pic credit: Gemini

Layer-1 blockchains, like Ethereum, Cardano, Terra, and Avalanche, are presumably familiar to you. However, others contend that another sort of blockchain is even superior to Layer-1 blockchains. These blockchains are underrepresented, but as the market evolves, they may deliver enormous profits in 2022.

Developers may create their own dApps using native programming languages on layer-1 blockchains like Ethereum. Solidity is used to power Ethereum, for example, but recent advances from the StarkWare project have brought smart contract capability to Layer-2 blockchains.

This leads some to go as far as to say, Layer-2 blockchains will replace Layer-1 blockchain due to functionality and scalability. But does this mean that you should dump your Solana or Cardano for a Layer-2 alternative?

You probably don't need to do anything that crazy, But Layer- 2 scaling solutions are trends you absolutely need to pay attention to a trend that may pay investors handsomely. So let's dive in and find some Alpha in how you might be able to capitalize on this potentially explosive trend.

Layer 2 Solutions: Ethereum Plasma

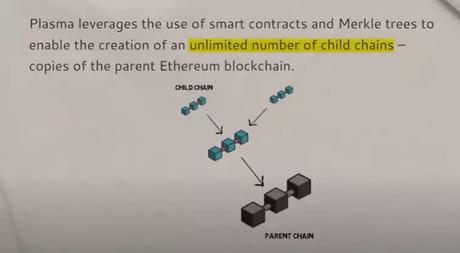

Plasma chains are the first Layer-2 scaling technique we'll discuss today. Plasma chains were the original Layer-2 scaling option offered by Vitalk Buterin, the man we all know and love, and Joseph Poon, the Lightning Network's inventor.

Plasma chains enable the formation of an infinite number of child chains, which are essentially Ethereum blockchain replicas that may offload transactions from the parent chain. This sounds fantastic, but it isn't quite so.

Users on Plasma chains must wait a long time to withdraw their cash back to the Ethereum blockchain. This can take several days to complete the transfer, which is unacceptable to many investors. This posed a significant problem for the utilization of plasma chains. You can't call it a superior technology if it takes longer to process than an ACH payment.

The More Advanced Scaling Solution

A more advanced scaling solution was absolutely needed, and this leads us to rollup scaling solutions. Without getting too technical, these are called rollups because they bundle up many different transactions into one.

Think of it like you're cleaning up the dinner table after dinner. You could go back and forth putting away one thing at a time the cup and the plate, then the napkin, all in separate trips. Let's say it takes ten trips to clean off the dinner table. Or you could grab as many things as you can carry from the dinner table every trip.

And let's say it only takes you two trips to clean off everything. The ultimate outcome is the same in both cases, but the second choice requires less effort. A rollup does something similar. A rollup enables a network to grow while maintaining the same degree of network security. Rollups are divided into two categories.

Rollup Type 1

Because certain transactions occur outside of the blockchain, one of them is known as Zero-Knowledge Rollups. The Ethereum chain, or the blockchain network, must be able to fraud-proof these transactions.

For ensuring that transactions are genuine and safe, ZK-Rollups employ a type of encryption known as Zero-Knowledge cryptography. In other words, there will be no amusing business. The most effective of the two rollup scaling techniques, ZK-Rollups, have the disadvantage of being less secure than the other alternative, Optimistic rollups, which we'll discuss later in this article.

Why You Should Care

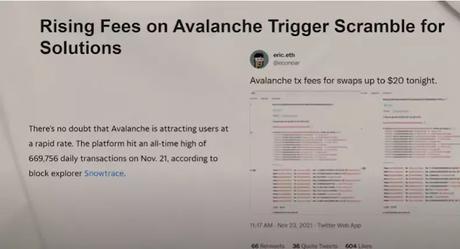

What's interesting about ZK-Rollups is that as the network grows in size, it actually becomes more efficient. It's a little strange. A Layer-1 blockchain functions in the opposite way. As a Layer-1 network becomes more crowded, speeds may decline and costs may rise.

pic credit: Twitter app

Layer-1 blockchains, such as Solana, Cardano, and Avalanche, which are very scalable, may ultimately become congested and pricey as their user base grows if crypto widespread adoption occurs. Everyone in the crypto world wants broad acceptance, yet mass adoption is a major roadblock to the industry's progress.

It's a Catch-22 situation here, since the more individuals that arrive, the slower and less efficient the blockchain will become. At the moment, just a small percentage of the world's population uses cryptocurrencies.

What Happens if Crypto Booms

Let's imagine the existing number is multiplied thirty times, which I would consider huge adoption. At this time, chains like Solana and Cardano will perform better than Ethereum. These newer general-purpose blockchains, on the other hand, may not be able to meet the increased demand. This is when Layer-2s enter the picture.

Nearly everything needed in crypto, according to experts like Polynya, is better executed on a rollup blockchain rather than a Layer-1 blockchain. If I had to estimate, I'd predict that crypto gaming will account for a huge percentage of mainstream crypto acceptance, given the gaming business is currently one of the largest in the world, far outperforming the film sector.

If this is the case, these networks would struggle to handle full-scale crypto games in their current condition. This is, however, to be anticipated. Although cryptocurrency is still a relatively new sector, progress is being made.

When ZK-Rollup platform StarkWare released their revised protocol StarkNet Alpha in December, it was one of the most significant changes in Layer-2 technology. This allows developers to start building and launching applications directly on Layer-2s. This is a paradigm shift in blockchain technology, and why I believe Layer-2s could be one of the most profitable trends in 2022 and beyond.

