Having some sort of bank account is essential – you need it to receive your wages and to pay direct debits. But what happens if you have a poor credit history and the bank won’t let you open an account?

Basic bank accounts

One option is to ask for a ‘basic’ bank account. Unlike a normal bank account, a basic account doesn’t have an overdraft facility (planned or un-planned), and it won’t pay you interest when you’re in credit. So you won’t be charged when you run out of money, and you won’t be paid when you do have money.

As the name suggests it’s simply a place where you can put your money, without any of the extra bells and whistles you would get with a regular current account. Basic accounts allow you to pay in cheques, set up direct debits and withdraw cash from a cash machine. Most basic accounts come with a debit card.

Basic accounts are popular with:

- People with a bad credit history

- People on a low income

- People who simply don’t want a bank account with an overdraft

There is however one thing a basic bank account can’t fix – and that’s bad money management. If you are the kind of person who’s always running out of money before payday and dipping into your overdraft, or you just struggle to keep track of your money, there is help available.

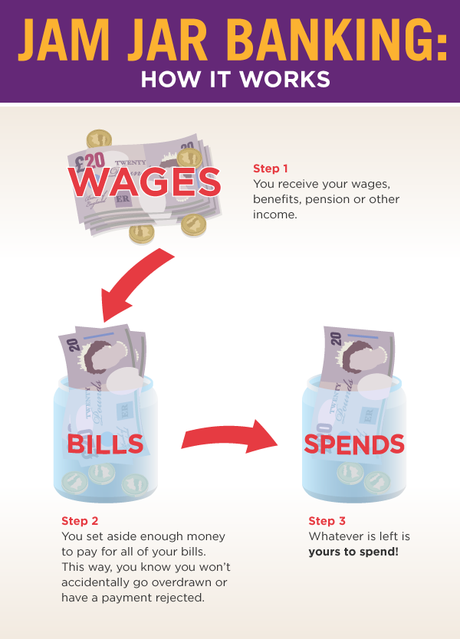

There are companies out there that can help you organise your money so that you always have enough to cover your bills and expenses. This is known as jam jar banking.

What is jam jar banking?

Imagine you have two empty jam jars. The first one has a label that says “bills” and the second one has a label that says “spends”.

On payday, you add up the cost of all your bills and monthly expenses – things like your rent, TV license, gas & electricity bills, car insurance, phone contracts and anything else you can think of. You take enough money to cover them all and put it in your “bills” jar. Then when it’s time to pay a bill, the money comes out of this jar.

The rest of your money goes into the “spends” jar. With your bills all out of the way and taken care of, you can use this money for whatever you want without worrying. If you get paid monthly, you could give yourself a quarter of your spending money at the start of every week, so you don’t go running out of money half way through the month.

It sounds extremely simple, but we all know how difficult it is in reality to keep track of everything. The best thing about jam jar banking is there are companies who will do it for you. Companies such as Card One will help you organise your money and make sure your bills always get paid on time.

The Card One prepaid Mastercard

Card One will give you three things:

- An account for your bills

- An account for your spending money

- A pre-paid Mastercard that you can use just like a debit card

They also give you an account manager who you can speak to over the phone. They will help you work out how much money you need to cover your bills, and set up your regular payments. You can also move money between accounts whenever you like by text or online. You will have an account number and sort code just like you would with a normal bank account. These accounts are available to anyone and there are no credit checks – you just have to be over 18 and a UK resident.

Is it free?

There is normally a monthly cost of around £12.50, but don’t let that scare you away. Bear in mind that an unauthorised overdraft of £200 for ten days with Lloyds TSB would cost you around £87.00 (according to this report from the Daily Mail). It’s for this reason that prepaid card accounts are so popular with people who are always dipping into their overdraft and/or having payments bounced. That £12.50 will pay for itself over and over again because you’ll never go overdrawn or miss a payment.

How do I apply?

You can apply via the Card One website, or call one of our Money Club advisors on 0800 142 2180 if you would like more information.

Share this article: