I’m getting almost daily mails from people asking me whether the bear market is over. Well, I don’t have a crystal ball. But to address these questions, I’d like to step onto the thin ice of speculation as the people seem to be afraid to miss investment opportunities. At least, according to such mails, there is still a FOMO. And with this, from a psychological point of view, the bear market is not over yet. But let’s delve more objectively into this.

Is The Bear Market Over Or Not?

In general, I think that the question whether the bear market is over, is obsolete. Of course, there are always arguments why you shouldn’t invest these days. And the killer argument is undoubtedly the current geopolitical situation.

It’s so explosive and fragile as 60 years ago at the time of the Cuban Missile Crisis. The world was on the edge of a nuclear war and there were two major players: the US and the Soviet Union. And today we have at least half a dozen such nuclear powers wanting to play a major role in world politics.

But back to the markets. Four thoughts come to my mind when answering the question whether the bear market is over now.

Firstly, as a stock investor, I’m buying permanently. I’m not even trying to time the market. Instead, I’m buying undervalued but high-quality companies. This gives me a safety margin and an opportunity-risk ratio that should work out in my favor in individual cases. Of course, I can make a wrong decision, but especially in the current environment there are endless bargains available.

Secondly, if we look at the overall market, then we have to say very clearly: it’s still too expensive.

For instance, the S&P 500 ETF is currently trading at a price-earnings ratio of 20.80.

A price-earnings ratio of 15 or a 7% EPS yield would be favorable, especially in the current inflationary environment.

The market as a whole is irrelevant to me, but it’s still too expensive overall and I ask myself: why is the market as a whole such expensive?

This brings me to the third thought, namely that the index’s highest capitalized stocks in particular are still very expensive.

The ten largest stocks in the S&P 500 make up 25% of the entire index and they alone ensure that it just looks expensive. The weighting of each company that can be viewed in real time on the website of slickcharts.com

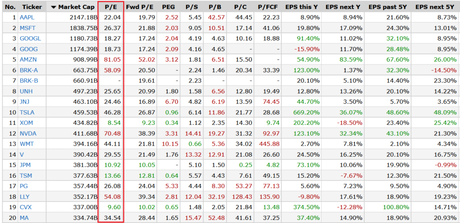

If you go further and list the 20 largest companies in the S&P 500 by market capitalization on finviz.com, you will find that some of them have insanely high P/E ratios.

Besides that, these companies have high forwarded P/E but also the costs for future profits, i.e. the PEG ratio which is almost always in the expensive range (which is a ratio > 1).

That brings me to the fourth thought and that’s where it comes to a full circle:

I don’t really care whether the bear market is over or not!

The indices, the ETFs, may face hard times because of the high valuation and the valuation problems of the blue chips in the S&P 500. For the ETF investor, the question of staying power now really arises. And now it’s time when they have to stick to their savings plans.

But there are enough companies, enough pearls that have been wrongly dragged down, at least from my point of view. Companies that have excellent prospects because they are much smaller and can grow much better, are cheaply valued and also have excellent development prospects.

Two years ago, you had to look for such companies with a magnifying glass. Today they are practically offered on the rummage table in the sale.

And if you want to act like Warren Buffett: I think, now is the time to be greedy because many others are fearful.

With this in mind, I wish you a lot of success in investing and take care of your money.

Subscribe for free to receive new posts and support my work. The subscription will be proceeded via substack.com. There, you can subscribe for free content but also for premium content. Just check it out by clicking the button below! If you would like to publish content on substack, please click here.

SUBSCRIBE FOR A NEWSLETTER