Investment Options in Layer-2

Now well, StarkWare doesn't currently have its own token. There are other Layer-2s who do. Immutable X is one such example. For trading Ethereum NFTs, Immutable X is a Layer-2 scaling solution. It was created by the same team that brought you Gods Unchained, an NFT trading card game.

Immutable X has a market capitalization of little under $1 billion. That, however, might alter at any time. Because of the magnitude of Ethereum, Immutable X might become a top 20 token at some time, with a market worth of up to $20 billion.

Any other blockchain will find it difficult to compete with Ethereum if it can figure out its fees. That is now Ethereum's most serious barrier. They are in charge of the ecosystem. It's all about those annoying costs.

However, this isn't the only opportunity you have right now. Two other Layer-2s, which could potentially offer huge rewards are the protocols zkSync and Loopring. zkSync is a Layer-2 that offers cheaper and faster transactions at 2000 transactions per second.

While zkSync doesn't currently have a token, many speculate that there will be an airdrop coming at some point in the future. One way you could potentially be eligible for a zkSync airdrop.

We don't know for sure, but if it happens, you could receive an airdrop by connecting your MetaMask wallet to the zkSync mainnet and making a transaction on the network. Airdrops may be worth thousands of dollars in incentives just for using a network, as we just witnessed with SOS.

Loopring, on the other hand, has a token, which has seen amazing increases since the end of 2021, rising from $0.40 to well over $3. Despite the fact that Loopring has a multibillion-dollar market cap, I believe it is a viable alternative for anybody looking to profit from Layer-2 without accepting the dangers of investing in a microcap coin. Of course, be cautious about moving too far into a project after any significant price increases.

Rollup Type 2

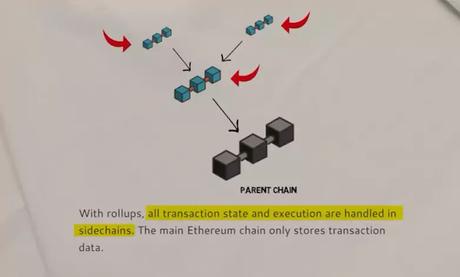

Now that we understand ZK-Rollups, we need to break down Optimistic rollups. While they're not as fast as ZK-Rollups, the benefit of these scaling solutions is that they offer the same level of security as the Ethereum mainnet. Some say optimistic rollups are the most promising way to scale Ethereum.

With Optimistic rollups, transactions are accepted "Optimistically". Validators then check and submit a fraud-proof if they find anything to be incorrect. Rollups provide blockchain scaling by processing transactions elsewhere.

This is referred to as moving execution to a different domain. The transaction data is put on the main chain, but the transactions are not executed there on the main chain. Instead, they are executed on the Rollup network. This means that the mainnet nodes are no longer required to execute the transactions, reducing their load and the amount of work on those nodes.

Unfortunately, there aren't any optimistic rollups that currently have tokens, but two of the most established optimistic rollups right now are Arbitrum and Optimism. It's rumored that Arbitrum may have a token airdrop in the future as well. And then we have Sidechains.

What are Sidechains?

Although Sidechains aren't officially a Layer-2 scaling solution, they do achieve some of the same objectives. Sidechains are completely separate blockchains that are compatible with a blockchain's mainnet. They do, however, employ different consensus procedures that are not protected by Layer-1. Don't worry if that's a little unclear. Polygon is a well-known sidechain.

As Vitalik Buterin pointed out, one of the disadvantages of sidechains is that if 51 percent of node operators on Polygon opted to be malicious, they could hack your transaction and steal all of your money, which is bad. This, however, is extremely improbable to occur. We just cannot rule out the possibility.

How can a blockchain be built on another blockchain?

On Ethereum, this is made possible by using the same Ethereum Virtual Machine. This means that contracts deployed to the Ethereum base layer can be directly deployed to the Sidechain.

What Makes Polygon So Advantageous?

This is what Polygon, formerly known as Matic, does. Matic was a plasma scaling solution before they rebranded themselves as Polygon. While Polygon exists as a sidechain, for now, it actually aims to create a hub that different blockchains can easily plug into, overcoming some of their individual limitations like high fees, poor scalability, or limited security.

This means Polygon will implement a number of different Layer-2 scaling solutions, including plasma chains, ZK-Rollups and Optimistic Rollups. They kind of do it all. Polygon had an explosive 2021 going from two cents in December 2020 to $2 in May 2021.

If you got in and held just for those 5 months, you would have 100X'D your investment. But Polygon isn't likely to 100X again. There is still an opportunity here for a potential ROI in the future, as well as with other Layer-2 solutions.

Final Thoughts

So, the cryptocurrency business continues to expand at a rapid rate. Every day, more investors and users arrive, and every week, more applications are developed that allow us to transact games and function on blockchains.

While some believe Layer-2 blockchains will eventually replace Layer-1 blockchains, given that ZK-Rollups incorporate smart contracts, this is still a source of debate in the cryptocurrency and blockchain industry.

Layer-2 scaling solutions, on the other hand, are clearly necessary if the business is to continue attracting new investors. As a result, I find it difficult to believe that layer two scaling will not be a viable market to invest in.

You should, however, use caution as usual. Cryptocurrency is still a very new concept, so there may be other options, and there are always dangers associated with investing in this area.