Biden is wrong. Inflation is not caused so much by Shrinkflation as it is by something much more basic - GREED! Corporate Profits have surged to levels not seen since the 1960s as Covid and Supply Chain disruption gave Corporations the perfect excuse to stick it to the Consumers - torturing them with higher and higher prices - until they find that perfect pain point for each of their products.

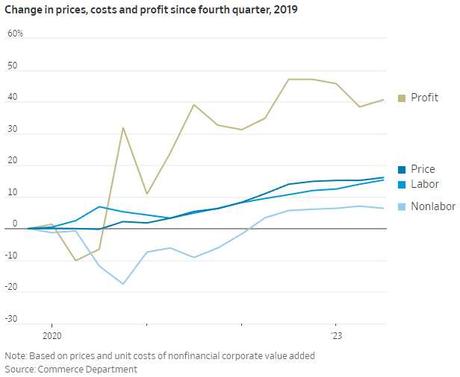

Biden is wrong. Inflation is not caused so much by Shrinkflation as it is by something much more basic - GREED! Corporate Profits have surged to levels not seen since the 1960s as Covid and Supply Chain disruption gave Corporations the perfect excuse to stick it to the Consumers - torturing them with higher and higher prices - until they find that perfect pain point for each of their products. The goal, for those of you playing at home, is to extract the maximum possible profits from each customer - even to the point of using dynamic pricing models to make sure people who can afford more also pay more. And yes, all this was going on WHILE the consumers, via our complicit Government, subsidized these Corporations during the Covid crisis. This is how they are paying us back:

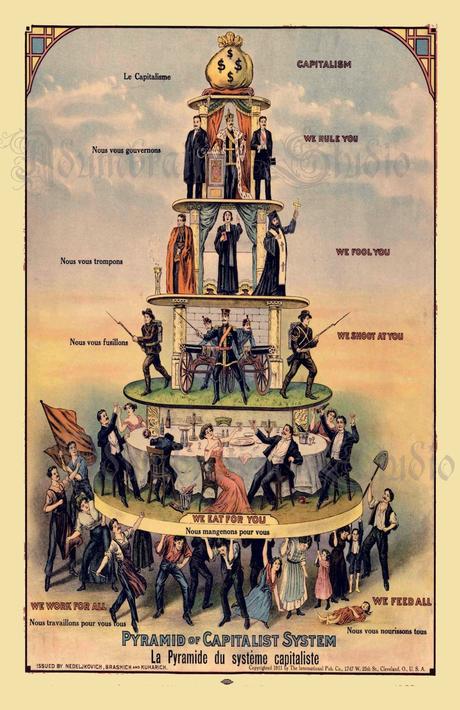

That's right, prices since 2019 are UP 13% but PROFITS are up 40%, 3 times the increase in prices. That means that MOST of the price increases are nothing more than Corporations deciding to make more profits. And yes, I know, we've been brainwashed into being obedient victims of Capitalism - it's the God we're supposed to worship above all others - the pyramid on our money that watches us all...

This worship at the altar of Capitalism, where greed is not just good but glorified, reveals a systemic issue far beyond mere Corporate Opportunism. It reflects a deep-seated imbalance in the power dynamics between Corporations and Consumers, where the former wields excessive influence over pricing, market practices, and even policy decisions. This imbalance is not a new phenomenon; it has historical roots that extend back through decades of economic policy prioritizing Corporate Growth and Shareholder Value over Consumer Welfare and Equitable Market Practices.

The advent of big-data driven dynamic pricing models takes this one step further, introducing a level of price discrimination that undermines the very principles of market fairness and competition. It's a stark reminder of the digital age's capacity to enhance Corporate Profit Strategies at the expense of consumer fairness, utilizing data analytics not to better serve customers but to better profit from them.

Deceptive practices are also a factor. In a recent report, Biden's Council of Economic Advisers estimates that the average household each year pays more than $650 in so-called junk fees, which it defines as mandatory but not disclosed fees on products ranging from food delivery to concert tickets.

The juxtaposition of rising Corporate Profits against the backdrop of Government Subsidies during Covid adds insult to injury, revealing a glaring lack of reciprocity in the Corporate-Social Contract. While Consumers faced job losses, health crises, and economic instability, Corporations received Government Bailouts only to turn around and impose higher prices on those same consumers...

In essence, the inflation we're witnessing is not merely a product of market forces but a deliberate outcome of Corporate Strategies that exploit these forces for maximum gain. To address this, we need a recalibration of Economic Policies and practices that places equal importance on fairness, equity, and Consumer Protection as it does on growth and profitability. Only then can we hope to mitigate the harsher impacts of Capitalism's excesses and ensure that the economy works for all, not just a select few at the top of the pyramid!This dynamic underscores a critical flaw in the current Capitalist system: the prioritization of profit at all costs , including the well-being of the Consumer and the health of the broader Economy. It raises fundamental questions about the role of Corporations in society and the extent to which their profit motives should be balanced against societal welfare.

8:30 Update: PPI came in 100% hotter than expected, at 0.6% vs 0.3%, which was what last month was. Core PPI was "only" 0.3% and that was "only" 50% hotter than the 0.2% expected but at least it's down from last month's nasty 0.5% reading.

As I said, TORTURE - Corporations are TORTURING Consumers to find the breaking point where they can extract the maximum amount of cash from them without breaking them completely - so they can come back and do it again tomorrow.

None of this seems to be phasing the futures, which are still chugging along in positive territory but that's because no one is getting MAD - we're just letting it happen and the money we used to make working for our Corporate Masters now just cycles right back to them as they raise prices (and profits) high enough to cause people to not only forego their savings - but to dip into those IRAs and 401Ks just to keep up with the current bills.

When will it end?

Yep, they sell those now.