Frequently, I hear that commodity ETFs are a good long-term investment. But is this really true? If you ask me, this statement is too general and in practice, you need to make a strong differentiation. For in the most cases, commodity ETFs are NOT a good investment but a method to lose money! In this article, I will delve deeper into this topic and give you some examples and show you which commodity exchange traded funds are really worth it to invest.

What Is A Commodity ETF?

First of all, we need to clarify of what type of a commodity ETF we are speaking about in this article.

A real (or pure) commodity ETF is one which tracks just one commodity like crude oil, soybeans, gold, silver, etc. And here is where the confusion begins because not every commodity EFT is a pure one!

For instance, in European Union, pure commodity ETFs are not permitted. The reason for this is that in the EU, all ETFs must include a minimum level of diversification (Article 22a(1) of the Directive 85/611/EEC)

Therefore, the issuers are offering so-called baskets of commodities which attempt to replicate the respective commodity indices. However, in this case several different commodities are mixed together, and that’s a problem.

For with which commodity can such a basket be compared? Should you compare an ETF consisting of wheat, corn and soybeans with the development of soybeans? Or rather with that of wheat? As you can see, there is no reasonable comparison to be made here.

Other issuers sell commodity exchange traded funds consisting of listed companies specialized in commodities. But these are also not real ETFs.

In the USA, on the other hand, you can put commodity ETFs in direct relation with the respective commodity. For example, the ETF on crude oil “USO” (United States Oil Fund) tracks just the development of crude oil and that’s why this one is indeed a real or a pure commodity ETF.

Therefore, in this article we will take a look only at real commodity ETFs.

One Important Thing For The Sake Of Completeness: ETCs as ETFs

To make this article complete, I need to provide you one more important information before we proceed. In order to get around the problem of the EU directive, another asset class was developed in Europe, which is called ETC (Exchange Traded Commodity). With ETCs, you can actually invest in individual commodities, e.g. in gold, silver, grain, etc.

ETCs basically work like exchange traded funds with the difference that, unlike ETFs, they are not part of the special fund and are not protected in the event of the issuer’s insolvency. The content of this article applies to both the real ETFs and the ETCs. For the sake of simplicity, I will call both asset classes ETFs.

Separation Of Real Commodity ETFs Into Physical And Non-physical ETFs

You have now learned that there is a difference between real and non-real ETFs. Furthermore, within the real ETFs, you have to differentiate between physical and non-physical ETFs. Because only those who know the difference will know which papers are worth investing in.

Physical ETFs are those where the ETF issuer actually buys a commodity and stores it somewhere. These are usually precious metals (gold, silver, platinum, etc.). These metals are usually quite expensive and therefore, the issuer can buy a “manageable” amount of them which would cover the total value of the ETF.

Now let’s take a closer look at non-physical ETFs. The situation here is different with commodities such as crude oil or grain. Compared to precious metals like gold or platinum, these commodities are fairly cheap, so it would take huge amounts and warehouses to store all these commodities to represent the total value of the ETF. In addition, these commodities can have an expiry date.

Hence, what do you do in this case? To work around the problem, issuers are launching non-physical ETFs through the purchase of futures. They are holding the futures until they are about to expire. Before the expiration date, the issuers sell the futures and then new contracts are purchased to preserve the value of the ETF.

Doing this, the issuers are solving the problem but causing another one because the value of these ETFs regularly suffers from so-called rollover losses. To understand what a rollover loss is, we need to take a little trip into the world of futures.

Rollover Losses Of Futures Contracts

There are entire books that deal extensively with the futures. I can only provide a brief description at this point, because everything else would go beyond the scope of this article.

- Futures contracts have a limited lifespan and point into the future.

Imagine, you own a refinery that processes crude oil into gasoline. If you want to buy the oil, you need to buy a futures contract today. But that doesn’t mean that you get the oil delivered as soon you have bought the contract. Instead, it takes a while because the delivery takes place when the future has expired. When a future has expired, it ceases to exist.

- Futures that point farther into the future are more expensive

For example, if you don’t need the oil in three months but in nine months, then you pay more for the futures contract that expires later.

You do this for a very simple reason: the oil that you will need in nine months may have to be stored somewhere by the producer. In addition, there are many other costs for the oil producer, such as insurance costs and so on. For this reason, he cannot sell you the oil that you will need in nine months at the same price as the oil that you would need in three months.

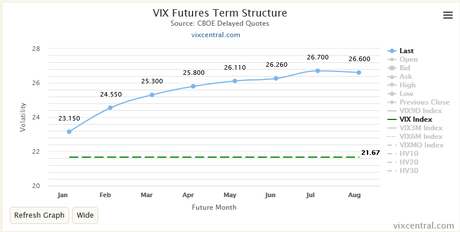

This type of pricing can be simplified using a curve called a forward curve. In the screenshot below, you can see an example of the VIX future and how such a forward curve looks like. However, this curve can be transferred to all other commodity contracts. Each dot represents a futures contract, and the farther into the future, the more expensive the contracts are. This is a normal situation, or as it’s called in the stock market, contango.

The Problem With Non-Physical Commodity ETFs

By constantly selling and buying, the issuers of non-physical ETFs are constantly rolling the contracts into the future. As we have just learned, the new futures (also called back month contracts) are always slightly more expensive than the futures with a shorter term (also called front month contracts).

However, if the back month contracts are always more expensive, then the ETF issuers have to spend a bit more money on buying the new contracts than they can make on selling the contracts they already bought. In other words, by rolling, they cause permanent losses, the so-called rollover losses.

And here is the problem I mentioned at the beginning: The non-physical ETFs constantly generate rollover losses and constantly lose a bit of their value.

