It’s Time to Expose Global Banking Elites at the International Monetary Conference

By: Andrew Gavin Marshall

Originally posted at Occupy.com

Ever heard of the International Monetary Conference? No, I’m not referring to the annual meeting of the IMF and World Bank but rather to another, more secretive annual gathering – this one hosted by the American Bankers Association and bringing together chief executives from over 100 of the world’s largest banks.

Hailing primarily from Western Europe and North America, the banking chiefs meet for several days along with invited guests who hold prominent “public official” positions – major finance ministers and central bank governors among them. The meetings of the International Monetary Conference are notoriously private, with very little if any news coverage or public accountability regarding what goes on there.

However, significant global financial decisions get made at the IMC meetings, which have been ongoing since 1954. Now in its 60th year as an elite financial and monetary conference – and amid hot global discussions of wealth inequality and high finance colluding with governments – one might suspect the gathering to attract a little more attention. Someone, at least, should answer why the conference doesn’t even hold an official website – but merely a password-protected, members-only page for invited guests.

Nor does the American Bankers Association (ABA), which has long been the host of the IMC, make any mention of the conferenceon its website. A search of academic literature listed through Google Scholar brings up, almost exclusively, references to unrelated international monetary conferences held in the 19th century; if there is mention of the modern IMC, it’s simply as a citation from speeches delivered there by public officials. Most books that reference the conference were written by past participants, and merely reflect on speeches presented there while never exploring the IMC in depth.

We, at the Global Power Project, felt it was time to do just that.

I was first made aware of the International Monetary Conference through references listed on some of the CVs of the world’s major bankers, some of which I catalogued for Occupy.com’s 10-part Global Power Project series. Having compiled the resumes of over 300 bankers and counting, I managed to collect a partial list of bankers who are also members of the board of directors at the IMC. I have attempted to contact multiple sources for comment on the conference, but received zero answer.

Instead, I turned to the archives of The New York Times and other newspapers, as well as copies of speeches by public officials at the conference over the years. The research has enabled me to paint a rough portrait of this secretive, highly influential global conference, both historically and in its present form.

Background on the IMC

A. W. Clausen was a major figure in international banking and finance in the 20th century. He spent a long career at Bank of America, becoming President and CEO in 1970, a position he held until 1981 when he became President of the World Bank. After leaving the World Bank in 1986, Clausen returned to Bank of America as Chairman and CEO until the 1990s. Clausen had also been a long-time participant in the International Monetary Conference, and in the later years of his life Clausen wrote briefly about the origins and evolution of the IMC in his essay, The Changing Character of Financial Markets in the Postwar Period – A Personal Perspective:

Indeed, the interdependency of international finance had become apparent to American business and financial leaders in the early 1950s. To provide a forum for discussion of major economic, monetary, and fiscal issues affecting the international banking community, the American Bankers Association hosted the first International Monetary Conference in 1954. Initially, the conference brought together chief executive officers of the 50 largest United States banks and 12 to 15 bankers of equal rank from abroad as well as central bank and government officials. The number of foreign bankers in attendance increased each year, and in 1970, the by-laws were changed to make the International Monetary Conference (IMC) a truly international body. The membership has broadened considerably in the last decade. It currently comprises 116 banks from 23 countries [as of 2009].

The U.S. Secretary of the Treasury in 1962, Douglas Dillon, attended that year’s meeting of the IMC, which he said had “served a very useful purpose in developing a closer degree of understanding of our common problems between responsible private officials in the banking world on both sides of the Atlantic” (“Financial Abroad Urged by Dillon,” New York Times, 20 May 1962).

In 1971, a few months before the U.S. Treasury broke the U.S. dollar’s link with gold, letting the currency float freely in international markets, the Treasury Secretary John B. Connally, Jr. spoke at the IMC, where he demanded that Western Europe, Canada and Japan “share more fully in the cost of defending the free world” and suggested that the implement “more liberal trading arrangements” which would allow “American exports to expand.” As the New York Times noted, “the heads of most of the world’s major banks were present as well as leading monetary officials.” The Chairman of the Federal Reserve Board, Arthur F. Burns, also addressed the conference (“Connally tells Bankers U.S. Will Defend Dollar,” New York Times, 29 May 1971).

During and following the 1973-74 oil price hikes, a major issue for bankers, financial and monetary authorities around the world was the challenge of managing the “recycling” of surplus “petrodollars” that had accumulated among OPEC nations. The oil price spikes generated enormous sums of money for the major oil-producing states, especially Saudi Arabia, and for those funds to be put to “productive use,” they had to be invested.

