Up we go again!

Up we go again!

In the end, the S&P 500 only made a weak retracement of the rally, back to the 3,800 line on the button, per our 5% Rule as we noted on Friday morning. Since then we bounced back but it's a fall from 3,900 so those bounces then should be 20 points so 3,820 (weak) and 3,840 (strong) and we don't pay much attention to the Futures but a fail to hold a strong bounce today means we are still more likely to be consolidating for a move down to 3,700 this week.

Bonds finally stopped falling (which indicates rates are rising) but they too are likely just bouncing after falling 5% from 140 to 133 so we're not very impressed with that move either until we see a strong bounce – which would be 2 points back to 135 – where you can see we paused on the way down.

Bonds finally stopped falling (which indicates rates are rising) but they too are likely just bouncing after falling 5% from 140 to 133 so we're not very impressed with that move either until we see a strong bounce – which would be 2 points back to 135 – where you can see we paused on the way down.

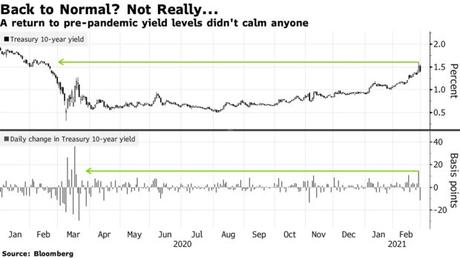

Pausing here is certainly nothing to get excited about as the US just held a TERRIBLE 7-year note auction that got very little interest (the lowest demand in history) and the 10-year note yield is still about 1.5% – back to where it was pre-Covid and miles above the Feds 0.25% target rate – a gap that shows how far away from reality the Fed really is at the moment.

Almost everything that mattered was red on Thursday. Treasuries sank, driving the yield on 10-year notes up as many as 23 basis points to 1.61%. Stock losses were most pronounced in Nasdaq-100 and small-cap shares that, with help from frenzied speculators and economic optimists alike, had led equities higher. Corporate bonds continued to rack up the biggest losses since the pandemic began as companies scramble to sell debt before yields go up even more. The dollar surged in a classic haven trade.

So, what's gotten better over the weekend? Nothing really. “I was surprised to see the almost complacency from Fed officials, with naive comments about U.S. bond yields reflecting a stronger outlook,” said Thomas Costerg of Pictet Wealth Management in Geneva. What sounds like reassurance to US investors sounds like idiocy to Global Traders – that's why no one is buying our bonds anymore – no faith in our Fed is a dangerous thing because faith is all we have holding this monetary system together at 200% debt levels.

“‘Trouble ahead’ is signaled by a rare combination of low-quality securities, staggering valuation metrics, overleveraged capital structures, a scarcity of honest profits, a desperate dearth of understanding evinced by the most active traders, and economic macro prospects that are not as thrilling as the mobs braying ‘Buy! Buy! Buy!’ seem to think,” wrote Paul Singer in his recent Fund letter.

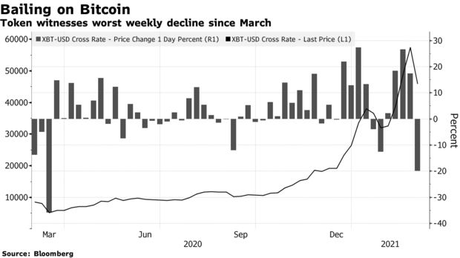

Even BitCoin did not escape last week's sell-off, dropping 22% from the record high of $57,000. We'll be watching for bounces in BitCoin as well but the last time we had a splike like this in March – it was the first week of a much greater sell-off.

Even BitCoin did not escape last week's sell-off, dropping 22% from the record high of $57,000. We'll be watching for bounces in BitCoin as well but the last time we had a splike like this in March – it was the first week of a much greater sell-off.

In fact, in case anyone is interested, I was offered this weekend a chance to broker some large blocks of BitCoins for Cash Discounts. 250,000 BitCoins can be yours at an 8% discount (2 blocks) and there are 2 blocks of 500,000, a 1M and a 1.3M between 4% and 8% off available as well.

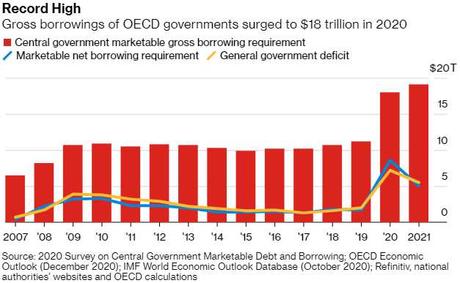

No one ever offers to sell me Dollars at an 8% discount – or Euros or Yen or even Yaun for that matter. What does that say about BitCoin? Keep in mind that's 3.8M BitCoin that people are trying to unload out of 21M total BitCoin in the World. They can't sell them on exchanges – it would crash the market – hence the cash discount if you happen to have $23Bn sitting around to buy 500,000 with (just $21.16Bn with the discount!). You would think BitCoin would be doing better with 2021's debt levels forecast to be even greater than 2020's were:

Led by Europe, of course:

What could possibly go wrong?

Speaking of borrowing massive sums of money that can never be repaid – Biden's $1.9Tn Stimulus Bill passed the House (without the minimum wage increase) and heads to the Senate for approval, where the Republicans will suddenly become concerned about debt again. As I've said before, that money is already baked into the markets and it can only be a disaster if we fail to execute this program at this point.

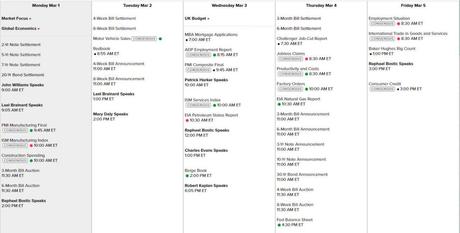

Fortunately, there are only a few short-term note auctions this week and not too much data leading up to Friday's Non-Farm Payroll Report. We have PMI, ISM and Construction Spending this morning, Motor Vehicle Sales tomorrow, Beige Book Wednesday, Productivity Thursday and then the Big Kahuna on Friday – all surrounded by 10 Fed Speeches:

Also there are still PLENTY of Earnings Reports coming in. Berkshire Hathaway (BRK.A) had a great Q4, boosted by Rail, Utility and Energy units while Consumer Products were dragging a bit. The company bought back $9Bn of it's own stock in Q4 on $5Bn in earnings so Buffet thinks his stock is so cheap that he's borrowing money to buy it! In 2020, Buffett bought $24.7Bn worth of his own stock, 5% of the market cap. Don't worry, they still have $138.3Bn in CASH!!! reamining – that's about 1/4 of their market cap right there.

Of course, a deeper reader will notice that Investment Gains were $30.4Bn vs $24.5Bn a year ago so that's $6Bn(ish) of the $5Bn in earnings (120%) coming from market gains that Buffett himself considers frothy – including the gains he made buying his own stock below $300,000, which is up 20% since! So I don't think we can think what's good for Berkshire must be good for the S&P 500 and those Investment Gains can reverse very quickly so to you and Mr. Buffett I say:

Be careful out there!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!