8.3%.

8.3%.

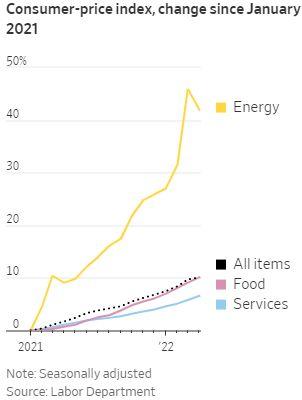

If your income isn't rising that much then you are falling behind on inflation. That's as of the last CPI report and we get another one at 8:30 and, like your eye doctor, the question will be "better or worse" when we see the numbers. We did an analysis last week and decided CPI was not likely to decline much and may even be HIGHER than last month, based on the price of commodities and the productivity report – which showed a sharp rise in Labor Costs. CPI is tricky though because if you pay $1,000 for an IPhone with 256G of memory and they pay $1,000 for an IPhone with 500G of memory – they say you saved 50% – even if you didn't ask for the bump in storage and would have much rather had a $500 phone.

Consumers’ grocery bills have risen by an annual rate of more than 10% since earlier this year, a pace last seen in the early 1980s. Food prices are up broadly, unlike early in the pandemic when meat prices drove much of the increase, said Paul Ashworth, chief North America economist at Capital Economics. “For people on lower incomes this is not discretionary spending,” Mr. Ashworth said. “Other than substituting out cheaper food types—cheaper meat cuts, whatever it might be—people need to continue buying food.”

8:30 Update: 8.6%!!! Much worse than expected by our Leading Ecconomorons but exactly what we predicted in Monday's PSW Report. That won't stop the rest of the market from panicking. Fortunately, yesterday afternoon, I sent out an alert to our Members to add more hedges so…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!