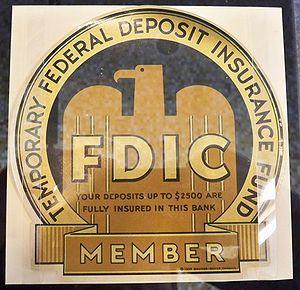

FDIC placard from when the deposit insurance limit was $2,500. Today, deposits are guaranteed to $250,000. Is that evidence of inflation? (Photo credit: Wikipedia)

In “Big depositors in Cyprus to lose far more than feared, Reuters reported that,

“Big depositors in Cyprus’s largest bank stand to lose far more than initially feared under a European Union rescue package to save the island from bankruptcy, a source with direct knowledge of the terms said on Friday.

“Under conditions expected to be announced on Saturday, depositors in Bank of Cyprus will get shares in the bank worth 37.5 percent of their deposits over 100,000 euros, the source told Reuters, while the rest of their deposits may never be paid back.”

That description of the terms for ending the Cyprus Crisis is not absolutely clear. However, I read that description to mean that anyone with over 100,000 euros in a Cyprus bank may lose 100% of his savings, but will receive shares in the newly recapitalized bank (recapitalized with his savings) equivalent to 37.5% of the value of his savings. Thus, the depositor may be forced to buy stock he doesn’t want in his own failing bank with 37.5% of his savings, and then be forced to effectively donate the other 62.5% to capitalizing that same failing bank.

You can use all the fancy words you want to justify that confiscation, but the confiscation differs from outright theft only in the fact that the Cyprus government—being a co-conspirator in that theft—has sanctioned that theft by law as “legal”.

Does that taking inspire your confidence in your bank?

If bankers can seize depositors’ funds in Cyprus, can they do it here in the US?

• The New York Times published “Big Depositors Seek a New Safety Net” which indicates that, like the wealthy Cyprus depositors, wealthy US bank depositors are also feeling targeted and unprotected by their banks and government.

Up until January 1st of this year, $1.5 trillion of US bank deposits (about 20% of total US bank deposits) was protected the Federal Deposit Insurance Corporation’s (FDIC) unlimited guarantee. If you had $1 million or $100 million or even a billion in your bank account, the FDIC guaranteed that, even if your bank collapsed, you’d recover your cash. Guaranteed.

However, as of January 1st of this year, the FDIC will only guarantee your savings account up to $250,000. That means a man or a corporation with $1 million in his bank account has $750,000 in unprotected funds and a good reason to be nervous. If his bank fails, the depositor will lose everything over $250,000.

According to the NYTimes,

“The unlimited guarantee was created in the depths of the [2008] crisis by the Federal Deposit Insurance Corporation, in order to stop a migration of customers from smaller banks to larger ones that were viewed as less likely to fail.

“The F.D.I.C. guarantee was one of a number of factors that encouraged depositors to shift money into noninterest bearing accounts after the crisis.”

When government effectively demands that bank depositors take a loss (no interest) in return for government protection, government emulates a common street gang that takes money from a mom-and-pop grocery store in return for protecting their store’s windows. This is criminal activity, and consistent with behavior we might expect if the government wanted to destroy the American people’s wealth and leave them impoverished and absolutely dependent on government. In other words, is the object of noninterest accounts to save the depositors, save the banks, or diminish the depositors’ savings?

“The vast majority of the holdings in these accounts are above the $250,000 limit and are held in the nation’s largest banks. That money is expected to stay put no matter what, in part because corporations and municipalities widely believe that the government will step in if those large banks encounter trouble, effectively considering them too big to fail.”

In Cyprus, the wealthiest depositors also “widely believed” that the Cypriot government would “step in” if the largest Cypriot banks encountered trouble. It was presumed that Cyprus would consider it’s biggest banks and super-wealthy depositors “too big to fail”. After all, who would dare to rob the Russian mafia, Russian KGB, Russian oligarchs, etc.?

Well, as it turns out, it appears that the world’s central bankers fear no man or earthly organization. The Russians, in all of their villainous personas, were robbed as easily as a bunch of Boy Scouts.

Is this evidence that the biggest and baddest gangsters running our earthly “hood” are the central banks?

If so, is your confidence in banking “inspired”?

