ouch, tough room…).

Meanwhile, for those of you who are thinking that hoarding physical metals (gold, silver) will keep you safe in a market collapse, let this be your valuable lesson for the weekend:

This is why I crack up when people tell me they keep a supply of gold coins or silver in a safe "just in case." If things get so bad that paper money becomes worthless, I advise people to have a stockpile of water filters instead – something that will actually have value in whatever post-apocalyptic fantasy world they think they are saving up for. For better or worse, money is here to stay, folks…

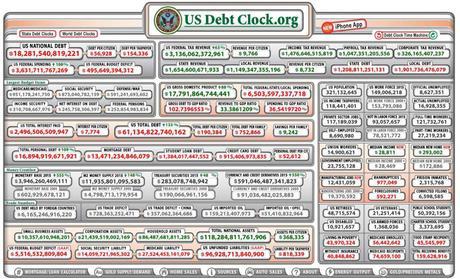

That's why the Central Banksters get away with printing so much of it. Those average people on the street all value Dollars – even though they can't buy what they used to and even though they are backed by nothing but a Government that is over 100% of it's GDP in debt, runs a $500Bn annual deficit and has $43Tn worth of unfunded obligations meaning each Dollar you hold is nothing more than an IOU from a nation that is $190,000 PER CITIZEN in debt already.

That's why the Central Banksters get away with printing so much of it. Those average people on the street all value Dollars – even though they can't buy what they used to and even though they are backed by nothing but a Government that is over 100% of it's GDP in debt, runs a $500Bn annual deficit and has $43Tn worth of unfunded obligations meaning each Dollar you hold is nothing more than an IOU from a nation that is $190,000 PER CITIZEN in debt already.

And the US is about the LEAST debt-laden of the G8 nations and those nations are head and shoulders above the rest of the World (with some exceptions). Australia, Canada, Denmark, Hong Kong (not China), Liechtenstein, Luxembough, Norway, Singapore, Switzerland and the UK are the only AAA-rated countries left and no, I did not mean to say "other" – the US is only rated AA+ and we probably would have lost the + if the Supreme Court had knocked down Obamacare (as it would have added another $300Bn to the deficit).

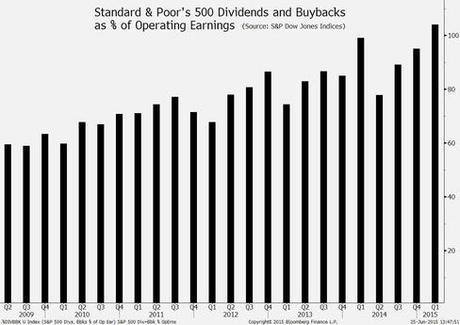

Meanwhile, we're all borrowing like we're AAA+ rated – that's for sure. Our Corporate Masters, in fact, are borrowing so much money that their spending on Buybacks and Dividends now EXCEEDS their Operating Profits. That's right, let that sink in – even at record market highs, paying more money for their stock than people have ever paid before, Corporations are INCREASING the rate at which they buy back their own stock.

Buybacks and dividends surpassed 100% of earnings last quarter for the first time since shares began rising, as shown in the chart. S&P 500 companies spent $144.1Bn on share repurchases and paid out $93.6Bn of dividends. The total equaled 104.1% of their profits, up from a just as ridiculous 95.1% in last year’s fourth quarter. Stock buybacks are a total scam at the best of times – in bull markets, they often mark the very top when they get to these levels.

The increase reflects a reliance on repurchases to spur earnings-per-share growth, according to Howard Silverblatt, a New York-based senior index analyst at S&P Dow Jones. He cited figures showing more than 20% of S&P 500 members cut the amount of stock outstanding last quarter by at least 4% from a year ago, as they had in the previous four quarters. “They’re getting a lot more pressure to do buybacks,” Silverblatt said yesterday in an interview. “It’s almost an entitlement program from an investor standpoint.” Repurchases will probably stay at current levels through year-end as many companies buy shares to offset expiring options, he added.

The increase reflects a reliance on repurchases to spur earnings-per-share growth, according to Howard Silverblatt, a New York-based senior index analyst at S&P Dow Jones. He cited figures showing more than 20% of S&P 500 members cut the amount of stock outstanding last quarter by at least 4% from a year ago, as they had in the previous four quarters. “They’re getting a lot more pressure to do buybacks,” Silverblatt said yesterday in an interview. “It’s almost an entitlement program from an investor standpoint.” Repurchases will probably stay at current levels through year-end as many companies buy shares to offset expiring options, he added.

Shareholder payouts previously rose above 100 percent of operating earnings in the second quarter of 2007. Two quarters later, the figure peaked at 156.5 percent of profit — and the bull market ended.

Have a great weekend,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!