Earnings, earnings, earnings!

Earnings, earnings, earnings!

We've got Apple and Google and Twitter and Meta, on Boeing on Qualcom, on Intel and Visa! Santa would be exhausted by the time he got through calling out our S&P high-flyers and, so far, investors have been in a punishing mood – using any hint of weakness as an excuse to dump their holdings.

All this is coming against a background of not IF but WHEN there will be a recession while war continues to rage in the Ukraine and Covid continues to rage around the World, Oh yes, and don't forget inflation, which is completely out of control with no end in sight – that's bad too.

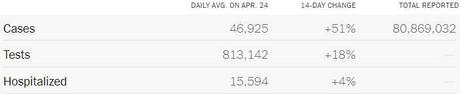

There's been a 50% rise in infections in the US this month and China is locked down but most of the rest of the World is just pretending it isn't happening. 1/4 (80M) of the US population has already gotten Covid and 1/3 of the population (110M) refuse to be vaccinated or take most precautions so there's essentially no way to get rid of this thing and the only question is how severe the next wave will be? It's not a political question – it's an economical one. We've run out of stumulus, which causes more inflation that we're trying to fight now anyway – so what are we going to do if we're hit with another wave of Covid?

There's been a 50% rise in infections in the US this month and China is locked down but most of the rest of the World is just pretending it isn't happening. 1/4 (80M) of the US population has already gotten Covid and 1/3 of the population (110M) refuse to be vaccinated or take most precautions so there's essentially no way to get rid of this thing and the only question is how severe the next wave will be? It's not a political question – it's an economical one. We've run out of stumulus, which causes more inflation that we're trying to fight now anyway – so what are we going to do if we're hit with another wave of Covid?

With Q1 GDP coming out on Thursday, what we're really concerned with is whether or not the indexes can stay out of our 20% correction range, which makes 13,500 on the Nasdaq hyper-critical as we crashed below the 20% correction line there as well as 1,920 on the Russell, which is our only index where we prediced more than a 20% correction LAST YEAR, when we began using this chart:

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong).

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong).

- Nasdaq is using 13,500 as the base. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,760 (weak) and 1,920 (strong)

So, very simply, if the Nasdaq turns green we have some hope but if the Russell turns red – we need to add more hedges and consider cashing out completely. If these levels fail, you can't even imagine the carnage that lies below us. Look what a mess the S&P is already:

But, of course, if you look at it in perspective, this is only a minor correction at best:

Covid alone took us from 3,300 to 2,200 (33%) in early 2020 and now that's just one of the things we are worried about. From 4,800 a 33% correction would be about 3,200 – the top of where we corrected from last time and, from a LONG-term perspective, that would be nice consoldation for the decade ahead and still better than the 60% correction we had in 2008/9, right?

Last Tuesday, in our morning PSW Report (which you can subscribe to here) I asked you if you would like to make a quick $10,000, saying:

S&P 500 Futures (/ES) pay $50 per point and we're below the 50-day moving average at 4,416 – so that would be the stop line and 4,320 is the strong bounce line and, failing that, we have no support at all until the weak bounce line at 4,180 – 200 points below where we are this morning (4,385). If we call 4,400 the stop line – then we risk losing $50 x 15 points = $750 against the potential gain of $10,000 if the S&P falls back to where we were a month ago.

We still have the war, we still have Covid, the Fed is still raising rates because we still have inflation – am I missing something? In fact, speaking of the Fed, St Louis President, James Bullard just said this morning that his target rate for THIS YEAR is 3.5%, not 2.5%.

4,218 is where we bottomed out on Friday and that was good for gains of $9,100 and we're back to 4,238 this morning and I'd certainly keep a stop at 4,250 to lock in $7,500 of profits and, by the way – you're welcome! Oil is down another 5% this morning at $97 and that's almost tempting to play for a bounce back to $100 on /CL but I'd rather play Natural Gas (/NG) over the $6.50 line with tight stops below as Putin might cut off gas to Europe and send prices well over $8. /NG futures pay (or take!) $100 per penny so even if you lose 0.05 – that's $500 but, on the very bright side, $8 would be $15,000 in gains on a single contract so playing off a good support line is the way to go but TIGHT STOPS is the key to surviving.

