Evening all,

After the good showing by stock markets at the beginning of this year, quite a number of indices are now touching or very near major highs. In February alone, markets did not do as well as in January though markets did hold on to their gains. On the news front, there has been nothing major to move markets. It seems like the stock market has been somewhat quiet over the last few weeks. If you zoom out of your charts, you will notice that indices are at previous major highs. And when you look at how far we have come ever since the 2008/2009 crisis, it is simply testament to the multi-year bull run we have been in. So, after a long while, market have finally arrived at all-time highs.

The S&P500 closed at 1519 on Friday – which is just a few percentage points off all-time highs. And the Dow Industrials is already above 14,000. The Nasdaq is a different story, though you cannot discount the buying pressure to push the Nasdaq clearly above previous year-highs.

All-time highs are always important. I always see it as a 50 – 50 bet whether the high is bested or not; what is definite is that the market does not stall there. The market will make up its mind whether to go higher or lower, decisively. At times, when I see reasons why I should perceive the odds as unbalanced (not 50 – 50), that is when I look for a set-up to trade. In this case, I am a little concerned for the uptrend we have been in.

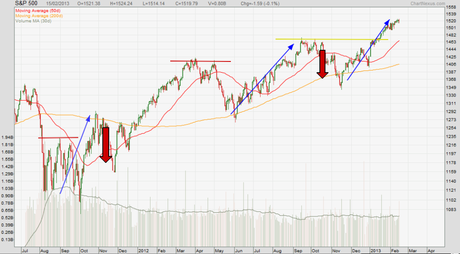

After the US debt downgrade scare in 2011, the US indices have been moving in a certain pattern: the market makes a run upwards, blows past previous strong resistance, then undergoes a correction. I illustrate this on the chart below. In January, the S&P 500 broke past 1470 easily, and has continued climbing to where it is now. Based on what I have seen in recent history, it would suggest to me that the index is going to face some headwinds in the near-term.

Also, indicators are showing slightly bearish divergence signals. While indices have been edging up, indicators are falling (have made lower highs). I see these as very reliable indications to take from technical indicators. The case for downside to come is looking stronger as the days go by.

As a side note to chinese readers out there, Gong Xi Fa Cai! Here is to wishing all of you a belated happy lunar new year! May this year bring you good results in the market.

All analyses, recommendations, discussions and other information herein are published for general information. Readers should not rely solely on the information published on this blog and should seek independent financial advice prior to making any investment decision. The publisher accepts no liability for any loss whatsoever arising from any use of the information published herein.