What a crazy couple of week’s we’ve been having! Very fortunately, in last month’s update of our virtual income portfolio, we had already cashed out $33,084 – more than enough to take us through our first 8 months (our planned $4,000 a month to live on). We did that using just $200,000 of our $1M in buying power ($500,000 portfolio), staying very conservative and waiting for a bigger dip than the one we had had in June.

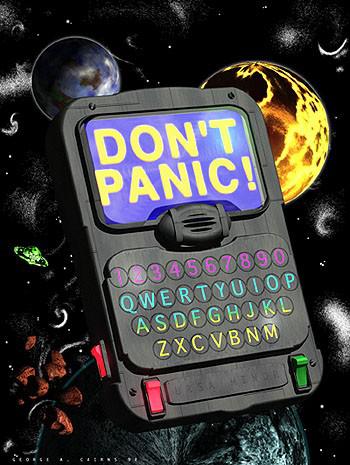

We stuck to our guns this week and had a lot of fun playing the wild gyrations with our short-term betting but the Income Portfolio is an exercise in managing a "low-touch" portfolio – one that does not require us to make daily adjustments. I am aware that can be frustrating for people who stare at the markets every day but that is what our short-term trade ideas are for in Member Chat. That goes for people who are retired or semi-retired too. You don’t HAVE to play every day – or any day for that matter but you do need to work one week a month and that would be this week – the week of…