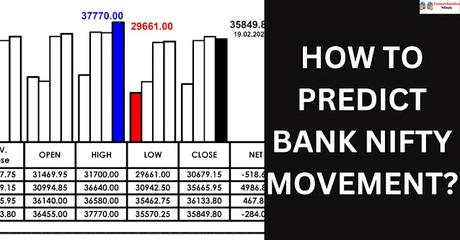

Options trading mein aate samay, traders ko Nifty aur Bank Nifty mein trading karne ka khaas attraction hota hai. Lekin equity stocks se alag, yahan par sahi position lena hai toh kuch aur parameters ko bhi dhyan mein rakhna padta hai. Iss article mein, hum bank nifty ke movement ko share market mein predict karne ke baare mein baat karenge.

BANK NIFTY KYA HAI?

Bank Nifty ek weighted index hai jo National Stock Exchange (NSE) par listed banking companies ke top 12 stocks ka hota hai. Bank Nifty traders ke beech khaas pasand kiya jata hai.

Iska reason hai ki yahaan par futures aur options ka high volume regularly trade hota hai Bank Nifty ke underlying asset ke roop mein. High trading volume risk ko kam kar deta hai, jisse traders ka bhi attraction badhta hai. Bank Nifty ke Futures and Options (F&O) traders ko unke paise ko multiply karne ka mauka dete hain, lekin ismein kafi risk hota hai.

Derivative traders Bank Nifty ke movement ko predict karne ki koshish karte hain taaki unhe Bank Nifty futures aur options mein trading karte samay sahi decisions le sake. Aage ke sections mein, hum Bank Nifty ke movement ko predict karne ke alag-alag strategies aur techniques ko explore karenge.

1. TECHNICAL ANALYSIS

A. INDICATOR ANALYSIS

Bank Nifty ke movement ko predict karne ke liye trends ko identify karna bahut zaroori hai. Aap kuch aise indicators istemal kar sakte hain jo kisi bhi asset ke prices ke trends ko analyze karne mein frequently use hote hain:

Trend Indicators – Moving Averages, Supertrend, Moving Average Convergence Divergence (MACD), Average Directional Index (ADX), etc.

Momentum Indicators – Relative Strength Index (RSI), Awesome Oscillator, etc.

Volatility Indicators – Bollinger Bands, Standard Deviation, Average True Range, etc.

Uptrend ko identify karne ke liye higher highs aur higher lows ko dekhein aur downtrend ko identify karne ke liye lower highs aur lower lows ko dekhein. Ye patterns future price movements ke baare mein valuable insights provide kar sakte hain.

B. SUPPORT AUR RESISTANCE LEVELS

Support woh point hai jahan Bank Nifty bar-bar downward movement ko upward movement mein convert karta hai. Resistance woh point hai jahan Bank Nifty upward movement ko downward movement mein convert karta hai. Support aur resistance levels dikhate hain ki market sentiment ke hisaab se Bank Nifty kisi bhi level ko cross nahi kar sakta.

Aap levels ko observe kar sakte hain jahan Bank Nifty ko support ya resistance milta hai. Isse aapko predict karne mein madad milegi ki Bank Nifty kis direction mein ya kis level tak move karega. Isse aapko trade ki potential risk aur reward ratio calculate karne mein bhi madad milegi.

Lekin support aur resistance levels hamesha unbreakable nahi hote. Aapko bas samajhna hai ki market sentiment kisi potential reversal ya breakout ke liye taiyar hai ya nahi.

C. CANDLESTICK PATTERNS

Alag-alag candlestick patterns jaise doji, hammer, engulfing, aur morning/evening stars ko interpret karne ka tarika sikhein. Ye patterns Bank Nifty mein potential trend reversals ya continuation ko signal kar sakte hain.

Aap index ke major stocks jaise HDFC Bank, ICICI Bank, SBI, etc. ke technical analysis ko bhi istemal kar sakte hain. Isse aapko samajh mein aayega ki Bank Nifty ka movement kis direction mein jaane wala hai.

