This morning we are up.

This morning we are up.

There's no news or no reason but we're bouncing a bit this morning after being down 1.2% on the S&P 500 last week. CPI is our big data point for the week and we have to wait until Friday and it's a quiet week for the Fed – so data is pretty much all we have with earnings winding down – and there's not much of that either.

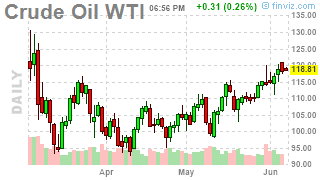

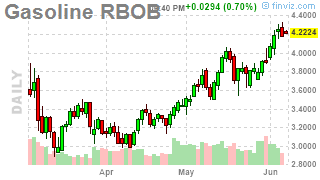

CPI was up 8.3% year/year as of April and is expected to calm down to 8.2% in May but I'm not so sure as oil and gasoline looked like this in May vs April:

That's higher, right? Now, I'm no "Leading Economist" but when Oil and Gasoline are 5-10% higher during the month – it's a little hard to imagine how general prices came down but maybe I'm too dumb to understand the nuances of economics?

Cotton and Orange Juice?

Corn and Rice?

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!