At Berkshire Hathaway’s annual meeting in 2022, there were several questions about ETFs. These questions, and especially the answers made me thoughtful. Because of that, I’d like to share my thoughts about it. It’s about control, the price stability of an ETF investment, about risks, and whether ETFs are still a good investment opportunity.

Passive investing through ETFs is still growing strongly. Already in 2018, there was some news that index investing controls around 45% of the US stock market. Meanwhile, it should be more than 50%. Thus, let’s check as an example the shareholder structure of Apple, one of the crowd favorites.

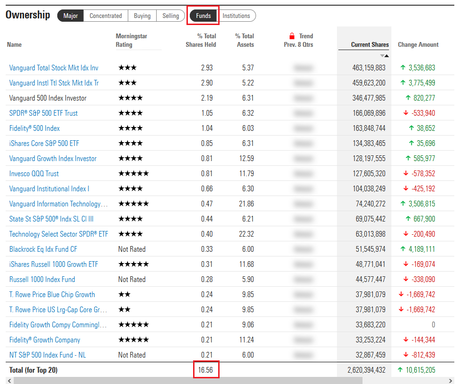

In the screenshot, you can see the top 20 ETF issuers holding Apple shares. And meanwhile, they are holding together 16.56% of all tradeable shares of Apple. It is quite a lot and with this, also the number of dividends flowing to these companies.

Who Has The Voting Rights?

One of the questions at Berkshire Hathaway’s meeting was (analogous) whether it makes sense to prohibit ETF investment managers from voting the shares they control through their investment funds. The reason for this question was sure because the top three issuers of ETFs hold a majority of the voting rights for every major publicly traded company in the US.

For instance, Blackrock alone manages $2.3 trillion! In total, in 2021, there were alone in the US 2632 different ETFs under management worth $10,02 trillion.

Charlie Munger gave a more succinct answer. He said it is not good for a country when three persons have such power and control over corporations. It would be counterproductive. Warren Buffett was more diplomatic and said that the US public wouldn’t like the idea that three people would decide the fate of corporate America, even if they have no evil intentions. You can read the whole transcript of Berkshire Hathaway’s annual meeting here.

Hence, there were some serious endeavors taken to prohibit such votings at annual meetings.

But more important is that in 2021 and 2022, a lot of ETFs were extensively sold. But what consequences does it have? Well, it means that the ETFs (or the issuers of the ETFs) have to get rid of a lot of stocks contained in the respective ETF investment.

What Effect Would This Have On The Stock’s Price?

Correct, the stock’s price will drop. And when prices are falling, then the corresponding index would also decline. This leads to the next selling wave in the ETF, then in the stock itself, and then again, to the decline of the index. In other words, a cascade of further selling would be unleashed.

This might not be really new information. But a lot of people probably don’t know that ETFs must keep the congruence between the inner value of an ETF (net asset value) and the ETF’s market price. This is ensured through the so-called redemption mechanism. The reason for this is that because of the frequent tradability, there can be differences between the net asset value and the actual market price of an ETF. Hence, there must be a possibility to match the market price with the net asset value of all stocks contained in the ETF. For this purpose, some so-called authorized participants ensure a balance (usually large banks).

For instance, if there are a lot of shares of the S&P500 ETF in demand but the index S&P500 is not rising, it’s not possible just to stop the trading. There must be still possible to buy ETFs because of that redemption mechanism. To assure this, there are simply new ETFs quickly created to be thrown onto the market.

To do this and to balance the surplus of the new ETFs, authorized participants are buying stocks on the market. Afterward, they hand over these blocks of stocks to the issuer of the respective ETF (so-called sponsor). In return, the sponsor hands out the new ETF shares to the authorized participant who can place them profitably on the market. With this, authorized participants are making small risk-free arbitrage deals. This whole procedure is managed automated “behind the scenes” and takes just milliseconds.

Therefore, publicly traded ETFs have no fixed numbers of shares as new shares can be created or collected back at any time.

What Does It Mean For Stock Investors Or For Those Who Are Involved in an ETF Investment?

Because of the redemption mechanism, the price fluctuation (the volatility) in both assets can be exorbitant. It’s like a catalyst or a fire accelerator when a stock contained in an ETF has to be sold.

Therefore, the low volatility of ETFs which is usually and frequently used as an argument in favor of an ETF investment should be critically scrutinized! Especially the issuers of actively managed ETFs, like the ARK-ETFs of Cathie Wood, are very familiar with this issue. But also, a lot of several special industry funds are strongly affected by these price movements. And in particular, it applies to leveraged ETFs which can be leveraged not only twice but also three times or even five times. And it applies to inverse ETFs as well.

Of course, nobody would complain when the price of such ETFs would surge. But in this article, I’m talking about risks which is the more important part of an ETF investment (or any other investment).

Hence, to call an ETF investment risk-free is for sure not correct, and it’s also not possible to say generally that all of them are price stable as believed in many places. Just for instance, in 2020, alone in the US there were 182 ETFs closed or merged because of these mere issues.

Should Investors Keep Hands Off An ETF Investment?

But don’t get it wrong: ETFs are a very good version of an investment possibility! Especially those ETFs that track a broad index like the S&P500 or the Russell 2000, etc. Investors, who conclude a savings plan on an ETF basis, they at least are doing something with their money. Not for nothing wanted Warren Buffet to raise a memorial for John Bogle who was the inventor of the first Vanguard ETF and who made them widely acceptable. But these investors also should be mentally strong and bear drawdowns or stronger price fluctuations.

In the meantime, there is a gold rush broke out within the financial industry. Frankly, I would do the same as there are for sure endless opportunities. One good example is the commodity ETFs that are touted but among them, only ETFs on precious metals can achieve profits.

Summary

Even if an ETF investment is a good alternative to stocks, many of them are not as secure as they have been at the beginning of the whole ETF development. One of the reasons is that there are meanwhile pure trading ETFs available that has nothing more common with the original idea of a long-term ETF investment. Hence, investors who prefer to buy ETFs instead of stocks should also check the ETFs thoroughly. They should also keep in mind that there is a new persistent risk as to the ownership structure. The risk is because of decisions or votes that could lead to strong volatility in the markets, which means that the price stability of an ETF is actually no more guaranteed. If an investor can stand it mentally, he will make good profits over time. But as we know, it’s the human psyche the inexperienced ones that induce them to close their positions with a big loss. Therefore, also with ETFs, strong risk management and position are needed.

So far for these thoughts. See you in the next article, folks.

Subscribe for free to receive new posts and support my work. The subscription will be proceeded via substack.com. There, you can subscribe for free content but also for premium content. Just check it out by clicking the button below! If you would like to publish content on substack, please click here.

SUBSCRIBE TO A NEWSLETTERDisclaimer: I am NOT a financial advisor. I’m using information sources believed to be reliable, but their accuracy cannot be guaranteed. The information I publish is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website.