यह भी पढ़ें :

Angel One KYC Online अपडेट ऑनलाइन कैसे करें

26 ASSETS that make you financially free

अपना cash bank में रखने की जगह इन 5 Assets में लगाओपैसो को संभालने में क्यों मुर्ख है Middle-Class इंसान2. FUNDAMENTAL ANALYSIS

A. ECONOMIC INDICATORS

GDP growth, inflation rates, aur interest rates jaise relevant economic indicators ko track karte rahiye. Economic data overall market sentiment aur Bank Nifty ke movement par significant impact daal sakta hai. Doosre important factors mein naye technology ke adoption, deposits mein increase, mergers aur acquisitions mein increase, banking sector ka overall growth, etc. shaamil hote hain.

B. FINANCIAL REPORTS

Bank Nifty index mein shaamil major banks ke earnings reports ko monitor karein.

Positive ya negative earnings surprises bade price swings la sakte hain. Kuch key financial metrics jin par dhyaan dena chahiye banking stocks ko assess karte samay, wo hai net interest income (NII), core income from operations, net interest margin (NIM), NPAs ka percentage, etc.

C. MONETARY POLICY REPORTS

Reserve Bank of India (RBI) ke announcements par dhyaan dein regarding monetary policy changes. Interest rate decisions banking sector aur uske baad Bank Nifty par bada impact daal sakte hain.

Jaise ki, repo rate aur interest rate ki increase bank ki earnings ko negative tareeke se prabhavit kar sakta hai. Ye notion Bank Nifty mein giravat ko le ja sakta hai jab central bank rate increase announce karta hai.

3. SENTIMENT ANALYSIS

A. MARKET SENTIMENT

Financial news, social media, aur trader sentiment indicators jaise sources se market sentiment ko analyze karein. Extreme bullishness ya bearishness Bank Nifty ke movement mein potential reversals ya continuations ke baare mein clues provide kar sakte hain.

B. OPTIONS CHAIN DATA

Option data jaise open interest aur implied volatility ko study karein, jisse market ke expectations ko samajh sakein. For example, agar kisi particular strike price par call options ke liye high open interest hai, toh bahut saare option sellers ko lagta hai ki spot price us price level ke neeche hi rahega.

Aap option chain ka put-call ratio (PCR) bhi check kar sakte hain, jisse pata chale ki market sentiment Bank Nifty ke baare mein kya hai. Agar PCR high hai, toh yeh indicate karta hai ki log puts sell kar rahe hain aur calls sell kar rahe hain.

Aap options ke price aur open interest ke changes ko bhi assess kar sakte hain, jisse market sentiment ke changes ko identify kar sakein. For example, agar Bank Nifty ke OI aur future price dono badh raha hai, toh yeh ek long buildup ka sign hai, jo ki bullish sentiment ka sign hota hai.

4. MACHINE LEARNING AUR ARTIFICIAL INTELLIGENCE

A. DATA COLLECTION

Historical Bank Nifty price data, relevant economic indicators, aur news sentiment ko gather karein machine learning models ke liye.

B. ENGINEERING

Technical indicators aur doosre data sources par based trading algorithms create karein, jo machine learning algorithms ko Bank Nifty ke movements ko predict karne mein madad karein. Prediction tasks ke liye appropriate machine learning algorithms chunein, jaise ki decision trees, random forests, ya neural networks.

C. BACKTESTING AUR OPTIMISATION

Apne machine learning model ko historical data ke saath backtest karein, jisse uski performance ka andaza lagaya ja sake. Uske baad model parameters ko optimize karein accuracy aur robustness ko improve karne ke liye.

CONCLUSION

Bank Nifty ke movement ko predict karna ek multi-faceted process hai jo technical aur fundamental analysis aur machine learning ko combine karta hai. Koi bhi method perfect predictions guarantee nahi kar sakta.

Lekin ek comprehensive approach jo in strategies ka combination use karta hai, woh aapki ability ko enhance kar sakta hai informed decisions lene mein. Hamesha yaad rakhein ki risk ko effectively manage karna zaroori hai aur apni analysis ko changing market conditions ke hisaab se update karte rahna chahiye.