Now let’s look at some examples. Please note that these are not 100% accurate calculations as the situation does not require it. Rather, it was important to me to show how the performance of non-physical commodity ETFs is developing in general.

Performance of non-physical commodity exchange traded funds

Crude Oil

The best-known of all oil ETFs is the United States Oil Fund (USO). Let’s compare it with the performance of the Sweet Light Crude Oil which it does tracking.

When you check the screenshot below, you will see that the USO has lost around 87% of its value since it was launched in 2006. It’s even below the lowest point during the financial crisis of 2008! The Crude Oil on the other hand, even if it wasn’t performing well as well, has gained around 9% within the same time span. Why this might be so? Now that you know what rollover losses are, the answer shouldn’t be too difficult.

Chart of USO

Chart of Light Crude Oil

Maybe it’s just a coincidence? Well, let’s check some more charts.

Wheat

One of the most well-known ETFs which is tracking wheat is the Teucrium Wheat Fund (WEAT). Let’s check the performance of the ETF:

Chart of WEAT

You can see that the security has lost around 65% since its launch in 2011.

Chart of wheat futures

How did the wheat itself perform? Let’s check. Here we can see a plus of around 27%.

Natural Gas

Can it be more extreme? Sure. See what happened to the ETF on natural gas, the UNG:

A loss of astonishing 98% since its launch.

Chart of UNG

Did the commodity itself perform well? Actually not. But the result is far less devastating than of the ETF. Here, we have a decline of “just” 35% since 2007:

Chart of natural gas futures

I will stop now with the screenshots to prevent of overloading this article. But you can check other ETFs by yourself and compare them with the futures:

- Corn: Teucrium Corn Fund (CORN)

- Copper: Global X Copper Miners (COPX)

- Live Cattle: iPath Series B Bloomberg Livestock Index (COW)

- Sugar: Teucrium Sugar Fund (CANE)

- Coffee: iPathA Series B Bloomberg Coffee Subindex (JO)

Are There Also Exceptions?

Yes, there are indeed exceptions. I will show you a temporary exception and a steady one.

Temporary exception

Cotton

In the chart below you can see the cotton ETF (BAL), which was launched in mid-2008. When you compare the both charts, you can see that since the launch of the ETF to date, cotton is up around 6%, while the ETF is up 20%.

But my prediction is that this is just a temporary exception because of the recent surge of cotton prices since 2020. As soon as the situation has normalized, we will see a typical rollover loss situation in the ETF.

Chart of BAL

Chart of cotton futures

Permanent exception: Soybeans

To be fair, here is a comparison on soybeans, where the tracking of the performance compared to the underlying has been relatively successful. Here, the value of the ETF Teucrium Soybean Fund (SOYB) deviates from the commodity soybeans by only around 1%. Only the issuer can explain how he did it.

But even if there are more exceptions, we see that the most of non-physical ETFs have performed poorly relative to their underlying assets.

Chart of SOYB

Chart of soybeans futures

Performance Of Physical Commodity exchange traded funds

The situation is different in precious metals. Therefore, let’s check two of them. But feel free to review other precious metals by yourself, like platinum.

Gold

The most well-known ETF on Gold is the SPDR Gold Trust (GLD). Let’s see how the ETF did perform:

Chart of GLD

Now let’s see how the commodity gold has performed since the launch of the ETF:

Chart of gold futures

Since the ETF was launched at the end of 2004, it has increased in its value by around 284% which is around 11% less compared to the commodity gold. However, we see a positive development in the GLD as opposed to non-physical ETFs you have seen above.

The reason for this is that the issuer buys the gold physically, and does not incur any rolling losses.

But where does the 11% difference come from? There may be various reasons. One of them is probably that you pay small fees to the issuer.

Let’s check the next commodity which is silver.

Silver

The probably most well-known ETF on silver is the iShares Silver Trust (SLV). Here we can see a similar development like in gold. Both the underlying and the ETF are showing a positive performance.

Chart of SLV

Chart of silver futures

Conclusion

In general, exchange traded funds are a great means to invest. But like in stocks you have to deal with this topic in detail. This blogpost is just an overview but you’ve already seen several differences:

Now you know that there are real and pseudo commodity ETFs. Furthermore, you now know that real commodity ETFs can be divided into two further categories: into physical and non-physical ETFs.

It is worth investing in physical ETFs because there are no rollover losses. But it goes without saying that physical ETFs can also lose value, because they track the performance of the actual commodity. For example, if gold loses value, then the ETF must inevitably lose value as well.

Would you rather invest in pseudo commodity exchange traded funds? No problem! You should just keep in mind that you are not investing in the commodity itself, but in commodity baskets or in shares of commodity companies. However, there are no reasons not to invest in such ETFs.

Summary

- There are real and pseudo commodity ETFs

- Real ETFs track the commodity itself and represent its (nearly) value

- With pseudo-ETFs, you invest in commodity baskets or in companies specialized on commodities

- Real commodity ETFs are divided into physical and non-physical ETFs

- Non-physical commodity ETFs track the asset using futures contracts which expose them to a permanent drop in value due to so-called rollover losses

- Physical ETFs replicate the value of the asset because the issuer buys the commodity physically and stores it somewhere. As a result, there are no rollover losses here.

- This means that physical ETFs are also suitable for long-term investments

- Non-physical ETFs are more suitable for short-term or medium-term trading but not for long-term investments

Subscribe for free to receive new posts and support my work. The subscription will be proceeded via substack.com. There, you can subscribe for free content but also for premium content. Just check it out by clicking the button below! If you would like to publish content on substack, please click here.

SUBSCRIBE FOR A NEWSLETTERDisclaimer: I am NOT a financial advisor. I’m using information sources believed to be reliable, but their accuracy cannot be guaranteed. The information I publish is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website.