The Dow is up another 125 points (0.5%) this morning.

The Dow is up another 125 points (0.5%) this morning.

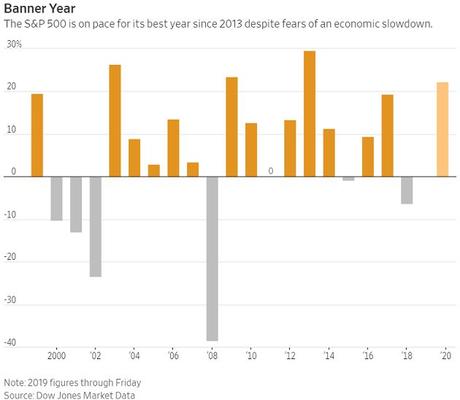

The S&P is already up 22% for the year and, as you can see from this WSJ chart, We've had lots of good years lately with the 2 down years in the last 10 combining for a total loss of less than 7% while the 8 positive years have added 142% but keep in mind that's cumulative, with the gains compounding each year – giving us the incredible new highs the market is at right now – despite having first dropped almost 40% in 2008.

On Fox News this morning, a guest was saying that we can't raise taxes now because the economy is so good that there's bound to be a recession coming so we need low taxes to fight off the recession. Of course, when there is a recession – they'll tell us that they need to lower taxes too. I've been watching a lot of Fox News this weekend as I'm on a ship and it's the only US news channel. By the way, when are the Democrats going to stop harassing poor Presient Trump?

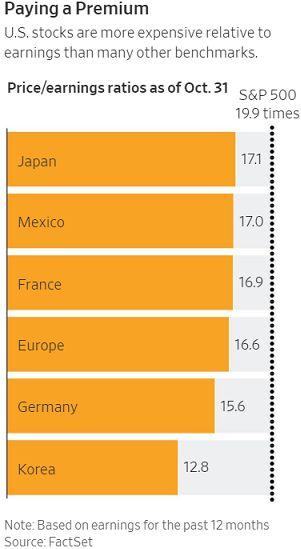

When will the music stop – if it ever does? The "normal" p/e ration for the S&P 500 is 16 – so we're 25% above that but "normally" there are other things you could do with your investment capital, like put it in the bank, bonds or housing but the banks and bonds now CHARGE YOU to hold your money in many countries and don't pay enough to keep up with inflation in the US while bonds are ridiculously low thanks to the Fed – certainly not a place you want to invest.

Real Estate is what led the last market correction so investors are sensibly gun-shy about tying up their assets in that sector again and that pretty much leaves…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!