4,218 is where we bottomed out on Friday and that was good for gains of $9,100 and we're back to 4,238 this morning and I'd certainly keep a stop at 4,250 to lock in $7,500 of profits and, by the way – you're welcome! Oil is down another 5% this morning at $97 and that's almost tempting to play for a bounce back to $100 on /CL but I'd rather play Natural Gas (/NG) over the $6.50 line with tight stops below as Putin might cut off gas to Europe and send prices well over $8. /NG futures pay (or take!) $100 per penny so even if you lose 0.05 – that's $500 but, on the very bright side, $8 would be $15,000 in gains on a single contract so playing off a good support line is the way to go but TIGHT STOPS is the key to surviving.

Gold (/GC) will be attractive if it gets back over $1,900 (now $1,895) with tight stops below and the same goes for Silver (/SI) at $23.50. The Dollar is super-strong at 101.50 but hasn't properly tested 100 as it's gone over so I'm expecting a little pullback this week as it's up on all the hawkish Fed comments last week and that's not likely to get worse and other Central Banksters may start talking about raising their own rates and leveling the playing field with our Fed – and that would calm the Dollar down as well.

Gold (/GC) will be attractive if it gets back over $1,900 (now $1,895) with tight stops below and the same goes for Silver (/SI) at $23.50. The Dollar is super-strong at 101.50 but hasn't properly tested 100 as it's gone over so I'm expecting a little pullback this week as it's up on all the hawkish Fed comments last week and that's not likely to get worse and other Central Banksters may start talking about raising their own rates and leveling the playing field with our Fed – and that would calm the Dollar down as well.

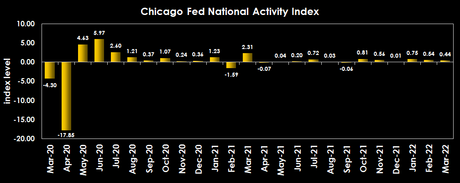

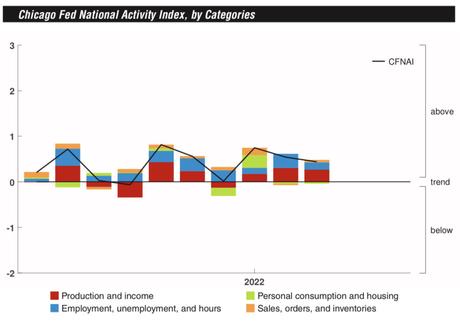

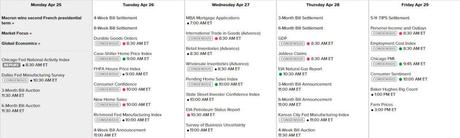

That being said, let's take a look at our calendar for the week where there are NO Fed speakers scheduled (doesn't mean they won't say anything) as they too are probably waiting for earnings results from Big Tech before trying to steer the markets one way or another. We have the Chicago and Dallas Fed Reports this morning and Chicago already reported a March slowdown to 0.44 from 0.54 in February and that's down from 0.74 in January – how's that for a trend?

Notice Personal Consumption and Housing went negative – that's not good… Notice the sharp decline in Employment from last month. The last time we had that was August and these are early indictators but we had a decline in September, as the S&P fell from 4,550 to 4,275 (6%). We're already down 7.5% from our March highs but I'm still expecting to see our -10% range at 4,180 before we're done (if we're even done there at all).

Our primary reason for not going to CASH!!! so far is we think the Government has another round of stimulus left to throw at us. It's hard to imagine they want to roll the dice on another 10-20% drop in the market from here coming into the election cycle but you never know – so far, the Republicans have held up each vote on more stimulus as they feel the public is blaming their economic problems on Biden and the Democrats – which is like blaming the firemen for the fire they came to put out – but what can you do?

What we could do was improve our hedges in our Short-Term Portfolio, which is what we did on Wednesday last week – BEFORE the market started dropping…

It's going to be a crazy week, so sit back and enjoy the ride.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!