This is where Western European, American and Japanese banks came on the scene in a big way. Oil-producers invested their new wealth in the industrial world’s major banks, which lent that money (multiplied several times over) to poor, developing nations that were in need of loans to pay for their own increased costs of oil. The petrodollar-fueled loans thus allowed those countries to finance their industrialization and development in a process referred to as “petrodollar recycling.”

At the 1974 meeting of the IMC, David Rockefeller, the chairman of Chase Manhattan Bank, and Wilfired Guth, the managing director of Deutsche Bank, both “expressed deep reservations… about how long the international banking network could carry the burden of recycling the vast flows of money resulting from the huge jump in oil prices” (“Burden of Oil Money Worries Bankers,” New York Times, 7 June 1974).

In 1976, the IMC was held in San Francisco, where the world’s major bankers “expressed cautious optimism… [that] the development of a more stable monetary system was proceeding favorably,” noting the emergence of floating exchange rates for national currencies (which allow financial markets, and thus the big banks, to become major players in determining the value of a nation’s currency, and thus the health of its economy).

While the bankers noted their pleasure at the “strengthening of the International Monetary Fund,” the more than 200 bankers present from over 20 countries stressed their belief in “the need to control inflation” (“Bankers Optimistic on Monetary System,” New York Times, 18 June 1976) – a longtime obsession of bankers that didn’t become an equal obsession of public officials or central bankers for several more years.

In 1978, the U.S. Treasury Secretary, W. Michael Blumenthal, attended the IMC where he discussed the decline of the U.S. dollar in the international monetary system but stressed that “there was no need to abandon the dollar’s role as a reserve currency.” Instead, the so-called “root causes” of monetary instability should be addressed, he said, “through harmonization of international payment surpluses and deficits, inflation levels and growth rates,” meaning that nations should reduce their debts but not through inflation (the eternal boogeyman of global financial institutions) since inflation is bad for lenders and savers though good for borrowers and debtors.

Further, Blumenthal noted, the increased focus on national debts (or “balance of payments deficits”) and inflation could be supported through increased “surveillance” (read: authority) by the International Monetary Fund over sovereign nations (“Monetary System Reform Opposed by Blumenthal,” New York Times, 25 May 1978).

At the same meeting, Blumenthal endorsed plans to create a unified European currency, stating that the United States “had no objection” so long as it was “compatible with the broader financial system.” He added, however, that “the plans or sketches for a new European currency which I have seen so far do not yet show any real promise of operational possibility.”

The second major oil price shock of the decade took place in 1979 and became the key topic of discussion at that year’s meeting of the IMC, where Treasury Secretary Blumenthal warned that developing nations dependent on oil imports for their industrialization would experience major new strains due to the price increases, which “could threaten individual banks or the entire monetary system.” (“Rockefeller Warns on Petrodollars,” New York Times, 14 June 1979).

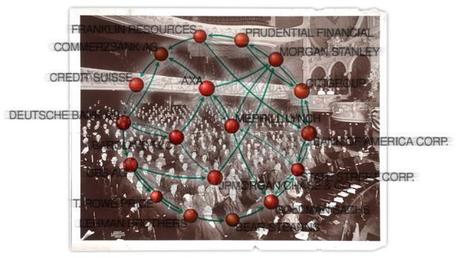

From this brief introduction we see that the International Monetary Conference – bringing together hundreds of the world’s top bankers with government officials and central bankers from the major industrial nations – has played a significant, if little talked about, role furthering the ideas, ideologies, objectives and policies of global financial elites and their partnering governments. In short: it’s not about “conspiracy” but rather consensus.

We can see, through analysis of the IMC and similar institutions and forums, an increasing interconnection and interdependence between the world’s major banks and the so-called “public” officials responsible for implementing the agreed-upon economic, financial and monetary policies worldwide. In three upcoming installments, the Global Power Project will examine the International Monetary Conference in depth, looking at its key role in the 1980s debt crisis as well as the current leadership that steers the organization.

Andrew Gavin Marshall is a 26-year-old researcher and writer based in Montreal. He is project manager of The People’s Book Project, chair of the geopolitics division of The Hampton Institute, research director for Occupy.com’s Global Power Project and the World of Resistance (WoR) Report, and hosts a weekly podcast show with BoilingFrogsPost.