The investor interested in retail investments will go for the direct plans of different mutual fund schemes having zero commissions. This way the investor is offered lowest possible expense ratio if compared with the regular plans available in the market, online or offline, elsewhere. The company commits to charge zero commission or kickbacks from the investor’s fund that ensuring unaltered and unbiased investment advice to the customer.

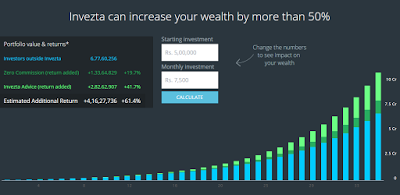

The main hassle for any investor comprises of a number of hidden fee and charges that you are never educated upfront. It comes to the knowledge of an investor only after the investment is done and certain fee and commission are charged on each investment. That makes it a unique model of advice to the customer with no biasing involved. Invezta is formed on these grounds to thrash out such pains to the investor with a goal of investor centric portfolio management built on a world class technologically driven platform with minimal or no cost is thrown on the investor.

The investor gets a best matching advice that is based on investor’s portfolio, product suitability, and investor’s choices to scale out the optimum risk assessment model in a customized manner. Invezta is built on a state of the art quality and technological model advisory platform for all variety of retail investors. The customized generated analytics for each individual provides unique insights to each individual in the manner same as used by the top class fund management firms across the globe. Thus, investors are empowered for best possible decision making and their internal assessment of the portfolio in a real-time environment.