• InvestmentWatchBlog.com recently published, “U.S DEPARTMENT OF HOMELAND SECURITY HAS TOLD BANKS–IN WRITING–IT MAY INSPECT SAFE DEPOSIT BOXES WITHOUT WARRANT AND SIEZE ANY GOLD, SILVER, GUNS OR OTHER VALUABLES IT FINDS INSIDE THOSE BOXES!”:

“According to in-house memos now circulating, the Department of Homeland Security (DHS) has issued orders to banks across America which announce to them that ‘under the Patriot Act,’ the DHS has the absolute right to seize, without any warrant whatsoever, any and all customer bank accounts, and to make “periodic and unannounced” visits to any bank to open and inspect the contents of “selected safe deposit boxes.”

“Further, the DHS ‘shall, at the discretion of the agent supervising the search, remove, photograph or seize as evidence’ any of the following items ‘bar gold, gold coins, firearms of any kind unless manufactured prior to 1878, documents such as passports or foreign bank account records, pornography or any material that, in the opinion of the agent, shall be deemed of to be of a contraband nature.’”

The author of this article admits that she has some evidence but not enough to verify these contentions. In truth, the previous description might be only a false rumor.

But, is there anything in the previous description that you’d say is beyond your federal government’s powers or inclinations?

I know that several other sources have reported the same story. That doesn’t prove that the story is true, but it does suggest that the story might be true.

Let’s suppose that the story is true. If it is, nothing you deposit into a bank account or bank safety deposit box is safe from confiscation by the government. Nothing.

Bank officials who received this information were allegedly warned to tell no one what they’d heard about possible seizures of bank accounts and safety deposit boxes. If they talked, they could face prosecution under the Patriot Act.

More, the author reports that,

“A family member from Irvine, CA (who’s a branch manager at Bank of America) told us two weeks ago that her bank held a ‘workshop’ where the last two days were dedicated to discussing their bank’s new security measures.

“The workshop included members from the Homeland Security Office who instructed them on how to field calls from customers and what to tell them in the event of a national disaster. She said they were told how only agents from Homeland Security (during such a national disaster) would be in charge of opening safe deposit boxes and determining what items would be given to bank customers.

“They were told that no weapons, cash, gold, or silver will be allowed to leave the bank—only various paperwork will be given to its owners. She and the other employees were then told not to discuss the subject with anyone.”

If bank officers and employees aren’t supposed to talk about it, the “national disaster” could be close at hand. After all, there are no secrets in the internet world. If you tell a “secret” to 20 people or even 10, you can expect that “secret” to be published to the world on the internet within days, hours or even minutes.

Therefore, IF this story is true, it implies that:

1) hundreds, and probably thousands, of bank officers and some bank employees around the country have heard the same message and been warned to keep quiet;

2) it’s virtually certain that some of them will, nevertheless, tell relatives and friends; and

3) the story will quickly appear on the internet and shed its cloak of secrecy.

Government must recognize the short shelf-life of secrets. If so, government should not dare to sound this alarm to several thousand bank officers and employees unless government believes we are very close to having the “national disaster”.

I.e., why communicate this warning to bankers, and allow it to propagate on the internet in April if the “national disaster” isn’t expected to take place before October?

If the story reported here is true, the “national disaster” might be expected to take place very soon—but probably not before April 15th (income tax payment day). First they’ll squeeze all the cash they can out of the taxpayers, and then have the “disaster” sometime after April 15th.

The article’s author suggests that you could verify some of this information yourself, if you would,

“Visit your bank, ask a few well-worded questions, being careful not to arouse suspicion—If that doesn’t work, talk to friends and other family members—maybe they’ve heard something—or as a last resort, just point-blank call the bank manager in private and demand to know what’s all this business with the Homeland Security deciding what I can have from my safe deposit box.”

Who can say? Maybe your local banker will admit there’s a looming problem. Maybe he’ll laugh in your face for believing an irrational internet rumor.

But,

1) We know that the rich depositors of Cyprus are being robbed.

2) We know that rich depositors in the US are similarly threatened with losing much of their wealth.

3) We know that Homeland Security has ordered 1.6 billion rounds of ammunition for “target practice” and several thousand new automatic weapons.

4) We know that 2,700 armored personnel carriers are being distributed by the feds to state and local governments.

5) We don’t know that the story about US banks being subjected to Homeland Security and threatened with confiscation of all bank accounts and safe deposit boxes is true.

Four of the last five “dots” are true. The fifth “dot” may or may not be true. If we connect all five “dots,” they create a fairly clear message: It’s time to rethink whether you still want to trust your cash and tangible wealth to your local bank’s accounts and safe deposit boxes—or if you want to take personal responsibility for your own wealth.